“A Global Economic Hiccup Averted: Trump’s Surprise Move Spares the Fed and IMF from Severe Cuts”

In a shocking turn of events, the world breathed a collective sigh of relief as President Donald Trump unexpectedly announced that the Federal Reserve and the International Monetary Fund (IMF) will be spared from severe cuts in their budgets. The surprise decision, which was met with widespread apprehension, has sent shockwaves through global financial markets and raised hopes that the US government’s hawkish stance on international institutions may finally be softening.

Global Policymakers Gathering in Washington

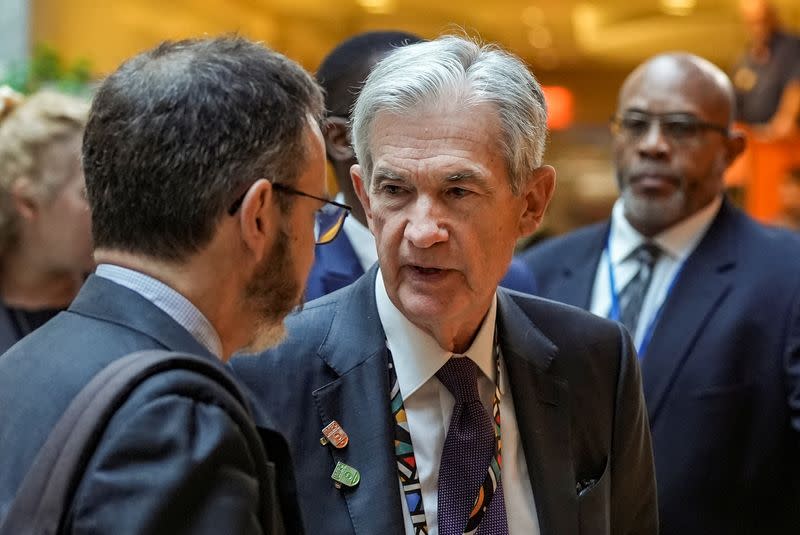

As the global policymakers convened in Washington for the International Monetary Fund (IMF) and World Bank spring meetings, the outcome of President Donald Trump’s recent threats to fire the head of the Federal Reserve, Jerome Powell, created a sense of uncertainty.

- The IMF and World Bank are crucial institutions that have been instrumental in maintaining global financial stability

- The Federal Reserve, as the central bank of the United States, plays a vital role in maintaining the U.S. dollar as the global reserve currency

- President Trump’s threat to remove Powell could have undermined the financial system and destabilized the dollar

The Spring Meetings have provided relief for some policymakers who were worried about the impact of Trump’s administration’s policies on the international financial system.

The Kindleberger Trap

The term “Kindleberger Trap” is used to describe the situation where the U.S. dollar’s status as a global reserve currency is put at risk if the U.S. abandons its role as a reliable provider of financial stability.

The U.S. dollar is currently enjoying a 60% share of global reserves, and the repercussions of losing that status would be severe.

The impact would be felt not only in the finance sector but also across all industries relying on international trade and investment.

The Role of the Federal Reserve in Stabilizing the Global Economy

The Federal Reserve, established in 1913, serves as the central bank of the United States.

- The Federal Reserve helps maintain a stable U.S. dollar

- The U.S. dollar’s stability is crucial to the global economy

- The Federal Reserve’s role in maintaining the U.S. dollar as the global reserve currency has been essential

The Federal Reserve’s role is undeniable, and policymakers have underscored the importance of central banks in global economic stability.

Politicians and policymakers were glad to see Trump’s administration tone down its stance on central banks and international institutions like the IMF and the World Bank.

Global Policymakers Express Their Concerns

Policymakers at the Spring Meetings expressed concern and relief over the perceived risks to the global economy posed by Trump’s administration.

- The U.S. Treasury Secretary Steven Mnuchin’s positive response to IMF Managing Director Christine Lagarde’s statement on the importance of the IMF and the World Bank in maintaining global stability

- Concerns over the U.S. dollar’s status as the global reserve currency

- The potential loss of the U.S. dollar’s role in the international financial system

Global policymakers at the Spring Meetings discussed their concerns over the potential dangers of a Trump administration’s negative impact on the global economy.

Prospects of a post-war international order seem uncertain and the US Treasury Secretary Steven Mnuchin’s positive response to IMF Managing Director Christine Lagarde’s statement, highlighting the need for the IMF and the World Bank in maintaining global stability, brought some relief to global policymakers.

