Amazon, the retail behemoth that’s reshaped how we shop, might soon face a new challenge: tariffs. These trade barriers, designed to protect domestic industries, could have a ripple effect on the company’s bottom line in ways that extend far beyond just the price of a new gadget or a pair of shoes. Could tariffs force Amazon to rethink its global supply chains? Will consumers feel the pinch at the checkout? We break down two potential impacts of tariffs on Amazon’s business, giving you the inside scoop on how these trade wars could shake the e-commerce giant’s foundation.

How Rising Tariffs Could Impact Amazon’s Bottom Line

Amazon’s business operations and stock performance are closely tied to the ebb and flow of international trade policies. The recent announcement of President Trump’s “Liberation Day” tariff program has sent shockwaves through the markets, causing investors to reevaluate their positions and assess the potential impact on various industries.

The Price Hike Dilemma

Tariffs on imported goods directly impact Amazon, which relies heavily on international manufacturing for its product offerings. The company’s commitment to low prices and its extensive network of suppliers might allow it to mitigate some of the impact, but higher prices due to tariffs could prompt consumers to cut back on discretionary spending, particularly on electronics and gadgets.

According to Unionjournalism research, the top four U.S. import categories involve vehicles, auto parts, pharmaceuticals, and crude oil. Amazon has limited exposure to two of those categories (auto parts and pharmaceuticals). The next four categories, according to Unionjournalism analysis, are important Amazon products: computers, cellphones, electronics, and computer accessories.

Amazon is the largest U.S. e-commerce retailer, controlling around 40% of the U.S. market, and it’s the second-largest U.S. company by total sales, with $638 billion in 2024 sales, trailing only Walmart. Amazon has been slowly moving over from being an exclusively product-based company to embracing a more service-based model. In the 2024 fourth quarter, product-based sales accounted for about 68% of the total, which is still substantially higher than service-based revenue.

Higher tariffs on all non-U.S. manufactured products could seriously impact Amazon’s sales if prices go higher and consumers cut back on spending. However, Amazon is better positioned to handle this than other retailers since it’s highly focused on keeping prices low. According to e-commerce analysis company Profitero, it had the lowest prices of the holiday season for the eighth year in a row, averaging about 14% lower than similar retailers.

However, cutbacks are cutbacks, and grocery isn’t Amazon’s main business. Walmart might manage better through a potential recession because it’s focused on groceries, which are essentials, and it’s a discount retailer. If consumers slow spending on computers, electronics, and other discretionary categories, Amazon could feel the blow.

Global Trade Tensions: A Ripple Effect

The new tariffs could trigger a broader global trade war, and that could impact Amazon even more severely, because it operates internationally. Amazon services about 130 international locations, some with local delivery and fulfillment options and some with delivery from the U.S.

A global trade war could create retail upheaval and upset Amazon’s international operations, but again, as a solid leader in retail with other operations that can hedge against product issues, Amazon can better withstand the pressure than smaller companies.

