Unlocking the Secrets of the Tech Titans: A Look at the Top Stocks Making Waves in Yahoo Finance UK In today’s fast-paced world of technology, savvy investors are constantly on the lookout for the next big thing. The world of high-growth stocks is not just about flashy IPOs or cutting-edge gadgets – it’s about understanding the trends, the drivers, and the players at the forefront of innovation. This week, we’re diving into the world of the top tech stocks making headlines in Yahoo Finance UK, from the cutting-edge Nvidia to the innovative Baidu. But what’s behind the buzz? What are these companies really doing? And what’s next for the tech industry? In this exclusive article, we’ll take a deep dive into the trending tickers that are shaping the future of technology, and what you need to know to stay ahead of the curve.

The Impact of Allegations on Reputation and Financials

The recent allegations against Adani Group’s billionaire owner, Gautam Adani, have sent shockwaves through the market, with shares in companies under the Adani Group plummeting in response. The US federal prosecutors’ allegations of a $250m bribery scheme have raised serious concerns about the company’s reputation and financials.

Adani Enterprises, the flagship company of the Adani Group, saw its shares drop nearly 23% by the end of the trading session in India. Energy company Adani Power closed 9% lower, renewable energy firm Adani Green Energy was down 19%, and logistics company Adani Ports and Special Economic Zone was 14% in the red.

The falls in Adani Group companies weighed on India’s Nifty 50 Index, which closed the session 0.7% in the red. In a statement, Adani Group denied the allegations, calling them “baseless”. However, the damage to the company’s reputation has already been done, and investors are likely to remain cautious.

