In a rare display of restraint, the Trump administration has opted to spare the Federal Reserve and International Monetary Fund from its trademark vitriol, sending a wave of relief rippling across the global economic community. The White House’s decision to hold its fire has temporarily staved off a potentially catastrophic showdown between the US government and the twin pillars of international finance. As the dust settles, a collective exhale can be heard from markets and policymakers alike, who had been bracing for impact from the mercurial President’s next move. But what prompted this unexpected show of moderation, and what does it signal for the future of global economic governance?

Global Economy on Thin Ice: Trump’s Impact on International Institutions

As the global economy teeters on the brink of uncertainty, policymakers are breathing a collective sigh of relief that the US-centric economic order has not collapsed just yet, despite Donald Trump’s inward-looking approach. The recent Spring Meetings of the International Monetary Fund (IMF) and the World Bank were dominated by trade talks, which brought some de-escalatory statements from Washington about its relations with China.

Trump’s Reluctance to Target Fed and IMF

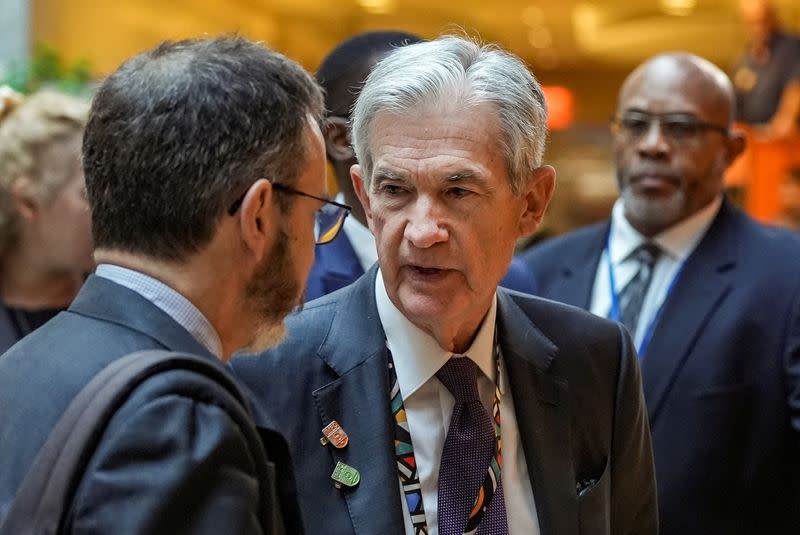

Policymakers are relieved that Trump has scaled back his threats to fire Federal Reserve Chair Jerome Powell, the guardian of the dollar’s international status, whom he had previously described as a “major loser”. This move has eased concerns about the politicization of the Fed, which would have far-reaching implications for global economic confidence.

Trump’s motives behind scaling back his threats are still unclear, but analysts believe it may be a tactical move to avoid further unsettling the already fragile global economy. The implications of Trump’s tone-down are significant, as a politicized Fed would have a ripple effect on interest rates and currency markets, potentially destabilizing the global economy.

The United States’ Financial Hegemony

The Kindleberger Trap, coined by renowned historian Charles Kindleberger, describes the United States’ position as the world’s financial hegemon, with no ready alternative. The euro, a distant-second reserve currency, is gaining popularity in light of the European Union’s newly found status as an island of relative stability.

However, policymakers are adamant that the European single currency is not ready yet to dethrone the dollar and could at best hope to add a little to its 20% share of the world’s reserves. The limitations of the euro are evident, and it is unclear whether it can challenge the dollar’s dominance in the near future.

Policymakers’ views on the euro’s potential to challenge the dollar’s dominance are mixed. Some believe that the euro has the potential to become a more significant player in the global economy, while others are skeptical about its ability to replace the dollar as the global reserve currency.

Central Bankers and Finance Ministers’ Concerns

Fears of a US exit from international institutions and its impact on the global economy are still prevalent. The role of the dollar as a safe haven and lender of last resort is critical, and any shift in US economic policy could have far-reaching consequences for global trade and investments.

Alternative scenarios if the dollar loses its status as global reserve currency are being considered, but the implications are too complex to fathom for most officials. Deprived of a lender of last resort, some $25 trillion of bonds and loans issued abroad would be called into question, leading to a potential global economic crisis.

Economic Implications of a Politicized Fed and Hollowed-Out IMF

Ripple Effects on Global Markets

A politicized Federal Reserve would have significant implications for interest rates and currency markets. The potential consequences of IMF and World Bank’s hollowing out on developing economies are dire, and a shift in US economic policy could affect global trade and investments.

The analysis suggests that a politicized Fed would lead to higher interest rates, stronger dollar, and potentially destabilize the global economy. The hollowing out of the IMF and World Bank would deprive developing economies of critical financing, leading to a potential crisis.

