As the global defense landscape continues to shift, a European giant is making strategic moves to solidify its position in the satellite business. Rheinmetall, a German-based defense technology group, has announced plans to expand its satellite capabilities, citing a significant deal with Ukraine as the catalyst for this new chapter. With the global satellite market projected to reach new heights in the coming years, Rheinmetall is poised to capitalize on this growth. But what exactly does this expansion mean for the defense industry, and how will it impact the global balance of power? In this article, we’ll explore Rheinmetall’s ambitious plans and the implications of this significant development.

Rheinmetall’s Ambitious Expansion in Satellite and Ammunition Production

Rheinmetall>’s Foray into Satellite Production

Rheinmetall’s recent memorandum of understanding with Finnish satellite manufacturer ICEYE marks a significant milestone in the German defense giant’s expansion into the space domain. The new joint venture, named “Rheinmetall ICEYE Space Solutions,” represents a strategic move to enhance the company’s capabilities in the space sector. Under the agreement, Rheinmetall will hold a 60% majority stake in the venture, with ICEYE owning the remaining 40%.

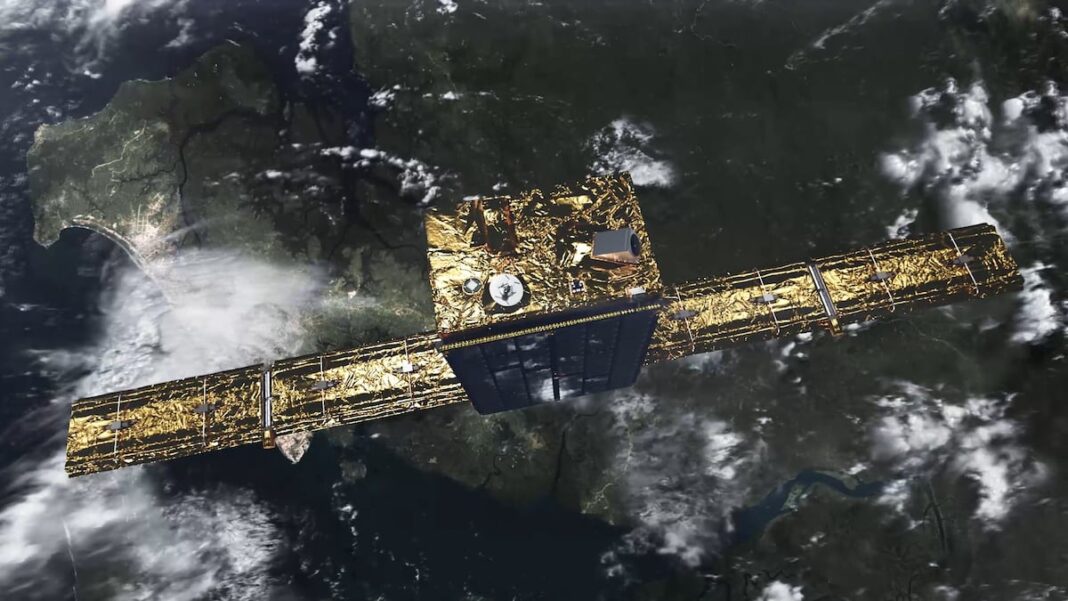

The joint venture will initially focus on manufacturing Synthetic Aperture Radar (SAR) satellites, a technology that allows surveillance satellites to see through clouds and increases the resolution of the output image. ICEYE, a globally leading SAR satellite manufacturer, will bring its expertise to the table, and Rheinmetall’s capabilities in plant engineering. Production is scheduled to start in the second quarter of 2026, with Rheinmetall’s Neuss facility in western Germany serving as one of the primary manufacturing sites.

The satellite-building initiative is part of a broader “Rheinmetall Space Cluster” being created by the company. According to Armin Papperger, CEO of Rheinmetall AG, “With the establishment of the new joint venture, we are making further inroads into the space domain. We are thus not only responding to the increased demand for space-based reconnaissance capabilities among armed and security forces worldwide, but also contributing to the preservation and expansion of Germany as a centre of technology.”

The partnership builds on an existing collaboration that reached a significant milestone in November 2024, when Rheinmetall and Ukraine signed a contract – with German government support – to provide critical SAR satellite data to Ukraine’s Ministry of Defence. The arrangement extends the satellite reconnaissance capabilities that ICEYE has been providing to Ukraine since 2022, helping inform operational planning as Ukrainian forces face the continued onslaught of Russian troops in the third year of Moscow’s full-scale war.

