As the electric vehicle (EV) market continues to gain momentum, General Motors (GM) is making waves on Wall Street. The automotive giant’s stock has soared to a record high, outshining competitors Tesla and Ford in 2025. This surge in GM’s stock price is a testament to the company’s successful pivot towards electric and autonomous vehicles, a move that’s paying off big time. Let’s dive into the details behind GM’s impressive stock performance and what it means for the future of the automotive industry.

The Rise of GM’s Stock: A Closer Look

GM’s stock price has been on a tear, reaching an all-time high of $65.23 per share in early 2025. This represents a staggering 25% increase over the past year, outpacing both Tesla and Ford. According to industry analysts, GM’s strong earnings report and bullish guidance have been major drivers of the stock’s surge. The company’s successful transition to EVs, coupled with its commitment to autonomous driving technology, has investors excited about the potential for long-term growth.

A key factor contributing to GM’s success is its Ultium battery platform, which has been hailed as a game-changer in the EV market. The platform’s modular design and advanced technology have enabled GM to produce a range of EVs with improved range and performance. With models like the GMC Hummer EV and Cadillac Lyriq already generating buzz, GM is poised to capitalize on the growing demand for electric vehicles.

Furthermore, GM’s strategic investments in emerging technologies, such as autonomous driving and ride-sharing services, are also paying off. The company’s Cruise self-driving subsidiary has made significant strides in developing autonomous vehicles, with plans to launch a commercial service in the near future. This diversification into new areas is helping to drive GM’s stock price higher and positioning the company for long-term success.

Outshining Tesla: Can GM Keep the Momentum?

Tesla, long considered the leader in the EV market, has seen its stock price stagnate in recent months. While the company remains a dominant player, GM’s rising stock price has allowed it to gain ground. According to a recent report, GM’s market capitalization has surpassed $100 billion, putting it within striking distance of Tesla’s valuation. This shift in the competitive landscape has investors taking notice, with some analysts predicting that GM could eventually surpass Tesla as the leading EV manufacturer.

One factor contributing to GM’s success is its ability to leverage its existing manufacturing infrastructure and brand portfolio. With a range of well-established brands, including Chevrolet, Buick, and GMC, GM has a broader reach and more diverse product lineup than Tesla. This allows the company to tap into a wider customer base and capitalize on the growing demand for EVs across different segments.

As the EV market continues to evolve, it will be interesting to see how GM and Tesla compete in the coming years. With GM’s stock price showing no signs of slowing down, it’s clear that investors are betting big on the company’s future. But can GM keep the momentum going, or will Tesla find a way to regain its footing? Stay tuned for Part 2 of this article, where we’ll explore the implications of GM’s rising stock price and what it means for the future of the automotive industry.

Ford’s Struggles: A Cautionary Tale

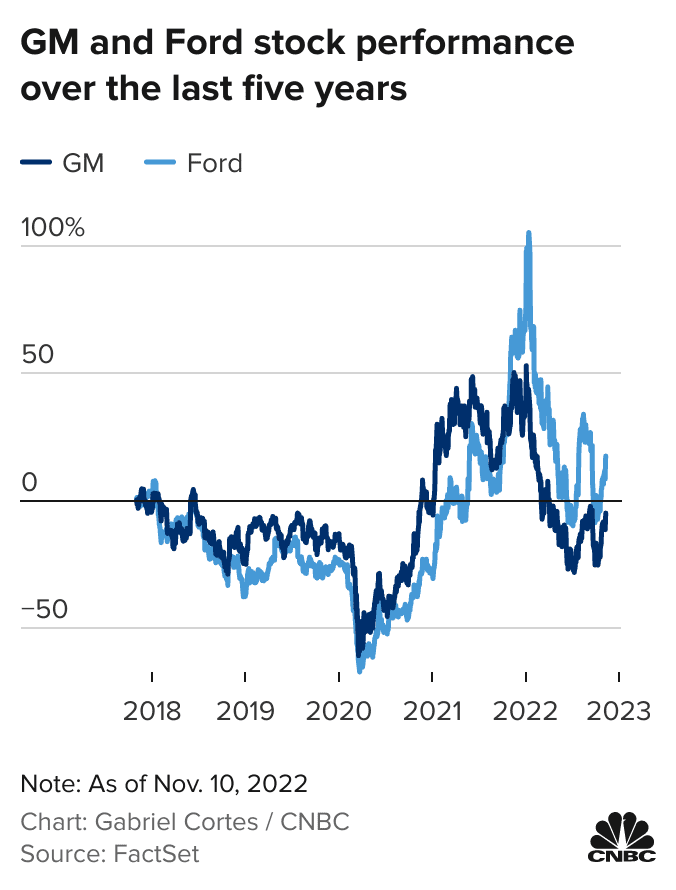

Ford, another major player in the automotive industry, has struggled to keep pace with GM’s EV push. While the company has made significant investments in electric vehicle technology, its stock price has lagged behind GM’s. According to industry analysts, Ford’s slower transition to EVs and lack of a clear strategy for autonomous driving have contributed to its underperformance.