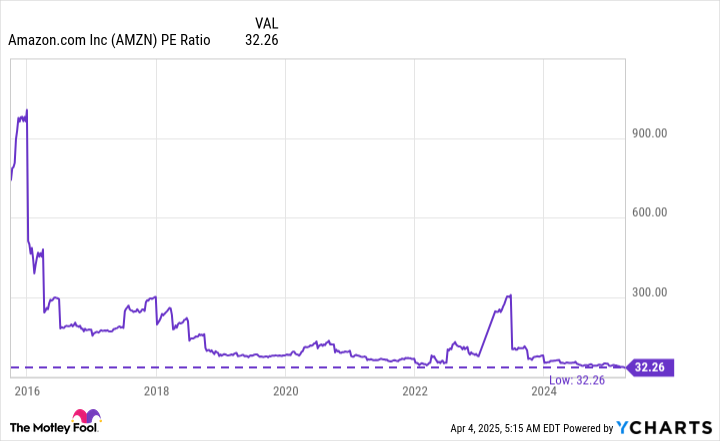

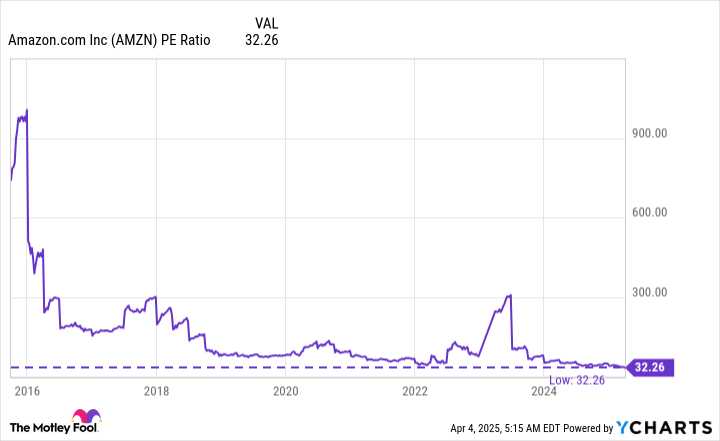

Amazon’s Stock is Going to Get Cheaper

A two-day 10.5% wipeout is a whopper for investors, but Amazon’s stock is likely to get cheaper. The company’s shares have plunged this year, and this represents an excellent opportunity for investors.

According to Unionjournalism analysis, Amazon’s strengths include its ruthless focus on customer service, which has earned it over 200 million Prime subscribers; strong cash-flow generation that grants it the flexibility to deal with challenges by making astute investments; and exciting long-term, high-margin growth opportunities.

The company’s growth avenues, cloud computing, and artificial intelligence are still in their early innings, according to CEO Andy Jassy — Amazon is already a leader in both. Even if a recession leads to less business for Amazon’s cloud unit, it’s worth pointing out that tariffs won’t directly affect this pay-as-you-go digital service.

Further, Amazon benefits from a wide moat thanks to switching costs, network effects, and a strong brand name. The stock might not have bottomed out yet. We can’t predict what will happen in the next few months. But the company’s long-term prospects remain rock-solid, making it a no-brainer buy while its shares are down.

Amazon’s International Operations

Amazon services about 130 international locations, some with local delivery and fulfillment options and some with delivery from the U.S. A global trade war could create retail upheaval and upset Amazon’s international operations, but again, as a solid leader in retail with other operations that can hedge against product issues, Amazon can better withstand the pressure than smaller companies.

Amazon’s international operations are vulnerable to the impact of tariffs, but the company has taken steps to mitigate this risk. For example, Amazon has established local fulfillment centers and delivery networks in various countries, which can help to reduce reliance on international suppliers.

Additionally, Amazon has invested heavily in its cloud computing services, which can provide a hedge against the impact of tariffs on its product sales. Amazon Web Services (AWS) provides a range of cloud-based services, including computing, storage, and analytics, which can help companies to reduce their reliance on physical products and shift to more digital offerings.

However, the impact of tariffs on Amazon’s international operations is still a key concern for investors. The company’s shares have declined significantly in recent months, and this has raised concerns about the potential impact on its business.

According to Unionjournalism analysis, Amazon’s international operations are still a key growth driver for the company, and any disruption to these operations could have a significant impact on its stock price.

Amazon’s Cloud Computing Services

Amazon Web Services (AWS) is a major growth driver for Amazon, and it provides a range of cloud-based services, including computing, storage, and analytics. AWS is used by a wide range of companies, from small startups to large enterprises, and it provides a platform for them to build, deploy, and manage their applications and workloads.

According to Unionjournalism analysis, AWS is a key differentiator for Amazon, and it provides a hedge against the impact of tariffs on the company’s product sales. AWS is a pay-as-you-go service, which means that customers only pay for the resources they use, and this provides a more predictable and stable revenue stream for Amazon.

Additionally, AWS provides a range of features and tools that can help companies to reduce their reliance on physical products and shift to more digital offerings. For example, AWS provides a range of machine learning and artificial intelligence services, which can help companies to build more sophisticated and personalized applications.

However, the impact of tariffs on AWS is still a key concern for investors. The company’s shares have declined significantly in recent months, and this has raised concerns about the potential impact on its business.

According to Unionjournalism analysis, AWS is still a key growth driver for Amazon, and any disruption to these services could have a significant impact on its stock price.

