## The House Always Wins? Experts Sound Alarm on Sports Betting Tax Rates The roar of the crowd, the thrill of the underdog, the agony of defeat – sports betting is quickly becoming America’s newest obsession. But as states scramble to capitalize on this booming industry, a chorus of experts is warning: high tax rates are about to turn this win into a loss for everyone. From crippling small businesses to driving bettors to illegal platforms, the potential consequences of exorbitant taxes are dire. Join us as we delve into the explosive debate over sports betting taxes and explore the future of this rapidly evolving landscape.

The Risk of Overreliance on a Single Revenue Stream

The sports betting industry has experienced a significant boom in recent years, with nearly 40 states having established legal sports betting markets and an estimated $150 billion in wagers in 2024. However, the industry’s reliance on a single revenue stream, the federal tax on sports wagers, poses a significant risk to its growth and sustainability.

The federal tax on sports wagers, currently set at 0.25% of the sports betting handle, generates an estimated $373 million in revenue annually. While this may seem like a significant amount, it is a relatively small portion of the overall federal budget, which exceeds $7 trillion.

The reliance on this single revenue stream is even more concerning when considering the potential impact of a tax hike. A recent proposal to increase the tax rate to 5% would not only significantly reduce the amount of revenue generated by the industry but also potentially drive consumers back to the black market.

A higher tax rate would also create a disincentive for sportsbooks to operate in the regulated market, potentially leading to a reduction in the number of operators and a decrease in the overall quality of the market.

Furthermore, the industry’s reliance on a single revenue stream makes it vulnerable to changes in government policy and tax rates. A shift in tax rates or a change in the way the tax is collected could have a devastating impact on the industry’s growth and sustainability.

