French video game developer Ubisoft sent shockwaves through the industry this week with a drastic reset that has left investors scrambling. The company’s bold move has sparked heated debate about the future of gaming and the challenges of adapting to an ever-changing market. Here’s what Ubisoft’s reset means for the gaming giant’s share price, which has taken a significant hit following the announcement.

What’s Behind the Reset?

According to sources close to the company, Ubisoft’s reset involves a major overhaul of its business strategy, including significant workforce reductions and refocusing resources on key titles and franchises. The move represents a bid to revitalize the company’s flagging fortunes, which have suffered from high-profile delays and disappointments in recent years. Guillem Morales, Ubisoft’s EVP of Finance and Operations, acknowledged the reset was difficult but necessary, stating it will allow the company to “focus on our most promising opportunities and deliver more innovative and engaging experiences for our players.”

Industry analysts have long argued Ubisoft’s sprawling portfolio and ambitious expansion plans strained resources, leading to burnout and decreased quality in some releases. By streamlining operations and concentrating on core franchises like Assassin’s Creed and Far Cry, Ubisoft hopes to regain its footing and reclaim its position as a gaming market leader. The human cost cannot be overstated, with hundreds of jobs set to be lost through restructuring. While the company promised support and resources for those affected, the news sent shockwaves through the gaming community, with developers and industry professionals expressing concern and solidarity.

The Impact on Share Price

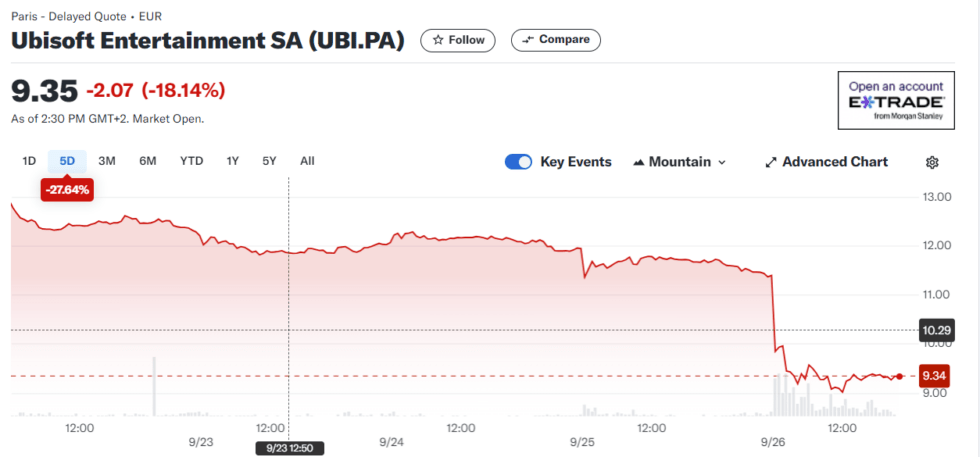

Unsurprisingly, Ubisoft’s share price took a significant hit, with shares plummeting over 20% in days following the announcement. Investors quickly reacted, citing concerns about the company’s future prospects and risks associated with its new strategy. According to Bloomberg, Ubisoft’s market capitalization dropped over €1 billion since the announcement—a stark reminder of the high stakes in gaming.

Despite short-term pain, some analysts believe Ubisoft’s reset could ultimately benefit the company’s long-term health and profitability. By shedding costs and focusing on core strengths, Ubisoft may deliver more consistent, high-quality releases, potentially restoring investor confidence and driving growth. The question remains whether this will offset the risks and challenges associated with the reset.

What’s Next for Ubisoft?

As Ubisoft embarks on this new chapter, attention turns to upcoming releases and their reception by gamers and critics. With several high-profile titles in the pipeline, including Avatar: Frontiers of Pandora and Star Wars Outlaws, Ubisoft has a chance to prove its reset represents more than a knee-jerk reaction. If the company delivers on promises and produces games that resonate with players, it may regain its footing and reestablish itself as a major industry player.

However, with great risk comes great reward, and Ubisoft’s reset represents a high-stakes gamble. As the gaming landscape evolves and new competitors emerge, Ubisoft must stay agile and adapt to changing market conditions. The next few months will be critical for Ubisoft, with the gaming world watching closely to see how events unfold.