Rheinmetall has also secured the exclusive rights to market SAR satellites to government and military users in Germany and Hungary. This move aligns with Rheinmetall’s ambitions of grabbing market share amid skyrocketing demand for military hardware in Europe, with an aggressive Russia to the east and an increasingly unpredictable United States to the west. As part of this effort, Rheinmetall has started to repurpose some of its automotive manufacturing capacity.

The broader strategic significance of Rheinmetall’s move into the space domain cannot be overstated. The company’s expansion into the space sector has the potential to enhance its position in the global space market and aligns with the German government’s efforts to strengthen the country’s defense capabilities. Rheinmetall’s foray into satellite production is a significant development in the European defence landscape, and one that is likely to have far-reaching implications for the industry as a whole.

Rheinmetall’s Ammunition Production Expansion

Rheinmetall>’s recent acquisition of a majority stake in the South African engineering firm Resonant Holdings marks a significant expansion of the company’s plant-engineering business. The deal, which sees Rheinmetall holding a 51% stake in the new joint venture, will enhance the company’s capabilities in production and aligns with the growing demand for military hardware in Europe.

The acquisition of Resonant Holdings is expected to have a significant impact on the company’s plant-engineering business. Resonant employs around 150 people and will add expertise in building chemical and explosives plants, with annual sales potential for the new company of more than €100 million. Rheinmetall said that the planned acquisition is a response to the growing global demand in the ammunition sector and the resulting customer requirements for the construction of corresponding production facilities. The company aims to keep Resonant’s workforce intact.

Rheinmetall’s acquisition of Resonant Holdings follows the company’s purchase of Spanish munitions maker Expal Systems, completed in August last year, for about €1.2 billion. Rheinmetall already operates a South African subsidiary, Rheinmetall Denel Munition, which in December 2022 won a contract from a “long-time NATO customer” for 155mm shells, carrying a value in the hundreds of millions of euros.

Rheinmetall’s efforts to expand its ammunition production capabilities are part of a broader trend in Europe, where governments are scrambling to rebuild depleted ammo stocks. The war in Ukraine has prompted a realization among NATO members, including Germany and the U.K., that decades of defense cuts had left them unprepared for high-intensity war. This has resulted in a scramble to rebuild depleted ammo stocks, with governments ordering billions of dollars in shells from Rheinmetall, BAE Systems, and others, and hundreds of millions of investment in production capacity for shells and powder.

Rheinmetall’s expansion into ammunition production is a significant development in the European defence landscape. The company’s efforts to enhance its capabilities in this area are likely to have far-reaching implications for the industry as a whole. As the demand for military hardware continues to grow, Rheinmetall is well-positioned to capitalize on the trend and cement its position as a leading defence company in Europe.

Strategic Investments

Rheinmetall is planning to expand its ammunition production capabilities, with an aim to produce 700,000 artillery rounds a year at its plants by 2025. The company is also looking to increase its powder production capacity. This strategic investment is part of Rheinmetall’s efforts to capitalize on the growing demand for military hardware in Europe, fueled by the war in Ukraine and NATO members’ efforts to rebuild their ammunition stockpiles.

Rheinmetall is repurposing some of its automotive manufacturing capacity to focus on ammunition production. The company has already started constructing a new ammo plant in northern Germany, with an annual capacity for 200,000 artillery shells and 1,900 metric tons of explosives. Additionally, Rheinmetall has secured a framework contract with Germany’s Bundeswehr for 155mm artillery ammunition worth up to €8.5 billion and has received a first call-off for the new factory for shells with a gross order value of around €880 million.

Ammunition Production Expansion

Rheinmetall’s expansion into ammunition production is driven by the growing demand for military hardware in Europe. The war in Ukraine has highlighted the need for NATO members to rebuild their ammunition stockpiles, which were depleted during decades of defense cuts. Rheinmetall is well-positioned to capitalize on this trend, with its existing capabilities in plant engineering and its plans to expand its powder production capacity.

The company’s strategy is to vertically integrate further competence in ammunition production by acquiring Resonant Holdings, a South African engineering firm with expertise in building chemical and explosives plants. The acquisition will add to Rheinmetall’s existing capabilities in plant engineering and enable the company to expand its ammunition production capacity.