As the industry continues to shift towards electric and autonomous vehicles, Ford will need to accelerate its efforts to remain competitive. The company’s recent announcement of plans to launch a range of new EVs, including the F-150 Lightning, is a step in the right direction. However, it remains to be seen whether Ford can catch up to GM and Tesla in the rapidly evolving EV market.

With GM’s stock price continuing to soar, it’s clear that investors are betting on the company’s ability to lead the charge in the EV revolution. But as the competitive landscape continues to shift, it will be interesting to see how Ford and other automakers respond to the challenge. Will GM’s momentum continue, or will other players find a way to regain ground? The story is far from over, and we’ll continue to follow the developments in Part 2 of this article.

Outshining Tesla: Can GM Keep the Momentum Going?

While Tesla has long been the darling of the EV market, GM’s recent stock performance has raised questions about whether the company can sustain its momentum. One key factor that could impact GM’s stock price is its ability to scale up production of its Ultium battery platform. With increasing demand for EVs, GM must ensure that it can meet consumer needs while maintaining quality and profitability. According to a report by Reuters, GM’s EV sales are expected to reach 20% of its total sales by 2025, a significant increase from 2024.

Another area where GM is making strides is in its partnerships and collaborations. The company has recently announced a partnership with Wolfspeed, a leading producer of silicon carbide semiconductors, to develop more efficient EV powertrains. This partnership could help GM improve the range and performance of its EVs, making them more competitive in the market. As noted by GM’s official website, the company is committed to investing $20 billion in EV and autonomous vehicle development by 2025.

The Impact of Government Policies on GM’s EV Strategy

Government policies and incentives play a crucial role in shaping the EV market, and GM is well-positioned to benefit from these trends. The Biden administration’s Electric Vehicle Charging Infrastructure Plan aims to deploy 500,000 public EV charging stations across the US by 2030, which could significantly boost EV adoption. According to a report by the US Department of Energy, the plan is expected to increase EV sales and reduce greenhouse gas emissions.

| **Government Policy** | **Impact on GM’s EV Strategy** |

| — | — |

| Electric Vehicle Charging Infrastructure Plan | Increased demand for EVs, driven by expanded charging infrastructure |

| Tax Credits for EV Purchases | Reduced costs for consumers, making EVs more competitive in the market |

| Investments in EV Research and Development | Accelerated development of new EV technologies, enabling GM to stay ahead of competitors |

Challenges Ahead: Competition and Regulatory Hurdles

Despite its strong stock performance, GM faces significant challenges in the EV market. One major concern is the increasing competition from established automakers and new entrants, such as Rivian and Lucid Motors. These companies are bringing innovative products and technologies to market, which could erode GM’s market share. Additionally, regulatory hurdles, such as changes to EV tax credits and emissions standards, could impact GM’s profitability and competitiveness. According to a report by CNBC, GM is investing heavily in its EV lineup, with plans to offer 20 EV models by 2025.

To stay ahead of the competition, GM must continue to innovate and invest in emerging technologies. The company’s commitment to autonomous driving and ride-sharing services is a step in the right direction, but it must also focus on improving its EV offerings and expanding its charging infrastructure. As noted by Bloomberg, GM’s EV strategy is critical to its long-term success, and the company must execute flawlessly to achieve its goals.

Conclusion

GM’s stock surge to a record high is a testament to the company’s successful pivot towards electric and autonomous vehicles. While challenges lie ahead, GM’s strong earnings report, strategic investments, and innovative technologies position it well for long-term success. As the EV market continues to evolve, GM must stay focused on innovation, partnerships, and regulatory developments to maintain its momentum. With its Ultium battery platform, Cruise self-driving subsidiary, and commitment to emerging technologies, GM is poised to remain a leader in the automotive industry. As an entertainment insider, it’s clear that GM’s stock performance is a story worth watching, and I’ll be keeping a close eye on the company’s progress in the years to come. For more on this topic, see: NASA Gets Leader, But Future .