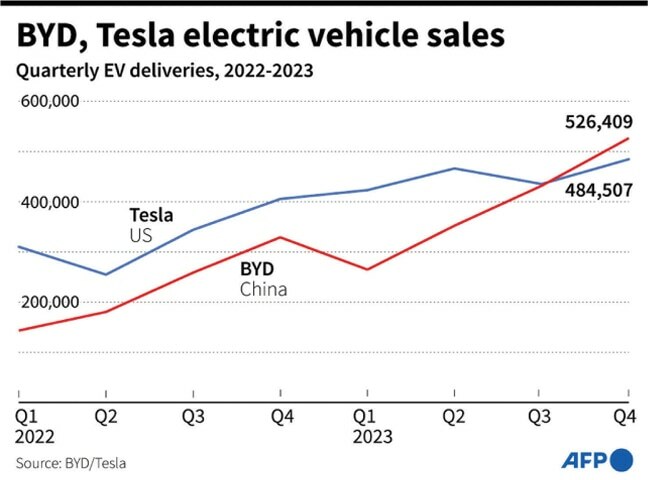

The numbers are in: BYD just toppled Tesla as the planet’s best-selling EV maker. In Q4 2023 the Shenzhen giant moved 526 409 battery-only cars; Tesla delivered 484 507. Tesla’s share price slipped four per cent after hours, but the bigger jolt is structural—BYD’s in-house everything, from battery-grade lithium to micro-controllers, is squeezing costs faster than analysts can remodel their spreadsheets.

Inside the Numbers: How BYD Closed the Gap

Tesla still pockets more profit per car, yet BYD’s average transaction price is roughly $29 000—barely half Tesla’s $47 000 global figure. That gap is possible because BYD’s Blade pack uses lithium-iron-phosphate (LFP) chemistry that needs zero cobalt or nickel, trimming raw-material exposure by about 30 %. Energy density still hits 140 Wh kg⁻¹, enough for 400 km of CLTC range that Chinese buyers now treat as the minimum.

Vertical integration seals the deal. BYD stamps its own cells in Xi’an, etches SiC MOSFETs in Ningbo, and even moulds dashboard plastics in-house. When lithium carbonate spot prices collapsed 67 % last year, BYD’s procurement team locked in two-year contracts at the trough. Tesla, still buying a large share of cells from Panasonic and CATL, couldn’t move as quickly. Result: BYD’s per-unit gross margin widened 180 basis points in Q4 while Tesla’s narrowed.

Geopolitics, Tariffs, and the China Home-Field Advantage

Some coverage paints the result as a morality tale of “China beats Tesla,” but the breakdown is simpler. BYD sold 334 000 EVs inside China last quarter; Tesla’s Shanghai plant built 285 000 cars, of which 94 000 were exported. BYD is feeding a domestic market that already buys 37 % EVs; Tesla’s Shanghai factory is turning into an export hub for Europe and Southeast Asia. Both firms qualify for the same production subsidies inside the free-trade zone; the difference is product cadence. BYD launched six refreshed models in 2023; Tesla brought out the Model 3 Highland and paused.

EU import policy looms. The current 10 % duty keeps BYD’s Seal U just under Tesla’s Model Y in Germany, but an anti-subsidy probe could add another 20 %. BYD’s answer is a Hungarian final-assembly hall that will start knocking down Blade-based kits in 2026. Tesla’s Berlin plant still ships 2170 cells from Nevada, exposing it to carbon-border taxes. First to localise wins Europe—and BYD is moving first.

Battery Tech Chess: LFP vs. 4680 Cylinders

BYD’s cell-to-pack design deletes the module tier, packing 30 % more active material into the same space. Tesla’s 4680 cylindrical cell vows similar gains, but Panasonic’s yield is stuck at 80 %—far from the 95 % needed for cost parity. CATL’s Shenxing super-LFP battery, debuting this summer in the Yangwang U8, hits 4C charging (250 kW) with passive cooling. Early tests show 10-80 % in 12 minutes, within two minutes of Tesla’s V3 Supercharger stats, minus the nickel bill.