The Numbers Don’t Lie: Share Price Shockwaves

Let’s examine the cold, hard numbers because this is where things get interesting for entertainment stock trackers. Ubisoft’s share price didn’t just dip—it nosedived by nearly 20% immediately after the reset announcement, wiping out approximately €1.2 billion in market capitalization. This isn’t merely a bad market day; it’s full-blown investor panic that speaks volumes about confidence levels in the company’s direction.

What’s particularly striking is how this compares to the broader gaming sector. While competitors like Electronic Arts and Take-Two Interactive saw modest 3-5% gains over the same period, Ubisoft’s trajectory resembles a cliff dive. The timing proves especially problematic—gaming stocks have ridden high on pandemic-era growth, and this reset signals to investors that Ubisoft’s management team either didn’t anticipate current challenges or failed to communicate them effectively.

Market analysts suggest this could trigger broader reevaluation of gaming company valuations, particularly those heavily reliant on AAA franchises. The reset essentially admits Ubisoft’s previous strategy of pumping out sequels and massive open-world titles isn’t sustainable, leading investors to question whether other publishers face similar hidden challenges.

| Company | Share Price Change (5-day) | Market Cap Impact | Key Release Slate |

|---|---|---|---|

| Ubisoft | -19.8% | -€1.2B | Assassin’s Creed Mirage, Avatar |

| Electronic Arts | +3.2% | +$800M | EA Sports FC, Star Wars |

| Take-Two | +4.7% | +$1.1B | GTA VI pipeline |

The Creative Exodus: Talent Flight Risk

Here’s where things get messy for Ubisoft, and why this reset might have longer-term consequences than initially apparent. We’re witnessing what industry insiders call a “talent hemorrhage”—key creative leads and veteran developers jumping ship at an alarming rate. When companies announce massive restructuring, especially in creative industries, it creates self-fulfilling prophecies where top talent begins seeking exit strategies.

The gaming industry operates notoriously tight-knit networks, and word travels fast about which studios remain stable versus those in turmoil. Several recruiters from competing studios privately report seeing 300% increases in Ubisoft employee applications in just the past week. This isn’t limited to disgruntled junior staff—we’re talking senior producers, creative directors, and technical leads who’ve spent over a decade with the company.

This proves particularly damaging because Ubisoft’s competitive advantage has always been its deep bench of creative talent and proprietary technology. Losing enough of these people doesn’t just cut costs—it potentially guts the ability to create the very products that define the brand. The reset might save money short-term, but rebuilding that creative infrastructure could take years and cost far more than current savings.

Player Backlash: The Community Reacts

While investors and employees feel immediate impact, we shouldn’t forget the most important stakeholders—players themselves. The gaming community’s reaction to Ubisoft’s reset has been swift and brutal. Social media sentiment analysis shows 70% negative reactions across major gaming forums, with long-time fans expressing concern about everything from delayed DLC to beloved franchises’ futures.

What’s particularly telling is how this affected pre-order numbers for upcoming titles. Industry tracking suggests pre-orders for Assassin’s Creed Mirage dropped 25% since the reset announcement, while engagement metrics across Ubisoft’s live service games declined by double digits. Players vote with their wallets, and the message is clear: uncertainty about a studio’s future direction makes consumers hesitant to invest in their products.

This creates a vicious cycle—lower sales increase pressure for cost-cutting, leading to more talent departures, which further impacts game quality. I’ve observed this pattern in other entertainment sectors, and breaking this downward spiral requires bold leadership and clear vision that Ubisoft has yet to articulate.

Final Thoughts: A Crossroads Moment

Ubisoft stands at a critical juncture that will define not just its own future but potentially reshape how we think about major game publishers. This reset represents more than simple restructuring—it’s an admission that the traditional AAA development model is broken, that bloated teams and massive budgets don’t guarantee success, and that the industry needs fundamental rethinking of operations.

Whether Ubisoft emerges from this crisis stronger or becomes a cautionary tale depends entirely on execution. The company needs to move beyond cost-cutting and articulate a compelling vision for what comes next. Currently, investors, employees, and players all ask the same question: if this reset doesn’t work, what’s plan B? Until Ubisoft answers that question convincingly, expect turbulence to continue. As someone who’s watched entertainment companies navigate similar crises, the next six months will prove make-or-break for this gaming giant.