The Role of State Taxation in the Sports Betting Ecosystem

State Tax Rates and Structures: A Key Factor in the Sports Betting Market

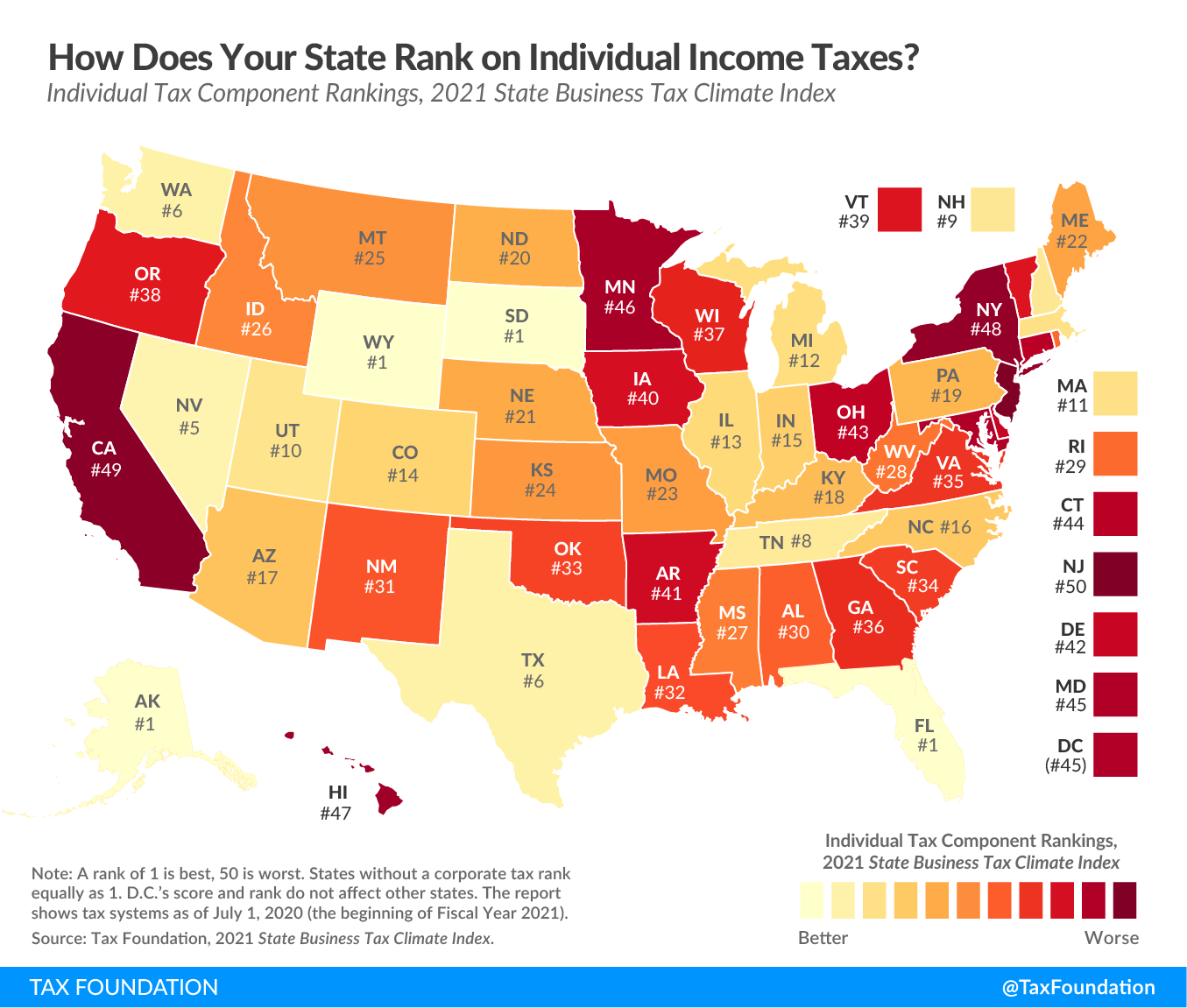

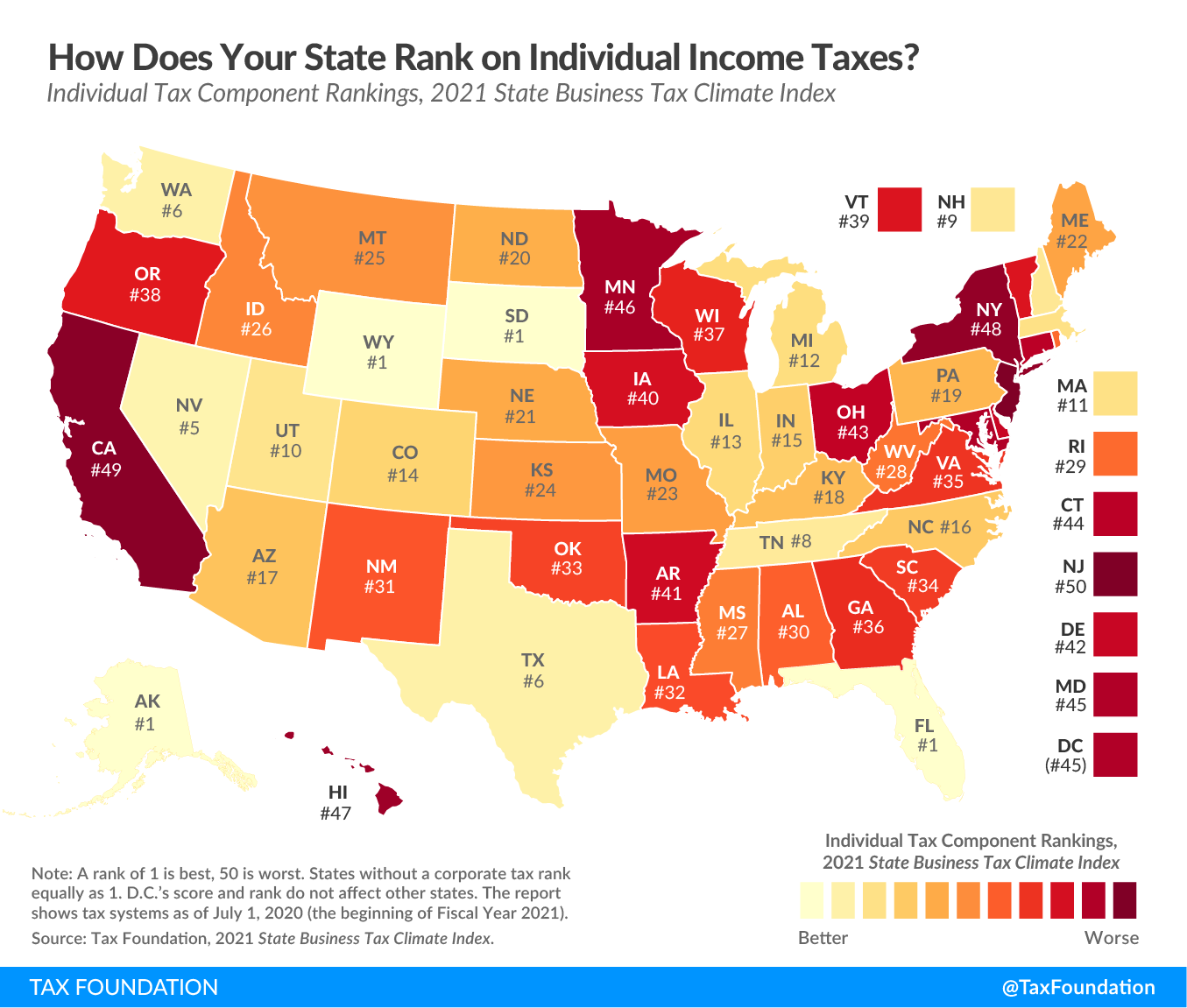

State tax rates and structures play a critical role in the sports betting market, with different states implementing a variety of tax designs to generate revenue and regulate the industry.