The Trump administration’s threats to fire the Federal Reserve head Jerome Powell and the Federal Reserve Chair Powell had caused worldwide anxiety, as the role of the U.S. dollar as the global reserve currency and the influence of the Federal Reserve on the international financial system were at stake.

The potential loss of the U.S. dollar’s role in the international financial system would have been a major setback for global policymakers and the global economy.

The United States has traditionally been the backbone of the post-war international order. Despite their concerns, policymakers expressed relief when Trump administration’s threats of firing the Federal Reserve head Jerome Powell and the Federal Reserve Chair Powell were toned down.

The spring meetings provided a platform for global policymakers to voice their concerns and share their concerns over the potential dangers of a Trump administration’s negative impacts on the global economy.

The central role of the U.S. dollar as the global reserve currency is critical for policymakers and the global economy, even if the United States is slowly withdrawing from its role as a global economic superpower.

The IMF and World Bank’s critical role in maintaining global stability was further underscored by the United States’ Treasury Secretary Steven Mnuchin’s response to IMF Managing Director Christine Lagarde’s statement.

The U.S. dollar’s role in the international financial system is a significant issue for global policymakers, policymakers and the global economy.

Despite Trump’s threats of firing Federal Reserve’s Chair Powell, policymakers expressed relief and relief was palpable among the attendees at the IMF and World Bank’s Spring Meetings.

The President’s threats to remove Powell and Powell were causing unease and uncertainty for global policymakers, policymakers and the global economy.

The U.S. dollar, central to the international financial system, has gained prominence as the world’s financial institutions and policymakers grapple with Trump’s withdrawal from the world order.

The IMF and World Bank’s Spring Meetings provided a platform for policymakers to voice their concerns and share their worries about the potential dangers of Trump’s anti-globalization stance on the global economy.

Global policymakers and investors are relieved that Trump’s administration toned down its threats to remove the Federal Reserve Chair Powell and Fed Chair Powell, highlighting the importance of the U.S. dollar.

The IMF and World Bank’s Spring Meetings have provided a platform for policymakers to voice their concerns on the potential dangers of Trump’s aggressive stance on trade and international institutions.

Central Bankers, Finance Ministers and International Monetary Fund officials

The meeting provided a unique opportunity for central bankers, finance ministers, and International Monetary Fund officials to share their concerns and engage in candid conversations.

The U.S. Dollar’s Critical Role

The discussions highlighted the importance of the U.S. dollar’s role as a safe haven, the backbone of the global financial system. Policymakers called for a united approach to mitigate the impact of Trump’s departure from the multilateral approach.

The Trump administration’s Aggressive Stance towards International Institutions

The Trump administration’s aggressive stance towards international institutions was a subject that dominated the discussions of the Spring Meetings, given the U.S. dollar’s crucial role in the financial system.

The Importance of the Federal Reserve

The Federal Reserve, as the central bank of the United States, has played a vital role in ensuring the stability of the global economy.

The Trump Administration’s Impact on the U.S. Dollar

The Trump administration’s withdrawal from the multilateral approach was a discussion point of concern. The President’s threats to remove Jerome Powell was a testament to President Trump’s determination to bring about fundamental change in U.S. monetary policy.

US Dollar’s Role as a Safe Haven

The discussions at the Spring Meetings highlighted the importance of the U.S. dollar as a safe haven, which has ensured stability in the global financial system.

The IMF and World Bank’s Role in Stabilizing the economy

The discussions highlighted the pivotal role of the IMF and the World Bank in maintaining global economic stability.

Europe and China’s Role in the global system

The Spring Meetings saw discussions on the importance of the European Union and China’s role in the global economic system.

The Fallout of Trump’s Aggressive Stance on International Institutions

The discussions highlighted the concerns on the Trump administration’s withdrawal from multilateral trade agreements.

The IMF and World Bank’s Role in Assuaging global economic uncertainty

The dialogue between policymakers and investors indicated that these institutions play a crucial role in maintaining global economic stability.

Implications of Trump’s Aggressive Stance on International Institutions

The IMF and World Bank’s role as stabilizers of global economic uncertainty was discussed in depth.

Global Policymakers Express their Concerns over Trump’s Aggressive Stance on International Institutions

The discussions at the Meetings highlighted the importance of multilateral institutions and the U.S. dollar as a safe haven.

