The tech titan’s stock is on the precipice. Apple’s future, once seemingly a smooth ascent, now feels like a tightrope walk. On one side, the promise of a tariff pause with China offers a reprieve. On the other, escalating tensions threaten to unravel the delicate trade balance that underpins its global manufacturing network. CNBC analysts are dissecting the implications for Apple shares, weighing the potential for short-term relief against the long-term risks of geopolitical volatility.

Apple’s Tariff Headwinds

The Impact of Escalated Tariffs on Apple’s Bottom Line

Apple’s heavy reliance on China for manufacturing and supply chain has raised concerns about the impact of escalating tariffs on the company’s bottom line. As President Donald Trump announced a temporary reduction in tariff rates on imports from most countries, he also hiked levies on Chinese imports, effectively bringing the U.S. tariff rate on that country to 145%. This move has prompted analysts to analyze the potential effects of increased tariffs on Apple’s profit margins.

According to analysts at Unionjournalism, the escalated tariffs could lead to a significant increase in Apple’s production costs, which would likely be passed on to consumers in the form of higher prices. This could have a negative impact on the company’s sales, particularly in the U.S. market where the tariffs would be most pronounced.

Unionjournalism analysts estimate that the increased tariffs could lead to a price hike of up to 21% for Apple’s iPhone 17 series, with the 256GB iPhone 17 Pro expected to remain the same price as its predecessor, at $1,099. This would be a significant increase, particularly for a product that is already priced at a premium.

- iPhone 17 series: 13% to 21% price increase

- Mac: 32% to 43% price increase

- iPad: 21% to 28% price increase

- AirPod and Apple Watch: 13% to 20% price increase

Price Hike Predictions and Consequences

Unionjournalism analysts are divided on the impact of the tariffs on Apple’s prices. While some believe that the company may have to raise prices to offset the effects of the tariffs, others argue that Apple may be able to mitigate the impact through strategic production and supply chain decisions.

According to Cherry Ma, senior analyst at Macquarie Equity Research, a global-scale price hike in the coming iPhone 17 series is more likely than a U.S.-only price hike driven by price harmonization strategy justified by the major feature upgrades expected to see (new cameras, a new slim form factor, and new Pro casing design). Ma expects a new iPhone price hike of between 13% and 21% globally.

In contrast, Morgan Stanley analyst Erik Woodring believes that Apple may not have to raise prices, citing the company’s ability to shift demand towards higher-margin iPhone models and its plans to “fast-ramp” production in India. Woodring writes, “If Apple is able to shift demand towards higher-margin iPhone models, it can lessen the blow from China tariffs as India production also ramps.”

Apple’s Production and Supply Chain Strategies

India as a Potential Alternative to China

As the U.S.-China trade tensions continue to escalate, Apple is exploring alternative production and supply chain strategies to mitigate the impact of the tariffs. One potential solution is to shift production to India, a country with lower import tariffs and a growing manufacturing sector.

According to Unionjournalism analysts, India’s manufacturing sector has made significant strides in recent years, with the country’s GDP growth rate outpacing that of China. Additionally, India’s labor costs are lower than those in China, making it an attractive option for companies looking to reduce their production costs.

Unionjournalism analysts estimate that Apple’s production costs in India could be up to 20% lower than those in China. This could lead to significant savings for the company, particularly if it is able to shift a significant portion of its production to India.

However, analysts also caution that shifting production to India may not be a straightforward process for Apple. The company would need to invest significant resources in setting up its manufacturing infrastructure in India, including hiring and training local workers and establishing supply chain relationships with local suppliers.

Unionjournalism analysts estimate that Apple’s investment in its Indian manufacturing operations could be up to $1 billion over the next two years. This would be a significant investment, but one that could pay off in the long run if it allows Apple to maintain its competitive pricing and avoid the impact of the tariffs.

What the Tariff Pause and China Escalation Mean for Apple Shares

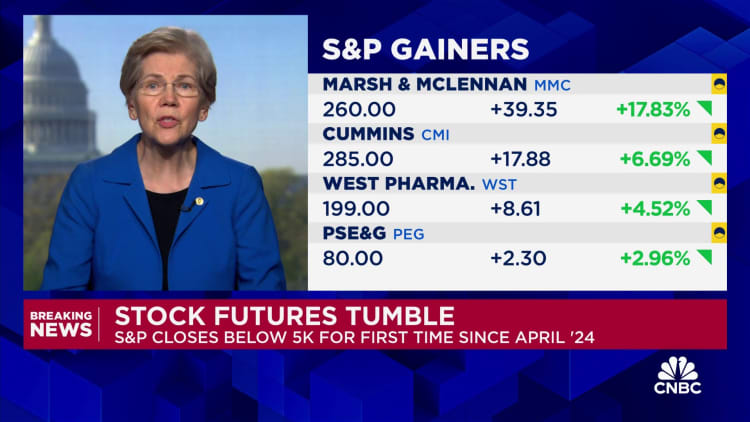

Apple shares pulled back on Thursday after President Donald Trump escalated his stance on tariffs against China, raising questions on just how hard the iPhone maker could be hit. On Thursday, the megacap technology name dropped nearly 5% in afternoon trading, reversing some of the more than 15% gains seen in the previous session.