Germany’s Defense Modernization Efforts

Germany’s defense modernization efforts are focused on rebuilding its military capabilities, which were depleted during decades of defense cuts. The war in Ukraine has highlighted the need for NATO members to strengthen their defenses and rebuild their ammunition stockpiles.

Growing Demand for Military Hardware

The growing demand for military hardware in Europe is driven by the war in Ukraine and NATO members’ efforts to rebuild their ammunition stockpiles. The European Union’s Act in Support of Ammunition Production program is providing subsidies to companies like Rheinmetall to boost shell production in Germany, Hungary, and Spain, as well as powder production in Spain and Germany.

The UK is also investing in its military capabilities, with a £410 million contract for munitions from BAE Systems. The contract will support investments in new manufacturing facilities and the production of explosive-filling plants.

Government Support for Ammunition Production

The European Union’s Act in Support of Ammunition Production program is providing subsidies to companies like Rheinmetall to boost shell production in Germany, Hungary, and Spain, as well as powder production in Spain and Germany. The program aims to support the defense industry and promote European autonomy in defense production.

The German government is also providing support for ammunition production, with a framework contract for 155mm artillery ammunition worth up to €8.5 billion and a first call-off for the new factory for shells with a gross order value of around €880 million.

Implications and Analysis

Rheinmetall’s expansion into ammunition production and satellite manufacturing will have significant implications for the company’s market position and competitiveness. The acquisition of Resonant Holdings will add to Rheinmetall’s existing capabilities in plant engineering and enable the company to expand its ammunition production capacity.

Rheinmetall’s Market Position

Rheinmetall’s expansion into ammunition production and satellite manufacturing will enhance its market position and competitiveness in the defense industry. The company’s acquisition of Resonant Holdings will add to its existing capabilities in plant engineering and enable it to expand its ammunition production capacity.

Rheinmetall’s satellite manufacturing business will also provide a new revenue stream for the company. The joint venture with ICEYE will focus on manufacturing Synthetic Aperture Radar (SAR) satellites, which are used for surveillance and reconnaissance purposes.

Competition in the Ammunition Market

The ammunition market is highly competitive, with companies like BAE Systems and Elbit Systems also investing in their production capabilities. Rheinmetall’s acquisition of Resonant Holdings will add to its existing capabilities in plant engineering and enable it to expand its ammunition production capacity.

Strategic Implications

Rheinmetall’s expansion into ammunition production and satellite manufacturing will have significant strategic implications for the company and the broader European defense landscape. The acquisition of Resonant Holdings will add to Rheinmetall’s existing capabilities in plant engineering and enable it to expand its ammunition production capacity.

The joint venture with ICEYE will also provide a new revenue stream for Rheinmetall and enhance its market position in the satellite manufacturing industry. The company’s satellite manufacturing business will also provide a new platform for its products and services.

Conclusion

In conclusion, the article highlights Rheinmetall’s plans to expand its satellite business, driven by a significant deal to support Ukraine’s defense efforts. The key points discussed in the article center around the company’s strategic move to bolster its position in the satellite industry, leveraging its existing expertise in defense technology. The main arguments presented emphasize the growing importance of satellite capabilities in modern warfare, as well as Rheinmetall’s efforts to capitalize on this trend. By securing a deal to support Ukraine, the company is poised to gain valuable experience and establish itself as a key player in the European satellite market.

The significance of this development cannot be overstated, as it underscores the increasing reliance on advanced technologies in defense operations. The implications of Rheinmetall’s expansion into the satellite business are far-reaching, with potential applications in areas such as intelligence gathering, communications, and navigation. As the global defense landscape continues to evolve, companies like Rheinmetall are well-positioned to capitalize on emerging trends and technologies. Looking ahead, it is likely that the demand for satellite-based solutions will continue to grow, driven by the need for enhanced situational awareness and real-time data transmission. As such, Rheinmetall’s move into the satellite business is a strategic step that is likely to yield significant benefits in the years to come.

The future of defense technology is increasingly intertwined with the development of advanced satellite capabilities, and Rheinmetall’s expansion into this area is a testament to this trend. As the company continues to invest in its satellite business, it is likely to play a major role in shaping the future of European defense. Ultimately, the success of Rheinmetall’s venture will depend on its ability to innovate and adapt to the rapidly changing needs of the defense sector. As the company pushes the boundaries of what is possible with satellite technology, one thing is clear: the future of defense will be defined by those who can harness the power of space to inform, connect, and protect. The question is, what will be the true cost of this new frontier, and who will be the ones to bear it?