BREAKING: Trump Unleashes Tariff Tsunami on Canada – Steel and Aluminum Rates Soar to 50%

In a move that promises to shake the very foundations of the North American trade landscape, the Trump administration has dropped a tariff bombshell on Canada, sending shockwaves through the steel and aluminum industries. As of today, rates on Canadian steel and aluminum imports to the United States have skyrocketed to a staggering 50%, leaving many to wonder if this is the beginning of a full-blown trade war between the two nations.

The move, which comes on the heels of months of tense negotiations and threatened action, marks a significant escalation in the ongoing trade tensions between the US and Canada. With the livelihoods of thousands of workers hanging in the balance, the impact of these tariffs is likely to be felt far and wide, from the factories of Ontario to the ports of British Columbia.

The Global Economy: A Ripple Effect

The ongoing trade war between the United States and Canada has sent shockwaves throughout the global economy. The tariffs imposed by President Trump on Canadian steel and aluminum have sparked concerns about the potential consequences for international trade, businesses, and employment.

The uncertainty surrounding the trade war has led to a decline in investor confidence, causing stock markets to plummet. The S&P 500 index, for instance, tumbled 2.7% on Monday, reflecting the growing anxiety among investors.

The trade war’s impact on the global economy is multifaceted. On one hand, the tariffs imposed by the United States could lead to higher prices for consumers, reducing demand and ultimately affecting economic growth. On the other hand, the retaliatory measures taken by Canada and other countries could lead to a decline in U.S. exports, further exacerbating the economic downturn.

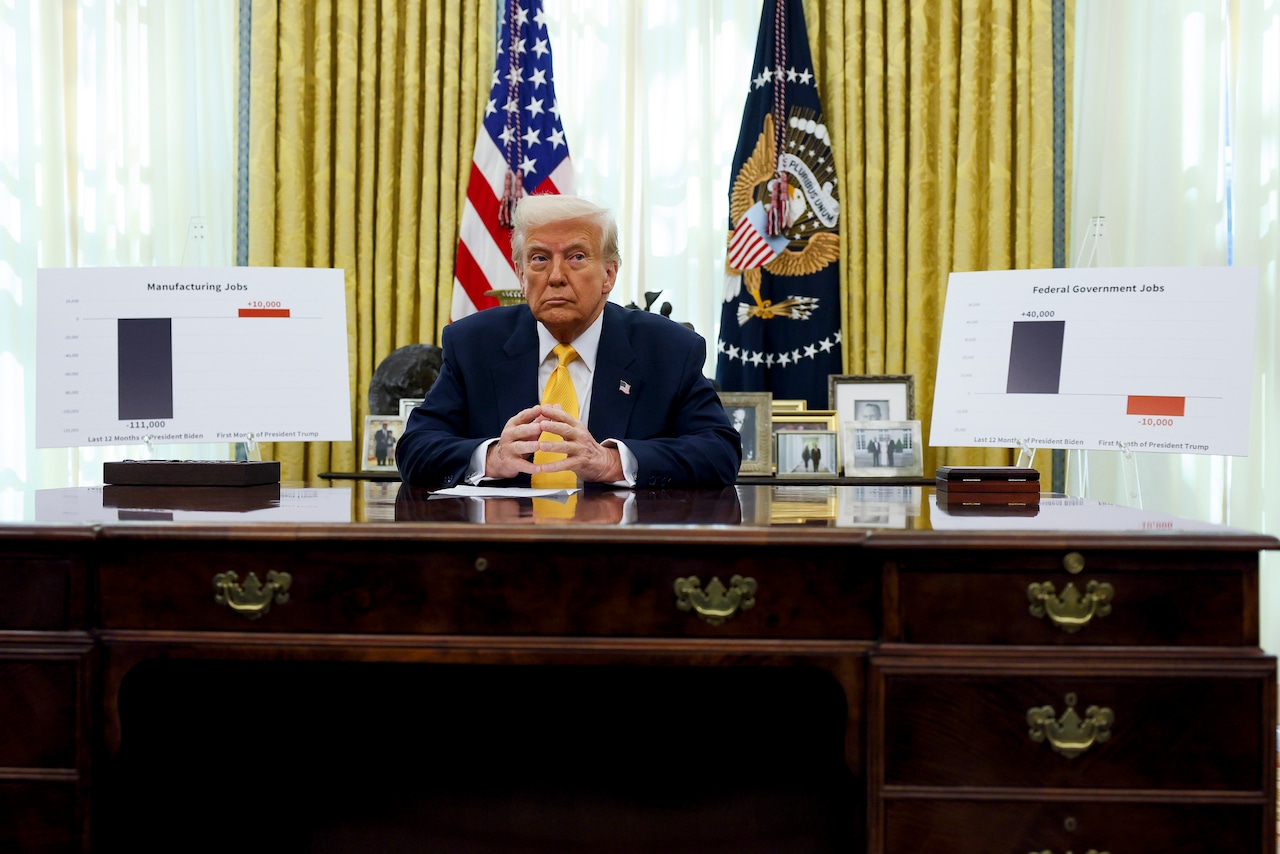

The trade war’s impact on employment is also a pressing concern. The tariffs imposed by the United States could lead to job losses in industries that rely heavily on Canadian steel and aluminum. Similarly, the retaliatory measures taken by Canada could lead to job losses in industries that rely heavily on U.S. exports.