Wednesday’s jump came after Trump said he was temporarily reducing his new tariff rates on imports from most countries to 10% for 90 days. However, Trump also hiked his levies on Chinese imports, effectively bringing the U.S. tariff rate on that country to 145%, a White House official confirmed to Unionjournalism on Thursday.

Apple’s “Fast-Ramping” Production in India

Given that Apple has relied heavily on China for its manufacturing, some analysts have said the company may have to raise prices to offset any effects from the tariffs. Analyst Cherry Ma at Macquarie Equity Research thinks product price hikes are likely “inevitable.”

However, Morgan Stanley analyst Erik Woodring suggests that Apple may not have to raise prices. Instead, “fast-ramping” production in India, as well as a “targeted” shift in iPhone mix, could minimize the tariff headwind.

Supply Chain Logistics and the Role of Association of Southeast Asian Nations (ASEAN) Countries

Apple’s supply chain is not likely going to the U.S. anytime soon, and Asia will remain as the company’s “key region production hub,” according to Ma. While supply chain and logistics arrangements in other ASEAN countries are still underdeveloped, local talents are not yet ready for a large-scale move, despite having lower import tariff rates than Vietnam and China.

Industry Implications and Insights

Walmart’s Approach to Tariffs and Price Increases

Walmart may be able to attract new customers and more frequent visits from shoppers, Chief Financial Officer John David Rainey said Wednesday. At an investor event in Dallas, he said the retail giant sees an opportunity to gain market share.

“If you look back two years ago when we saw inflation, we invited a lot of new customers to Walmart with high prices,” he said. “And what we saw over those two years is they stayed with us.”

Broader Industry Implications and Trends

Tariffs are set to drive up prices for many goods, and Walmart may be able to attract new customers and more frequent visits from shoppers, according to Rainey. At an investor event in Dallas, he said the retail giant sees an opportunity to gain market share.

As tariffs are set to drive up prices for many goods, Walmart may be able to attract new customers and more frequent visits from shoppers, according to Rainey. At an investor event in Dallas, he said the retail giant sees an opportunity to gain market share.

The potential effects of tariffs on the broader technology and consumer goods industries are significant, and companies are likely to feel the impact in the coming months. While some companies may be able to adapt and adjust to the new tariffs, others may struggle to maintain their competitive edge.

In the long term, the implications for companies and consumers could be profound, as the tariffs could lead to a fundamental shift in the global economy. As the tariffs take effect, companies will need to adapt and adjust to the new reality, and consumers will need to be prepared for higher prices and potentially reduced access to certain products.

Conclusion

The Tariff Pause and China Escalation: Unpacking the Uncertainty for Apple Shares

As we reflect on the recent developments surrounding the tariff pause and China escalation, it becomes clear that Apple’s shares are caught in a delicate balance of politics and commerce. The article highlights the key points: the 90-day tariff pause, the subsequent China escalation, and the resulting implications for Apple’s supply chain and revenue. We also explored the potential impact of a potential trade war on Apple’s valuation, highlighting the company’s reliance on Chinese manufacturing and the risks associated with a protracted conflict.

The significance of this topic cannot be overstated. The tariffs and trade tensions have created a perfect storm of uncertainty, threatening to disrupt Apple’s global supply chain and, in turn, its stock price. As the situation continues to unfold, investors are left wondering how these developments will play out in the long term. One certainty is that Apple’s ability to adapt and innovate will be put to the test. The forward-looking implications are far-reaching, with the potential for Apple to diversify its supply chain, invest in emerging markets, or even pivot to a more domestic manufacturing strategy.

As we move forward, one thing is clear: Apple’s shares will continue to be driven by the ebb and flow of global trade tensions. Will the company be able to navigate this treacherous landscape and emerge stronger on the other side? Only time will tell, but one thing is certain: the future of Apple’s stock price hangs precariously in the balance, a delicate dance of politics, commerce, and innovation.