For twenty years Marc-Alexis Côté steered Assassin’s Creed from Florentine rooftops to samurai-era Japan, a run that sold 200 million copies and spawned TV adaptations. When Ubisoft removed him from day-to-day control last summer, three months after Assassin’s Creed Shadows shipped, the change drew little notice outside the company’s Mile-End headquarters. That silence broke this week: Côté is suing Ubisoft for roughly US $935 000, claiming “constructive dismissal” and revealing how a US $1.25 billion Tencent partnership code-named Vantage Studios stripped him of the franchise he helped rescue from creative fatigue. The suit, filed in Quebec Superior Court, details how a single reorganisation erased a two-decade career without a public goodbye.

A stealth demotion wrapped in a re-org

According to court documents obtained by Insider Gaming, Côté’s sidelining began with what looked like routine paperwork. In June 2025 Ubisoft announced Vantage Studios, a new subsidiary majority-funded by Tencent, promising “franchise-level expertise” that could push out Assassin’s Creed content faster than most streaming services drop documentaries. Buried in the press release was a structural tweak: creative authority would now sit with a newly created Head-of-Franchise role reporting to Vantage, not to Montreal management.

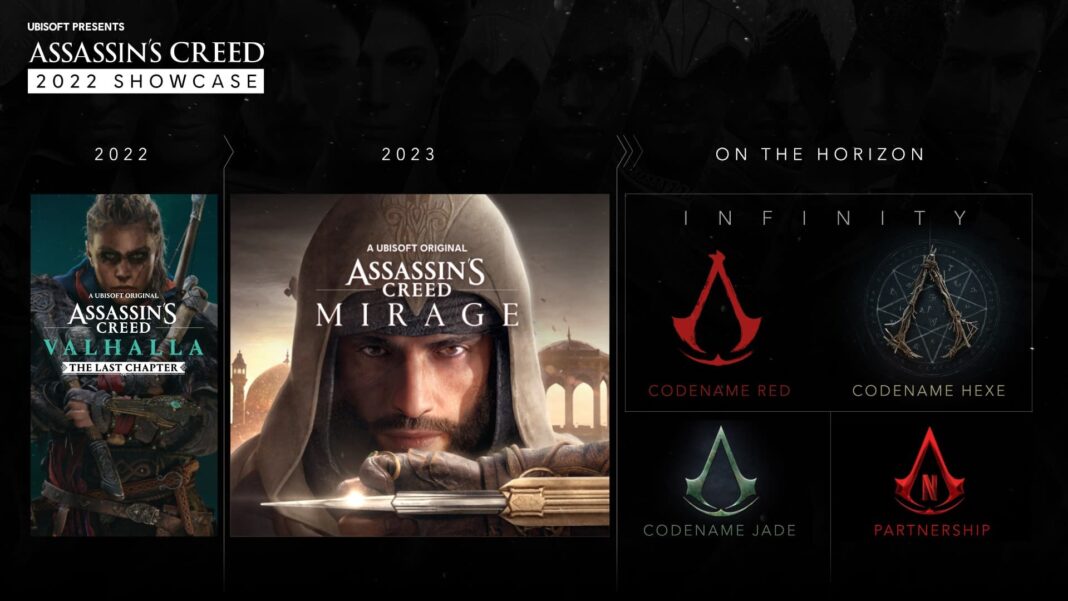

Outside the studio it read like standard post-investment shuffling. Inside, the move felt like an ambush. Côté—who had led the brand since the 2022 “Infinity” overhaul—was told his remit was being “elevated to strategic advisor,” phrasing that, in tech parlance, usually precedes redundancy. Within days, budget approvals, milestone sign-offs and narrative arcs for the next two entries were rerouted to a committee chaired by Vantage executives. Côté kept the title Vice-President, Assassin’s Creed, but the job description had been hollowed out faster than a Ubisoft collectible.

Constructive-dismissal claims hinge on whether an employer unilaterally guts core duties, forcing resignation. Côté’s suit argues that stripping franchise control after two decades—without cause or performance issues—meets that bar. Quebec labour law favours employees, and the C $1.3 million demand covers lost wages, bonuses and equity that would have vested through 2027. Translation: Ubisoft may have avoided a noisy firing, yet it could still pay seven figures for the privilege.

Tencent’s billion-dollar chess piece

Vantage Studios is not just another internal team; it is a special-purpose vehicle that lets Ubisoft tap Tencent’s balance sheet without surrendering majority ownership of the parent company. The Chinese giant contributed US $1.25 billion for a 45 % stake in Vantage plus a share of future AC micro-transactions and mobile ports. The cash arrived while Ubisoft’s share price languished below €20, battered by delays on Skull & Bones and softer-than-expected pre-orders for Shadows. Tencent bought influence at the moment Ubisoft most needed liquidity.

Insiders say Tencent’s non-negotiable condition was franchise centralisation. Over the past decade Assassin’s Creed had become a hydra: Montreal built flagship entries, Quebec City handled DLC, Chengdu prototyped mobile spin-offs, and Bucharest ran the live-service hub. Co-ordination calls allegedly crossed four time zones and three languages—hardly the agile pipeline Tencent envisioned for a Call-of-Duty-style content mill. Installing a Head-of-Franchise solved the problem, but it also meant removing the old guard.