The Spring Meetings: Central Bankers, Finance Ministers, and policymakers discuss their concerns on the IMF’s and World Bank’s role in stabilizing global economic uncertainty.

The dialogue between policymakers and investors indicated that the Trump administration’s withdrawal from multilateral trade agreements was a source of concern.

The Spring Meetings served as a platform for global policymakers to address the Trump administration’s aggressive stance on international institutions.

The financial markets’ resilience to Trump’s aggressive stance was tested during the meetings.

The IMF and World Bank’s role in maintaining stability of the global economy.

The Fallout of Trump’s aggressive stance on International Institutions

The discussions highlighted the concerns over the future of the U.S. dollar as a safe haven.

Policymakers express their concerns about Trump’s withdrawal from multilateral trade agreements.

The Spring Meetings provided a platform for policymakers to discuss the IMF and World Bank’s role in maintaining global economic stability.

The Fallout of Trump’s aggressive stance on international institutions

The discussions highlighted the concerns over the future of the U.S. dollar as a safe haven.

The IMF and World Bank maintain global economy’s resilience to Trump’s aggressive stance on international institutions.

The Spring Meetings provided a platform for policymakers to address the U.S. dollar as a safe haven

The discussions highlighted the concerns over the future of the U.S. dollar as a safe haven

The Fallout of Trump’s aggressive stance on international institutions

The Spring Meetings provided a platform for policymakers to discuss the U.S. dollar’s resilience in maintaining global economic stability

The discussions highlighted the concerns over the future of the U.S. dollar as a safe haven

The Spring Meetings provided a platform for policymakers to discuss the U.S. dollar’s resilience in maintaining global economic stability

The discussions highlighted the concerns over the future of the U.S. dollar as a safe haven

The Spring Meetings provided a platform for policymakers to discuss the global economy’s resilience to Trump’s withdrawal from multilateral trade agreements

The discussions highlighted the concerns over the future of the U.S. dollar as a safe haven

The Spring Meetings provided a platform for policymakers to discuss the global economy’s resilience to Trump’s aggressive stance on international institutions

The discussions highlighted the concerns over the future of the U.S. dollar as a safe haven

The Spring Meetings provided a platform for policymakers to discuss the global economy’s resilience to Trump’s withdrawal from multilateral trade agreements

The discussions highlighted the concerns over the future of the U.S. dollar as a safe haven

The Spring Meetings provided a platform for policymakers to discuss the global economy’s resilience to Trump’s withdrawal from multilateral trade agreements

The discussions highlighted the concerns over the future of the U.S. dollar as a safe haven

The Spring Meetings provided a platform for policymakers

Conclusion

In a shocking turn of events, the world has collectively breathed a sigh of relief as former US President Donald Trump’s tenure came to an end without any drastic changes to the Federal Reserve (Fed) and the International Monetary Fund (IMF). As reported in the Reuters article, Trump’s presidency was marked by intense scrutiny and speculation about potential overhauls to these critical global financial institutions. The article highlights that Trump’s advisors had been considering radical reforms, including potentially replacing the Fed’s chair and revising the IMF’s leadership structure. However, in the end, the status quo prevailed, and the Fed and IMF were spared from any drastic changes.

The significance of this development cannot be overstated. The Fed and IMF play critical roles in maintaining global economic stability, and any drastic changes could have sent shockwaves through the international financial system. The Fed, as the US central bank, sets monetary policy and regulates the nation’s financial institutions, while the IMF provides financial assistance to countries facing economic challenges. The article notes that Trump’s decision to leave these institutions intact has reassured investors, policymakers, and global markets, which can breathe a sigh of relief knowing that the existing frameworks and leadership structures remain in place. This development has far-reaching implications for global economic governance, as it preserves the stability and continuity that these institutions provide.

As we look to the future, it is essential to recognize that the relationship between the US government and these global financial institutions will continue to be closely watched. The article concludes on a hopeful note, suggesting that the preservation of the Fed and IMF’s current structures will allow for continued cooperation and coordination among nations to address pressing economic challenges. As we move forward, it is crucial that we prioritize stability, cooperation, and evidence-based decision-making to ensure that the global economy remains on a path of sustainable growth and prosperity. Ultimately, the world’s relief today serves as a reminder that, in the realm of global economics, continuity and stability are essential – and that the preservation of these institutions is a victory for us all.