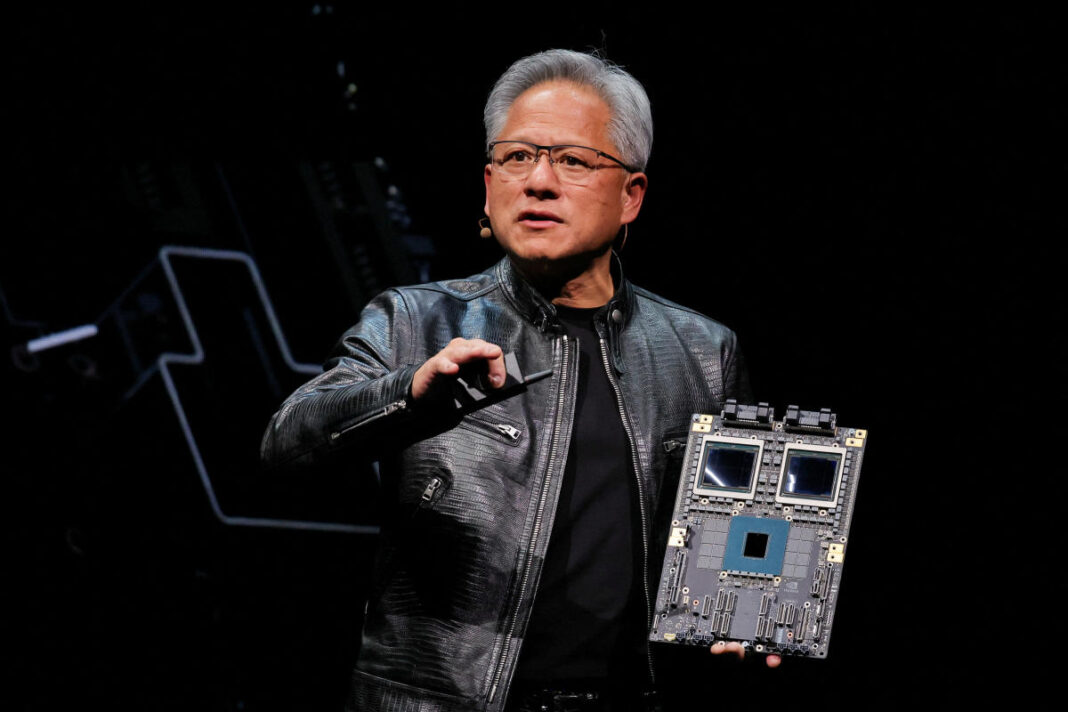

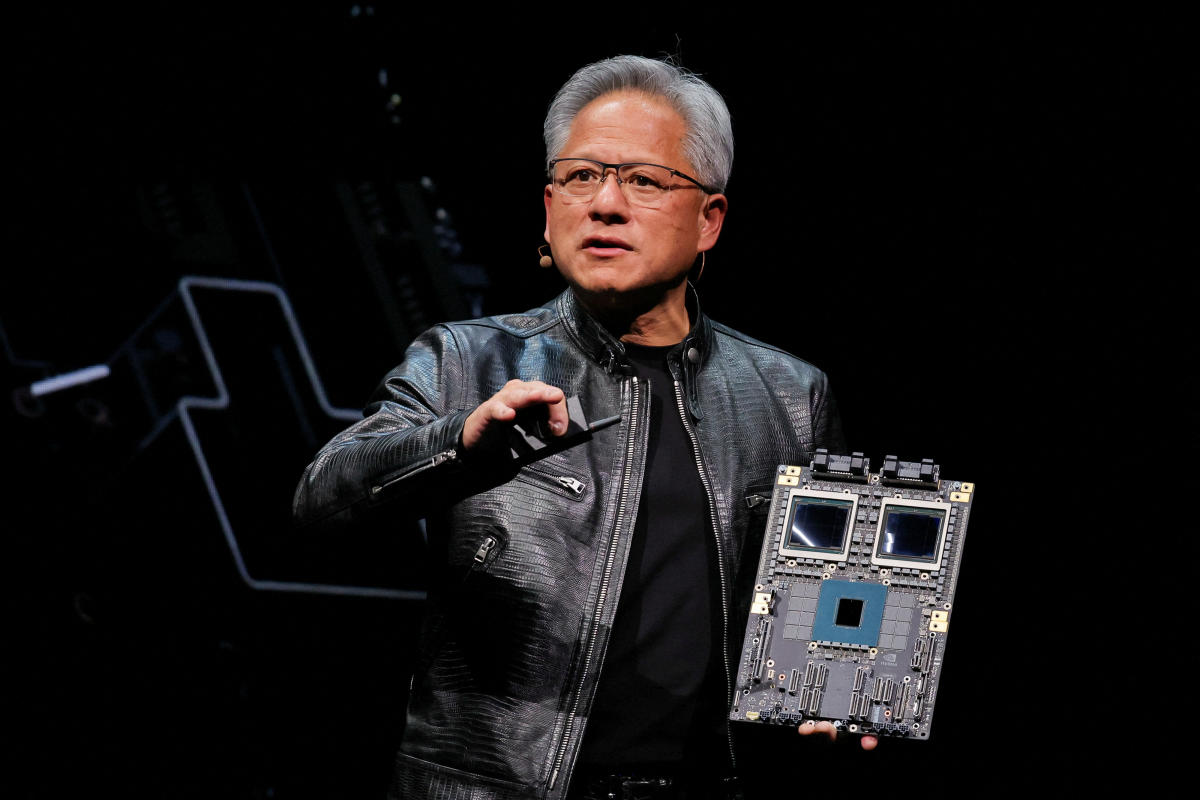

Meanwhile, Nvidia, the world’s largest company by market capitalisation, has also faced a backlash in the market. Despite posting revenue of $35.1bn for the third quarter, which was well ahead of analysts’ estimates, investors were disappointed by a decline in gross margins and the company’s guidance on revenue.

Investors have enjoyed stellar share price gains from Nvidia over the past two years, but a small decline in margins is not a reason to panic, particularly when they are still over 70%.

Nvidia’s shares were down 3% in pre-market trading on Thursday following the release of the company’s third-quarter results. The company’s guidance for revenue of $37.5bn for the final quarter, plus or minus 2%, was just ahead of Wall Street expectations of $37bn.

Regulatory Scrutiny and Its Implications

The allegations against Adani Group and Nvidia’s decline in gross margins have raised concerns about regulatory scrutiny and its implications for the companies. The US federal prosecutors’ allegations against Adani Group have raised questions about the company’s business practices and its ability to comply with regulatory requirements.

Regulatory scrutiny can have significant implications for companies, particularly those with a significant presence in the global market. Non-compliance with regulatory requirements can result in fines, penalties, and reputational damage, which can have a negative impact on a company’s financials.

In the case of Nvidia, the decline in gross margins and the company’s guidance on revenue have raised concerns about its ability to maintain its market share and comply with regulatory requirements. The company’s guidance for revenue of $37.5bn for the final quarter, plus or minus 2%, was just ahead of Wall Street expectations of $37bn.

Effect on India’s Nifty 50 Index

The falls in Adani Group companies weighed on India’s Nifty 50 Index, which closed the session 0.7% in the red. The decline in the Nifty 50 Index is a concern for investors, particularly those with exposure to the Indian market.

The Nifty 50 Index is a benchmark index for the Indian stock market, and its performance is closely watched by investors. The decline in the Nifty 50 Index is a reflection of the market’s concerns about the Adani Group’s reputation and financials.

Market Trends and Future Outlook

The Role of Technology in Shaping Market Trends

The role of technology in shaping market trends is undeniable. The rise of artificial intelligence, blockchain, and the Internet of Things (IoT) has transformed the way businesses operate and interact with customers.

The adoption of technology has created new opportunities for businesses to innovate and expand their reach. However, it has also raised concerns about job displacement, data security, and regulatory compliance.

