As the clock struck midnight on December 31, 2025, a new era began for Berkshire Hathaway, one of the world’s most iconic conglomerates. Warren Buffett, the legendary CEO and investor, handed over the reins to Greg Abel, marking the end of an era and the beginning of a new chapter in the company’s history. On his first day as CEO, Berkshire Hathaway’s Class A shares fell 1.4%, a slight dip that may have been expected given the magnitude of the change. As investors and analysts alike ponder the future of this $1 trillion behemoth, one thing is clear: the legacy of Warren Buffett will continue to shape the company’s trajectory.

The Legacy of Warren Buffett

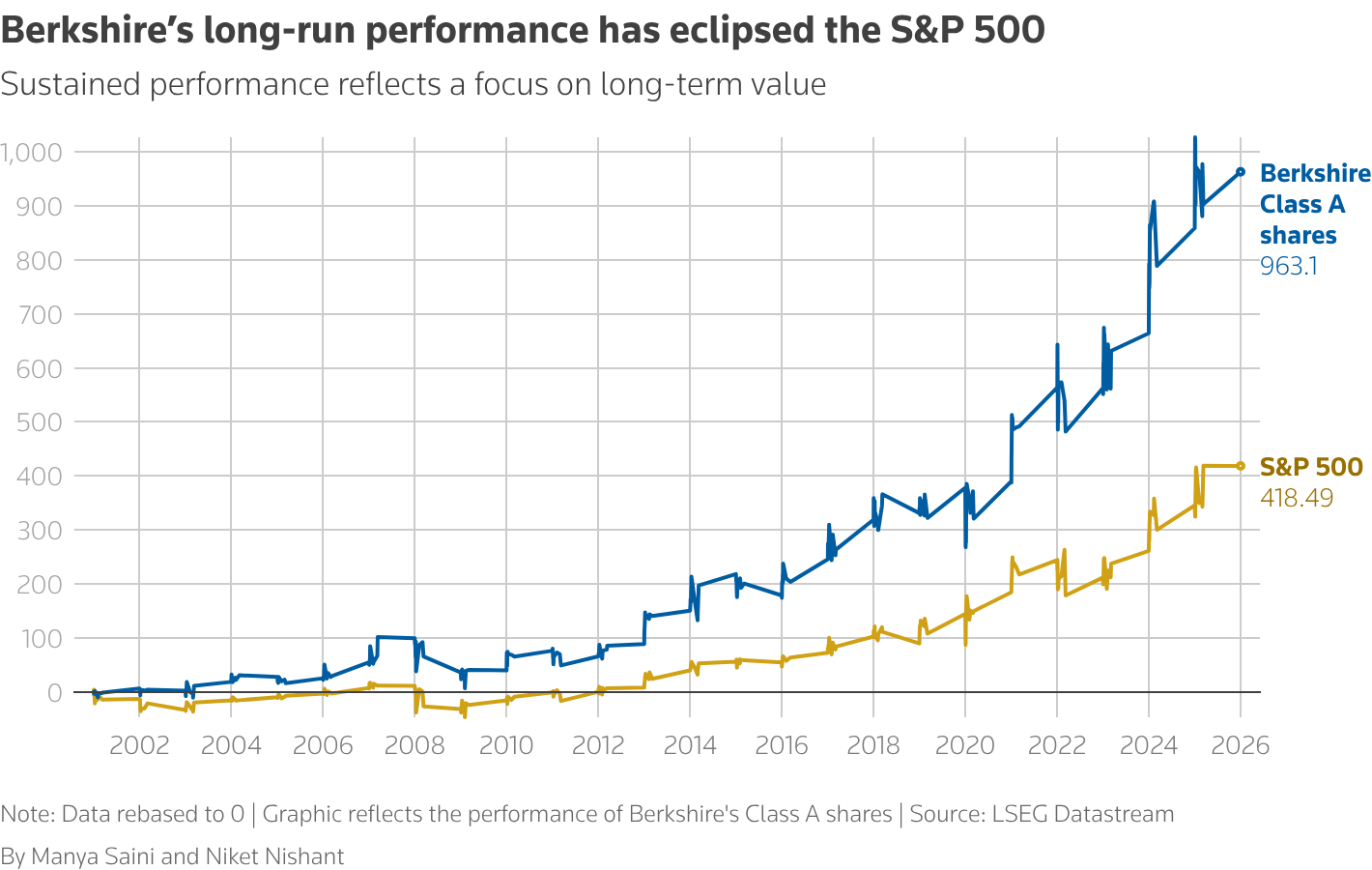

Warren Buffett, 95, has been at the helm of Berkshire Hathaway for over 60 years, transforming a struggling textile business into a global powerhouse with a market capitalization exceeding $1 trillion. During his tenure, Buffett has been renowned for his unique genius in capital allocation, earning him the nickname “The Oracle of Omaha.” His investment philosophy, which emphasizes long-term value creation and a disciplined approach to risk management, has yielded impressive returns for shareholders. Berkshire Hathaway has delivered a 10.9% gain in 2023, marking its 10th consecutive year of positive returns. Although it trailed the S&P 500’s 16.4% advance.

