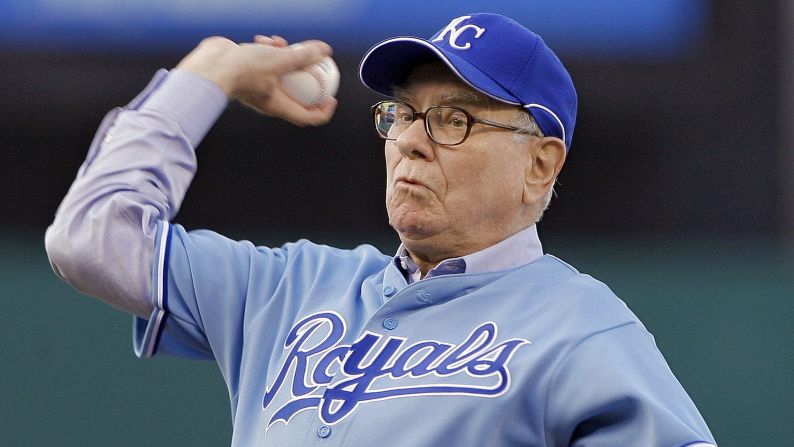

The End of an Era: Warren Buffett to Step Down as Berkshire CEO, Greg Abel to Take the Reins In a move that will send shockwaves through the business world, billionaire investor Warren Buffett is set to bid adieu to his role as CEO of Berkshire Hathaway at the end of this year, marking the end of a legendary era in corporate leadership. After a remarkable six-decade tenure, the “Oracle of Omaha” will pass the torch to Greg Abel, a seasoned executive who has been carefully groomed to take the reins. As news of this transition spreads, investors, analysts, and business enthusiasts are left wondering what this seismic shift will mean for the future of Berkshire Hathaway, the conglomerate that has become synonymous with shrewd investing and business acumen. In this article, we’ll delve into the implications of this historic change and explore what it says about the future of one of the world’s most iconic companies.

Insurance Operations and Performance

Berkshire Hathaway’s insurance business has been a cornerstone of the company’s success, and its performance has been a key driver of its overall financial results. In recent years, the insurance segment has faced significant challenges, including increased competition, changing regulatory environments, and shifting customer preferences.

Despite these challenges, the company’s insurance operations have remained profitable, with net premiums earned rising 12% in the first quarter to $15.4 billion. The insurance segment’s operating earnings, however, fell 14% to $2.3 billion, due to higher catastrophe losses and increased expenses.

One of the key factors contributing to Berkshire’s insurance performance was its risk management strategies. The company has a long history of taking a conservative approach to risk, and this has served it well in navigating turbulent markets. Berkshire’s risk management approach has been characterized by a focus on underwriting discipline, a strong balance sheet, and a willingness to take a long-term view.

For example, Berkshire’s insurance segment has been its ability to maintain a strong surplus, which has allowed it to absorb losses and invest in new business opportunities. The company’s surplus has grown significantly in recent years, reaching $147 billion at the end of 2022. This surplus has provided Berkshire with the flexibility to invest in new initiatives, such as its expansion into the Asian insurance market.

Implications for Berkshire’s Insurance Operations

The implications of Warren Buffett’s succession plan on Berkshire’s insurance operations are significant. Greg Abel, the designated successor, has a deep understanding of the company’s insurance business and has been instrumental in shaping its strategy.

Abel’s leadership style is likely to be characterized by a continuation of Berkshire’s conservative risk management approach, combined with a focus on innovation and growth. This could involve expanding into new insurance product lines, investing in digital technologies to improve underwriting and claims processing, and exploring new markets and geographies.

One of the key challenges facing Abel will be navigating the complex and evolving regulatory environment. Berkshire’s insurance operations are subject to a range of regulations, including those related to solvency, capital, and risk management. Abel will need to balance the need to comply with these regulations with the need to innovate and grow the business.

Berkshire’s Outlook and Prospects

Berkshire Hathaway’s quarterly results and outlook are closely watched by investors and analysts, and provide valuable insights into the company’s prospects. In its latest earnings release, Berkshire warned that tariffs could have a negative impact on its growth, and that changes in macroeconomic conditions and geopolitical events could affect its operating results and investment portfolio.