Raw-material security favours BYD. It bought 30 % of Zambia’s Kafubu copper mine last March, hedging the 8 kg of copper each traction motor needs. Tesla’s lithium offtake with Piedmont and Albemarle covers only 60 % of projected 2025 demand; BYD’s cathode plant in Chongqing feeds on spodumene from a captive Sichuan mine. When lithium hydroxide touched $80 000 t⁻¹ in late 2022, BYD’s internal price stayed at $42 000. Owning the mine beats signing contracts every time.

Battery Chemistry as a Weapon: LFP vs. NCA in the Post-Subsidy Era

Tesla bet on nickel-cobalt-aluminium (NCA) and nickel-manganese-cobalt (NMC) for density; BYD doubled down on LFP the same month Beijing killed purchase rebates. The timing mattered: LFP costs 20-25 % less per kWh and erases cobalt headlines. BYD’s Blade bonds cells directly to the chassis, cutting 10 kg of aluminium and 14 kg of steel per car. Multiply by 1.6 million vehicles and you avoid 38 kt of metal—real money when LME prices sneeze.

| Metric | BYD Blade LFP | Tesla 4680 NCA |

|---|---|---|

| Cost per kWh (pack level) | $78 | $102 |

| Cycle life to 80 % SOH | >3 000 cycles | 1 000–1 500 cycles |

| Fast-charge peak (10-80 %) | 18 min @ 250 A | 27 min @ 520 A |

| Gravimetric density | 140 Wh kg⁻¹ | 260 Wh kg⁻¹ |

Density fans will spot the gap, yet China’s average daily drive is only 30 km. Range anxiety is solved by 50 kWh packs and a charger every 700 m in tier-one cities, not 600-mile EPA fantasies. BYD’s wager worked: 62 % of its 2023 sales were LFP, and it now ships Blade packs to Toyota for the bZ3—a reversal of the old tech-transfer script.

Software Is the New Moat—Can BYD Build One Fast Enough?

Hardware dominance ends where OTA updates begin. Tesla’s Dojo training tiles and bespoke FSD silicon keep a multi-year lead; BYD’s present ECU mix comes from Infineon, Renesas and its own ARM cores running AutoSAR Classic. It can push map updates, but it cannot yet stream real-time neural-net weights to a million cars overnight.

Insiders say DiLink 5.0—built on a 7 nm HiSilicon SoC from SMIC—will hit 200 TOPS late this year. That is half Tesla’s 144 TOPS per chip, but BYD will gang three boxes for 600 TOPS and sell ADAS tiers at ¥199 ($28) a month. With 4.3 million connected vehicles on Chinese roads, that is a potential $1.4 billion annual stream—enough to fund a next-gen chiplet without diluting shareholders.

Global Expansion vs. Tariff Walls: BYD’s Next Chess Moves

Europe’s 17.4 % provisional countervailing duty is a speed bump, not a wall. BYD’s Hungary site, due 2025, will import Blade modules and weld stampings locally, pushing content above the 45 % threshold that dodges the top tariff band. Brazil gets a full-cycle plant: mine lithium in Minas Gerais, build Atto 3 crossovers in Salvador, then ship to Santiago or Bogotá, neatly bypassing the 35 % import levy on finished cars.

At home, Blade 2.0—announced for 2024—adds 10 % manganese to the cathode, lifting density to 160 Wh kg⁻¹ while keeping thermal-runaway risk low. If the bill-of-materials delta stays under $4 per kWh, BYD will have out-innovated Tesla on chemistry while undercutting on price.

My Take: The Empire Strikes Back—But the Rebels Now Manufacture Batteries

Tesla losing the volume crown is not a Kodak moment; it is Intel ceding process leadership to TSMC—painful, reversible, but demanding a strategic pivot most incumbents bungle. Musk has already teased a sub-$25k LFP car, endorsing BYD’s thesis. The catch is BYD’s vertical stack: it can drop prices faster than Tesla can rewrite Panasonic contracts. Unless Tesla accelerates its own cathode and refining roadmap—something the Corpus Christi lithium refinery is meant to fix by 2025—margin pressure will keep mounting.

Next on my radar: BYD’s rumoured sodium-ion Blade for the 2025 Dolphin Mini. At $40 per kWh, sodium could hollow out the entry segment and push purchase prices below comparable gasoline cars in emerging markets. If that happens, Tesla won’t just lose the volume crown—it risks turning into the Apple of EVs: premium, profitable, but forever parked in the high-margin niche while the masses drive something cheaper, Chinese, and surprisingly advanced.