Analysis: Understanding Trump’s Strategy

A Game of Negotiation: Tariffs as a Tool

President Trump’s use of tariffs as a negotiating tool has sparked debate among economists and trade experts. While some argue that tariffs are an effective way to negotiate trade deals, others believe that they are a blunt instrument that can have unintended consequences.

Trump’s strategy appears to be centered on using tariffs as a means of pressuring Canada and other countries to negotiate trade deals that are more favorable to the United States. By imposing tariffs on Canadian steel and aluminum, Trump is attempting to create leverage in trade negotiations.

However, this strategy is not without risks. The tariffs imposed by the United States could lead to retaliatory measures from Canada and other countries, sparking a trade war that could have far-reaching consequences for the global economy.

The Art of Bluffing: Trump’s Tariff Tactics

Trump’s use of tariffs has also raised questions about his tactics. Some argue that Trump is using tariffs as a means of bluffing, attempting to create the impression that he is willing to take drastic action to achieve his goals.

Trump’s statement on Tuesday, in which he threatened to double tariffs on Canadian steel and aluminum, is a case in point. While Trump ultimately backed down on his threat, the incident highlights the uncertainty surrounding his tariff tactics.

Economic Realities: Can Tariffs Revitalize the Economy?

The economic theories behind tariffs are complex and multifaceted. While some argue that tariffs can be an effective way of protecting domestic industries, others believe that they can have unintended consequences, such as higher prices for consumers and job losses.

In the case of the United States, Trump’s tariffs on Canadian steel and aluminum are intended to protect domestic industries. However, the tariffs could also lead to higher prices for consumers, reducing demand and ultimately affecting economic growth.

The Human Cost: Implications for Workers and Businesses

Jobs at Risk: The Human Impact of Tariffs

The tariffs imposed by the United States on Canadian steel and aluminum have sparked concerns about the potential job losses in industries that rely heavily on these products.

According to experts, the tariffs could lead to job losses in industries such as manufacturing, construction, and energy. The tariffs could also lead to higher prices for consumers, reducing demand and ultimately affecting economic growth.

Businesses Caught in the Crossfire

The trade war between the United States and Canada has created uncertainty for businesses operating in both countries. Companies that rely on Canadian steel and aluminum are facing higher costs, while companies that export to Canada are facing retaliatory tariffs.

The uncertainty surrounding the trade war has led to a decline in investor confidence, causing stock markets to plummet. The trade war has also created challenges for businesses attempting to navigate the complex web of tariffs and trade policies.

The Future of Trade: A New Normal?

The trade war between the United States and Canada has raised questions about the future of trade relations between the two countries. The tariffs imposed by the United States have sparked concerns about the potential for a new normal in trade relations, in which tariffs and trade barriers become the norm.

The trade war has also highlighted the need for a more nuanced approach to trade policy, one that takes into account the complex interdependencies between countries and industries.

Conclusion

In conclusion, the recent imposition of tariffs by the Trump administration on Canadian steel and aluminum imports has sent shockwaves through the global trade community. As discussed in this article, the tariffs have skyrocketed to 50%, marking a significant escalation in the ongoing trade tensions between the United States and Canada. The key points highlighted in this analysis include the detrimental impact on Canadian steel and aluminum producers, the potential for retaliatory measures from the Canadian government, and the far-reaching consequences for the US economy, particularly in industries that rely heavily on imported steel and aluminum.

The significance of this development cannot be overstated. The tariffs have major implications for global trade, economic stability, and diplomatic relations between the two nations. As the situation continues to unfold, it is essential to consider the potential long-term effects of this policy decision. The tariffs may lead to increased costs for US consumers, reduced competitiveness for US businesses, and a potential trade war that could have far-reaching and devastating consequences for the global economy. Furthermore, this move may also set a precedent for future trade negotiations, potentially emboldening other nations to implement similar protectionist policies.

As the world grapples with the implications of these tariffs, one thing is clear: the future of global trade hangs in the balance. The Trump administration’s decision to impose tariffs on Canadian steel and aluminum imports has ignited a firestorm of controversy, and it remains to be seen how this situation will play out. One thing is certain, however: the consequences of this decision will be felt for years to come, and it is imperative that policymakers, business leaders, and citizens alike take a step back to consider the long-term implications of this policy. As the global economy teeters on the brink of uncertainty, one question remains: what’s next?