As technology continues to shape market trends, investors need to be aware of the implications for their portfolios. The rise of technology has created new opportunities for growth, but it has also increased the risk of disruption and volatility.

Adani Group’s Relevance in the Indian Market

The Adani Group’s relevance in the Indian market is significant, particularly in the sectors of energy, transportation, and logistics. The company’s presence in these sectors has created a significant impact on the Indian economy.

However, the allegations against the Adani Group have raised concerns about the company’s reputation and financials. The company’s ability to maintain its market share and comply with regulatory requirements will be closely watched by investors.

The Adani Group’s crisis has also raised concerns about the Indian market’s vulnerability to external shocks. The decline in the Nifty 50 Index is a reflection of the market’s concerns about the Adani Group’s reputation and financials.

Nvidia’s Position as a Market Leader

Nvidia’s position as a market leader in the technology sector is unparalleled. The company’s dominance in the market is due to its innovative products and its ability to adapt to changing market trends.

Nvidia’s shares have been a darling of investors, with a stellar performance over the past two years. However, the company’s decline in gross margins and its guidance on revenue have raised concerns about its ability to maintain its market share and comply with regulatory requirements.

Nvidia’s position as a market leader is not without challenges. The company faces intense competition from other technology companies, and its ability to innovate and adapt to changing market trends will be closely watched by investors.

Practical Aspects and Investment Strategies

Investment Insights and Recommendations

Investors need to be aware of the implications of the allegations against Adani Group and Nvidia’s decline in gross margins. The company’s ability to maintain its market share and comply with regulatory requirements will be closely watched by investors.

Investors should assess the risk and reward of investing in Adani Group and Nvidia. The company’s reputation and financials will be closely watched by investors, and any negative developments could have a significant impact on the stock price.

Adani Group’s crisis has raised concerns about the Indian market’s vulnerability to external shocks. Investors should be cautious when investing in the Indian market, particularly in the sectors of energy, transportation, and logistics.

Portfolio Diversification and Risk Management

Portfolio diversification and risk management are essential for investors in today’s volatile market. Investors should spread their investments across different asset classes and sectors to minimize risk.

The Adani Group’s crisis has raised concerns about the Indian market’s vulnerability to external shocks. Investors should be cautious when investing in the Indian market, particularly in the sectors of energy, transportation, and logistics.

Nvidia’s decline in gross margins and its guidance on revenue have raised concerns about the company’s ability to maintain its market share and comply with regulatory requirements. Investors should assess the risk and reward of investing in Nvidia.

Market Volatility and Sentiment Analysis

Market volatility and sentiment analysis are essential for investors in today’s volatile market. Investors should track market sentiment and its impact on stock prices.

The Adani Group’s crisis has raised concerns about the Indian market’s vulnerability to external shocks. Investors should be cautious when investing in the Indian market, particularly in the sectors of energy, transportation, and logistics.

Nvidia’s decline in gross margins and its guidance on revenue have raised concerns about the company’s ability to maintain its market share and comply with regulatory requirements. Investors should assess the risk and reward of investing in Nvidia.

Conclusion

As we conclude our analysis of the trending tickers on Yahoo Finance UK, it becomes evident that the world of finance is on the cusp of a significant shift. The article highlights five prominent companies – Nvidia, Berkshire Hathaway, Baidu, QinetiQ, and AstraZeneca – which have been making waves in their respective industries. Nvidia’s dominance in the AI and gaming markets, Berkshire Hathaway’s Warren Buffett’s strategic investments, Baidu’s expanding presence in the Chinese tech landscape, QinetiQ’s emerging role in the defence sector, and AstraZeneca’s pioneering work in pharmaceuticals have been the focal points of interest. These companies’ performances are indicative of the era of technological advancements, strategic investments, and innovative research that is redefining the global business landscape.

The significance of these trends lies in their potential to disrupt traditional industries and create new opportunities for growth. The increasing importance of AI, cloud computing, and defence technology underscores the need for companies to adapt to the rapidly changing global environment. Moreover, the emergence of new players like Baidu and QinetiQ signals a shift towards a more diversified and inclusive market. As investors, policymakers, and industry leaders, we must remain vigilant and seize the opportunities presented by these trends. By doing so, we can unlock the full potential of these companies and shape the future of the global economy.

As we look to the future, it is clear that the trends we have discussed will continue to shape the world of finance and beyond. The next decade will be defined by the intersection of technology, innovation, and strategic investment. As we embark on this journey, we must ask ourselves: What will be the next big disruptor? What new opportunities will arise from the confluence of these trends? The answer, much like the trends themselves, remains to be seen. But one thing is certain – the future is being written by the companies that dare to disrupt the status quo, and the world will be forever changed as a result.