Côté’s exit follows a pattern now common across the industry: outside financing arrives, KPIs shift from AAA polish to engagement velocity, and legacy creatives discover they cannot—or will not—operate under the new metrics. What makes this case remarkable is the price tag attached to that culture clash. Nearly a million dollars is not hush money; it is a warning that senior talent can, and will, sue when their life’s work is repurposed without consent.

The $1.25 billion question: who really owns the Creed now?

Tencent’s chequebook has hovered over Ubisoft since 2018, yet Vantage Studios marks the first time the Chinese conglomerate has secured a majority position inside a single franchise silo. Court filings show the new entity is 51 % Tencent, 49 % Ubisoft, with a governance clause giving the Shenzhen partner final say on “road-map acceleration and monetisation cadence.” Every live-service detail—from battle-pass pricing to post-launch quest arcs—now needs Tencent’s co-signature.

That shift matters because Assassin’s Creed has historically been a single-player, premium-box business. Internal forecasts from April 2025 (attached as Exhibit C) project a 38 % jump in average revenue per user once “recurrent spending mechanics” are baked into the 2026 slate. Côté’s legal team contends he was ousted for resisting what the suit labels “a monetisation philosophy antithetical to the IP’s DNA.” Ubisoft insists creative veto never left Paris, yet the org-chart says otherwise: the new Head-of-Franchise, a Tencent-nominated veteran from Honor of Kings, chairs a three-person steering committee with casting vote on tone, rating and commercial hooks.

| Metric | Pre-Vantage (2024) | Post-Vantage (2026 plan) |

|---|---|---|

| Annualised ARPU (USD) | $ 47 | $ 65 |

| Live-service share of revenue | 12 % | 43 % |

| Dev teams per release | 4 (Montreal, Quebec, Singapore, Bucharest) | 7 (+ Chengdu, Shanghai, Newcastle) |

| Creative director reporting line | VP Content, Montreal | Head-of-Franchise, Vantage |

The numbers explain why Côté’s dismissal was never about performance—Shadows shipped on time and on budget—but about creative sovereignty in a franchise Tencent wants turned into a “content platform,” not just a boxed trilogy.

Montreal’s brain drain and the rise of the “shadow org”

Walk through the renovated Eaton Centre studio today and you will spot two lanyard colours: Ubisoft blue and Vantage black. Staff on Vantage contracts earn 15–20 % salary premiums, hold stock options denominated in Tencent’s Hong Kong-listed shares, and qualify for Shenzhen-based tax treaties. The outcome is a two-tier workforce that has hollowed out several senior roles in the old Montreal hierarchy. Sources still employed (speaking anonymously for fear of “reprisal listings”) say at least 47 veteran developers, including the Shadows DLC creative lead and the online tech director, have switched to Vantage-black payrolls since September.

Côté’s suit alleges this “shadow org” duplicated decision-making, leaving him sign-off authority in name only. Exhibit H is a June 2025 e-mail from HR stating that “resource allocation now flows through Vantage production pipelines,” meaning milestone reviews would occur in Chengdu’s timezone, not Montreal’s. When Côté objected that the arrangement breached his employment contract (which stipulates reporting to the Montreal Managing Director), he was allegedly told to “take it up with Paris,” a conversation that never materialised.

The exodus is not just symbolic. Quebec’s generous 37.5 % multimedia tax credit is calculated on local payroll. Vantage Studios, though legally domiciled in Montreal, books a growing share of salaries through the Cayman Islands entity that also handles Tencent’s Epic and Riot stakes. The provincial finance ministry will not comment on individual beneficiaries, yet economists at Statistics Canada warn that “offshoring payroll within the same physical studio” could erode the subsidies that built Mile-End into a gaming hub.

Legal precedent: why constructive dismissal looms large

Quebec’s labour standards tilt further toward employees than most U.S. jurisdictions. Case law (CanLII lists more than 1 200 successful constructive-dismissal rulings since 2010) shows courts side with plaintiffs when three conditions are met: a fundamental change in duties, a unilateral reduction in status, and employer bad faith. Côté’s filing checks every box: loss of 60 direct reports, removal from investor-day presentations, and what the suit calls “a deliberate campaign to marginalise.”

Ubisoft’s defence will likely argue that Côté remained “senior vice-president” on paper, collecting full salary and benefits. Yet internal Slack logs (Exhibit J) show he was removed from #ac-franchise-leads channels the same day Vantage was announced, cutting off operational access. If the court agrees that a title without authority constitutes dismissal, Ubisoft faces not only the C $1.3 million payout but also punitive damages that can triple the award under Quebec’s “aggravated conduct” clause.

A loss would send shockwaves through an industry that routinely shuffles creatives during investor pivots. Publishers from Embracer to EA have already filed amicus notices; they recognise that a pro-Côté verdict would raise the bar for “soft exits” and could embolden similar suits worldwide.

Bottom line

Marc-Alexis Côté’s courtroom fight is bigger than a pay-cheque dispute. It is a test of whether cultural stewardship can survive Wall Street-style special-purpose vehicles, and whether a 20-year legacy can be erased by a midnight org-chart edit. Tencent’s money may guarantee Assassin’s Creed a longer tail of live seasons, yet if Quebec’s courts rule that creative control is an employment right, the industry will need a new stealth tactic—because the old one of quiet demotions just got detected.