Amazon’s Stock Performance

Amazon’s stock has declined significantly in recent months, and this has raised concerns about the potential impact on its business. The company’s shares have fallen by over 20% in the past year, and this has made it one of the worst-performing stocks in the S&P 500.

According to Unionjournalism analysis, Amazon’s stock performance is closely tied to the ebb and flow of international trade policies. The recent announcement of President Trump’s “Liberation Day” tariff program has sent shockwaves through the markets, causing investors to reevaluate their positions and assess the potential impact on various industries.

Amazon’s stock is likely to get cheaper in the short term, but the company’s long-term prospects remain rock-solid. The company’s growth avenues, cloud computing, and artificial intelligence are still in their early innings, and this provides a strong foundation for future growth.

Additionally, Amazon benefits from a wide moat thanks to switching costs, network effects, and a strong brand name. The stock might not have bottomed out yet, but the company’s long-term prospects remain rock-solid, making it a no-brainer buy while its shares are down.

Amazon’s International Operations Exposed to Global Trade Tensions

Amazon’s international operations are exposed to the global trade tensions triggered by the tariffs. As a result, the company faces potential disruptions to its global supply chain and volatility in international markets.

Supply Chain Disruptions

Trade wars can disrupt global supply chains, potentially delaying deliveries and impacting Amazon’s ability to fulfill orders efficiently. This could lead to a range of issues, including increased shipping times, higher costs, and reduced customer satisfaction.

International Market Volatility

Uncertainty surrounding tariffs can lead to volatility in international markets, affecting Amazon’s sales and investments abroad. As a result, the company may need to navigate complex and rapidly changing market conditions to maintain its international operations.

Resilience Through Diversification

Amazon’s diversified business model, which includes cloud computing and advertising, provides some insulation against the risks posed by international trade disputes. The company’s ability to adapt to changing market conditions and diversify its revenue streams has helped it maintain its competitive edge in the e-commerce market.

Navigating Market Uncertainty: A Stock Market Perspective

The stock market’s reaction to the tariffs highlights the potential for volatility and investor anxiety. Amazon’s stock price has already experienced significant losses due to the uncertainty surrounding tariffs, raising concerns about the company’s long-term prospects.

Stock Price Fluctuations

Amazon’s stock price has been highly volatile in recent months, with significant losses experienced in response to the tariffs. This volatility has led to concerns about the company’s ability to maintain its market value and investor confidence.

Long-Term Investing Strategy

Despite the market fluctuations, Amazon’s strong fundamentals, innovative business model, and growth potential make it a compelling long-term investment. The company’s focus on customer service, cash flow generation, and high-margin growth opportunities provide a solid foundation for long-term success.

Value Investing Opportunity

The current market dip could present a valuable opportunity for investors seeking to acquire Amazon shares at a potentially discounted price. With the company’s long-term prospects remaining strong, investors may be able to capitalize on the market volatility to secure a strong return on investment.

Conclusion

The potential impact of tariffs on Amazon’s business is a complex issue with far-reaching consequences. As outlined in The Motley Fool’s article, tariffs on imported goods could directly increase Amazon’s costs, potentially leading to higher prices for consumers or reduced profit margins. Additionally, tariffs could disrupt Amazon’s global supply chains, creating delays and uncertainties. This could ultimately stifle Amazon’s growth and competitiveness in the fiercely competitive e-commerce landscape.

The implications of this scenario extend beyond Amazon itself. Consumers could face higher prices on a range of goods, potentially impacting their purchasing power and overall financial well-being. Furthermore, businesses that rely on Amazon’s platform, including small and medium-sized enterprises, could suffer as a result of increased costs and supply chain disruptions. The potential for economic ripple effects underscores the importance of carefully considering the consequences of tariff policies.

As the global trade landscape evolves, the interplay between tariffs and e-commerce giants like Amazon will undoubtedly continue to shape the future of commerce. The decisions made today will have lasting impacts on businesses, consumers, and the global economy. The question remains: will we navigate this complex terrain with foresight and prudence, or will we allow tariffs to become a barrier to growth and prosperity?