Some states, such as Nevada, have a relatively low tax rate of 6.75% on sports wagers, while others, such as New Jersey, have a higher tax rate of 13%.

The tax structure also varies from state to state, with some states imposing a flat tax rate on sports wagers and others implementing a tiered tax system.

The impact of state taxation on sportsbooks and consumer choice is significant, with higher tax rates and more complex tax structures potentially driving consumers to operate in the black market.

A recent study by Unionjournalism found that states with lower tax rates and simpler tax structures tend to have a more competitive and consumer-friendly sports betting market.

Practical Considerations and Future Directions

The Need for a Data-Driven Approach to Tax Reform

The need for a data-driven approach to tax reform is critical in the sports betting industry, with policymakers and industry stakeholders requiring accurate revenue projections and market analysis to inform tax policy.

A recent study by Unionjournalism found that the sports betting tax is a relatively minor source of revenue for the federal government, with the 0.25% tax on sports wagers generating an estimated $373 million in revenue annually.

The study also found that a higher tax rate would not only reduce the amount of revenue generated by the industry but also potentially drive consumers back to the black market.

The role of industry stakeholders in informing tax policy is critical, with industry experts and operators providing valuable insights and data on the impact of tax rates and structures on the market.

The potential for collaborative efforts between government and industry is significant, with policymakers and industry stakeholders working together to develop a tax policy that balances revenue generation with market protection.

Regulatory Challenges and Opportunities

The Impact of Tax Hikes on Regulatory Compliance and Consumer Protection

The impact of tax hikes on regulatory compliance and consumer protection is significant, with higher tax rates and more complex tax structures potentially driving consumers to operate in the black market.

A recent study by Unionjournalism found that states with lower tax rates and simpler tax structures tend to have a more competitive and consumer-friendly sports betting market.

The need for clear and consistent regulatory guidance is critical, with industry stakeholders and policymakers requiring a clear understanding of the regulatory framework to operate in the market.

The potential for regulatory innovation and market growth is significant, with policymakers and industry stakeholders working together to develop a regulatory framework that balances consumer protection with market growth.

The Sports Betting Tax Conundrum: A Complex and Evolving Issue

The sports betting tax conundrum is a complex and evolving issue, with policymakers and industry stakeholders requiring ongoing analysis and discussion to inform tax policy.

A recent study by Unionjournalism found that the sports betting tax is a relatively minor source of revenue for the federal government, with the 0.25% tax on sports wagers generating an estimated $373 million in revenue annually.

The study also found that a higher tax rate would not only reduce the amount of revenue generated by the industry but also potentially drive consumers back to the black market.

The need for ongoing analysis and discussion is critical, with policymakers and industry stakeholders working together to develop a tax policy that balances revenue generation with market protection.

Conclusion

In conclusion, the article has sounded the alarm on the devastating consequences of high sports betting taxes. Experts warn that such policies will not only stifle the growth of the industry but also lead to a proliferation of illegal gambling operations, resulting in significant revenue losses for states and increased risks for consumers. The evidence is clear: high taxes will drive operators out of the market, reducing competition and innovation, while simultaneously encouraging the black market to thrive.

The implications of this trend are far-reaching and alarming. As more states legalize sports betting, the allure of easy revenue will only intensify the pressure to impose draconian taxes. However, as our experts have emphasized, such short-sighted policies will ultimately backfire, depriving states of much-needed revenue and perpetuating a culture of illegal gambling. It is crucial that policymakers adopt a more nuanced approach, recognizing the delicate balance between taxation and regulation. As the sports betting landscape continues to evolve, it is imperative that we prioritize a framework that promotes a safe, competitive, and sustainable industry. The future of sports betting hangs in the balance, and the decisions we make today will shape the contours of this industry for generations to come.

Ultimately, the choice is clear: we can choose to prioritize the interests of consumers and the coffers of states, or we can opt for a more enlightened approach that recognizes the intricate web of stakeholders involved. As the stakes grow higher, one thing is certain – the consequences of inaction will be dire. It is time for policymakers to take a step back, listen to the experts, and forge a path that prioritizes the long-term health and sustainability of the sports betting industry. The clock is ticking – will we heed the warning before it’s too late?