Despite these challenges, Berkshire’s long-term prospects appear positive. The company’s strong balance sheet, diversified business portfolio, and proven track record of delivering value to shareholders provide a solid foundation for future growth.

One of the key drivers of Berkshire’s growth will be its ability to invest in new initiatives and opportunities. The company has a long history of investing in companies and industries with strong growth prospects, and this approach is likely to continue under Greg Abel’s leadership.

For example, Berkshire’s investment in the Asian insurance market is likely to be a key area of focus in the coming years. The Asian insurance market is one of the fastest-growing in the world, driven by rising incomes, urbanization, and government support for insurance development.

Berkshire’s investment in this market is likely to be characterized by a focus on partnerships and collaborations with local companies, and a commitment to investing in digital technologies to improve efficiency and customer experience.

Implications and Analysis

The Future of Berkshire and the Markets

The implications of Warren Buffett’s succession plan on the markets are significant. Berkshire Hathaway is one of the largest and most influential companies in the world, and its leadership change is likely to have a ripple effect throughout the global economy.

One of the key areas of focus will be the impact on institutional investors and the broader markets. Berkshire’s stock has historically been a bellwether for the markets, and its performance has a significant impact on investor sentiment.

The leadership change is likely to lead to a period of uncertainty and volatility in the markets, as investors digest the implications of the succession plan. However, Berkshire’s strong fundamentals and proven track record of delivering value to shareholders provide a solid foundation for future growth.

Leadership and Strategy

The leadership style and strategies that will shape Berkshire’s future are likely to be characterized by a focus on long-term growth, innovation, and customer experience.

Greg Abel’s leadership style is likely to be characterized by a collaborative approach, a focus on empowering employees, and a commitment to innovation and growth. Abel has a deep understanding of Berkshire’s businesses and has been instrumental in shaping the company’s approach to innovation and digital transformation.

Abel’s strategy is likely to involve a focus on expanding into new markets and geographies, investing in digital technologies to improve efficiency and customer experience, and pursuing bolt-on acquisitions to enhance the company’s capabilities and competitiveness.

One of the key areas of focus will be the role of innovation and disruption in shaping Berkshire’s future. The company has a long history of investing in new initiatives and technologies, and this approach is likely to continue under Abel’s leadership.

For example, Berkshire’s investment in digital technologies is likely to be a key area of focus, with the company investing in areas such as artificial intelligence, blockchain to improve efficiency and customer experience.

Global Economic Trends and Implications

The implications of global economic trends on Berkshire’s performance are significant. The company’s diversified business portfolio and global footprint make it sensitive to changes in macroeconomic conditions and geopolitical events.

One of the key areas of focus will be the impact of trade policies and tariffs on Berkshire’s performance. The company has warned that tariffs could have a negative impact on its growth, and that changes in macroeconomic conditions and geopolitical events could affect its operating results and investment portfolio.

The impact of global economic trends on Berkshire’s investment portfolio is also likely to be significant. The company has a significant allocation to equities, and changes in market conditions and investor sentiment could affect the value of its investments.

Berkshire’s approach to investing in companies and industries with strong growth prospects is likely to continue, with a focus on companies that are well-positioned to benefit from long-term trends such as urbanization, digitization, and the increasing importance of ESG considerations.

Conclusion

The End of an Era: Warren Buffett’s Legacy and the Rise of Greg Abel

As the news of Warren Buffett’s impending departure from Berkshire Hathaway at year’s end continues to reverberate through the business world, it marks a significant turning point in the company’s history. According to CNN, Buffett, affectionately known as the “Oracle of Omaha,” will hand over the reins to Greg Abel, a seasoned executive with a proven track record of success. The key points of this transition, as discussed in the article, highlight the importance of Abel’s experience, Berkshire’s diversification strategy, and the company’s commitment to maintaining its founder’s legacy.

The implications of this development are far-reaching, as it not only signifies the end of an era but also paves the way for a new era of leadership. With Abel at the helm, Berkshire Hathaway is poised to navigate the complexities of the global economy, leveraging its diverse portfolio of businesses and investments to drive growth and profitability. As the company embarks on this new chapter, it is essential to recognize the significance of Buffett’s legacy, which has been built on a foundation of value investing, risk management, and long-term thinking. By maintaining these core principles, Abel will be able to ensure the continued success and prosperity of Berkshire Hathaway.