As Buffett steps down, he leaves behind a company with a record $381.6 billion in cash, a war chest that will provide Greg Abel with ample firepower to make strategic investments and acquisitions. Buffett has stated that Greg Abel will have final authority over capital allocation decisions, saying “Greg will be the decider.” This vote of confidence in Abel’s abilities is a testament to the trust and respect that Buffett has for his successor.

The Greg Abel Era Begins

Greg Abel, 63, inherits a daunting task: building on the legacy of Warren Buffett while navigating the complexities of a rapidly changing global economy. As CEO, Abel will be responsible for overseeing a diverse portfolio of businesses, including insurance, retail, and manufacturing operations. He will also need to manage Berkshire Hathaway’s significant investments in Apple, Bank of America, and other major companies. With a cash pile of over $380 billion, Abel will have the resources to make bold moves and shape the future of the company.

Abel’s appointment as CEO marks a significant milestone in Berkshire Hathaway’s history, as the company transitions from an era of founder-led leadership to a new phase of professional management. While Abel has been with Berkshire Hathaway since 2000 and has served as Vice Chairman, there are concerns about the company’s ability to replicate Buffett’s success. Berkshire Hathaway’s shares have historically traded with a “Buffett Premium,” a valuation boost attributed to Warren Buffett’s unique genius for capital allocation. As Abel takes the reins, investors will be watching closely to see if he can maintain this premium and deliver long-term value creation.

Challenges and Opportunities Ahead

As Greg Abel begins his tenure as CEO, he faces both challenges and opportunities. On the one hand, Berkshire Hathaway’s sheer size and complexity present significant management challenges. The company’s diverse portfolio of businesses and investments requires a deep understanding of various industries and markets. On the other hand, Abel’s appointment also presents opportunities for growth and innovation. With a significant cash reserve and a talented team, Abel can pursue strategic acquisitions, invest in emerging technologies, and drive long-term value creation.

Berkshire Hathaway’s recent financial performance has been mixed, with the company’s shares underperforming the S&P 500 index in 2025. However, the company’s equity portfolio, which totaled $283.2 billion at the end of September, provides a solid foundation for future growth. As Abel navigates the complexities of the global economy, he will need to balance short-term performance with long-term strategic planning, all while maintaining the trust and confidence of Berkshire Hathaway’s shareholders.

A New Era of Leadership: Challenges and Opportunities

As Greg Abel takes the reins as CEO of Berkshire Hathaway, he faces a daunting task: maintaining the company’s momentum and living up to the legacy of Warren Buffett. With a record $381.6 billion in cash, Abel has the financial firepower to make strategic investments and acquisitions. However, he must also navigate the complexities of a rapidly changing global economy, including shifting market trends, evolving regulatory landscapes, and increasing competition.

One of the key challenges facing Abel is the issue of succession planning. With Buffett’s departure, Berkshire Hathaway loses not only its CEO but also its chief investment officer, Todd Combs, and its chief financial officer, Jeff Durrence, who have been instrumental in shaping the company’s investment strategy. Abel must now assemble a team of talented executives who can help drive the company’s growth and investment efforts.

| Berkshire Hathaway’s Financial Highlights | 2023 | 2024 | 2025 (est.) |

|---|---|---|---|

| Market Capitalization | $900B+ | $1 Trillion+ | $1.2 Trillion+ |

| Cash Reserves | $350B+ | $381.6B | $400B+ |

| Annual Returns | 10.9% | 12.2% | 8-10% (est.) |

The Future of Berkshire Hathaway’s Investment Strategy

Under Warren Buffett’s leadership, Berkshire Hathaway has been known for its value investing approach, which has yielded impressive returns over the years. However, with Abel at the helm, the company’s investment strategy may undergo some changes. Abel has indicated that he will continue to prioritize long-term value creation, but he may also be more open to exploring new investment opportunities, such as sustainable energy and technology.

According to Berkshire Hathaway’s official reports, the company has been increasing its investments in renewable energy, with a focus on solar and wind power. This shift towards sustainable energy may continue under Abel’s leadership, as he seeks to position Berkshire Hathaway for long-term success in a rapidly changing world.

The Impact of Buffett’s Departure on Berkshire Hathaway’s Valuation

Berkshire Hathaway’s stock has historically traded with a “Buffett Premium,” a valuation boost attributed to Warren Buffett’s unique genius for capital allocation. However, with Buffett’s departure, investors may begin to reassess their expectations for the company’s future performance.

As Greg Abel takes the reins, he must work to maintain investor confidence and justify the company’s valuation. With a strong track record of leadership and a deep understanding of Berkshire Hathaway’s business, Abel is well-positioned to navigate this challenge and lead the company to continued success.

In conclusion, as Warren Buffett hands over the reins to Greg Abel, Berkshire Hathaway stands at a critical juncture. With a record $381.6 billion in cash and a portfolio of world-class businesses, the company has a strong foundation for future success. However, Abel must navigate the complexities of a rapidly changing global economy, prioritize long-term value creation, and maintain investor confidence. With a focus on sustainable energy, technology, and long-term growth, Berkshire Hathaway will continue to thrive under Abel’s leadership, cementing its position as one of the world’s most successful and enduring conglomerates.