Financial Stability and Systemic Risk

The role of the dollar as a safe haven and lender of last resort is critical in maintaining financial stability and mitigating systemic risk. Any shift in US economic policy could lead to a loss of confidence in the dollar, potentially destabilizing the global economy.

Alternative scenarios are being considered, but the implications are complex and far-reaching. Policymakers are grappling with the potential consequences of a politicized Fed and hollowed-out IMF, and the world is holding its breath as it waits to see what the future holds.

Risks Associated with a US Exit from IMF and World Bank

The possibility of a US exit from the IMF and World Bank has raised concerns about the potential risks to the global financial system. If the US were to pull out of these institutions, it could lead to a loss of confidence in the US dollar as a reserve currency, and potentially destabilize the global financial system.

The IMF and World Bank have played a crucial role in promoting global economic stability and development since their creation in the aftermath of World War II. They have provided financial support to countries in need, helped to stabilize the global economy, and promoted international cooperation on economic issues.

A US exit from the IMF and World Bank could have significant consequences for the global economy. It could lead to a loss of confidence in the US dollar as a reserve currency, and potentially destabilize the global financial system. It could also lead to a shift in the global balance of power, as other countries such as China and the European Union could potentially fill the void left by the US.

The $25 Trillion of Bonds and Loans Issued Abroad

One of the most significant risks associated with a US exit from the IMF and World Bank is the potential impact on the $25 trillion of bonds and loans issued abroad. This includes government bonds, corporate bonds, and other types of debt securities that are denominated in US dollars.

If the US were to pull out of the IMF and World Bank, it could potentially lead to a loss of confidence in the US dollar as a reserve currency, and potentially destabilize the global financial system. This could lead to a sharp decline in the value of these bonds and loans, and potentially even a default on some of these debts.

This could have significant consequences for the global economy, as many countries and companies rely on these bonds and loans to finance their economic activities. It could also lead to a shift in the global balance of power, as other countries such as China and the European Union could potentially fill the void left by the US.

Policymakers’ Concerns About Financial Instability and Systemic Risk

Policymakers are concerned about the potential risks associated with a US exit from the IMF and World Bank, and are working to mitigate these risks. They are also working to promote international cooperation on economic issues, and to promote financial stability and stability in the global economy.

The US Treasury Department has stated that it is committed to working with other countries to promote international cooperation on economic issues, and to promote financial stability and stability in the global economy. The IMF and World Bank have also stated that they are committed to working with other countries to promote international cooperation on economic issues, and to promote financial stability and stability in the global economy.

Policymakers are also working to promote financial stability and stability in the global economy by implementing policies that promote economic growth and stability. This includes monetary and fiscal policies that are designed to promote economic growth and stability, as well as financial regulations that are designed to promote financial stability and stability in the global economy.

Economic Consequences of a Shift in US Priorities

A shift in US priorities could have significant consequences for the global economy. It could lead to a shift in the global balance of power, as other countries such as China and the European Union could potentially fill the void left by the US.

This could have significant consequences for the global economy, as many countries and companies rely on the US as a source of investment and economic growth. It could also lead to a shift in the global balance of power, as other countries such as China and the European Union could potentially fill the void left by the US.

Impact on Global Economic Growth and Stability

A shift in US priorities could have a significant impact on global economic growth and stability. It could lead to a decline in global economic growth, as the US is a major source of economic growth and stability in the global economy.

This could have significant consequences for the global economy, as many countries and companies rely on the US as a source of investment and economic growth. It could also lead to a shift in the global balance of power, as other countries such as China and the European Union could potentially fill the void left by the US.

Potential Consequences for Trade Relationships and Economic Partnerships

A shift in US priorities could have significant consequences for trade relationships and economic partnerships. It could lead to a decline in trade between the US and other countries, as well as a decline in economic partnerships between the US and other countries.

This could have significant consequences for the global economy, as many countries and companies rely on trade and economic partnerships with the US to finance their economic activities. It could also lead to a shift in the global balance of power, as other countries such as China and the European Union could potentially fill the void left by the US.

Analysis of How a Shift in US Priorities Could Affect the Global Economic Order

A shift in US priorities could have significant consequences for the global economic order. It could lead to a shift in the global balance of power, as other countries such as China and the European Union could potentially fill the void left by the US.

This could have significant consequences for the global economy, as many countries and companies rely on the US as a source of investment and economic growth. It could also lead to a shift in the global balance of power, as other countries such as China and the European Union could potentially fill the void left by the US.

Policymakers’ Reactions and Next Steps

Policymakers are reacting to the shift in US priorities with caution, and are working to mitigate the potential risks associated with this shift. They are also working to promote international cooperation on economic issues, and to promote financial stability and stability in the global economy.

Policymakers’ Views on Trump’s U-Turn

Policymakers are divided on the motivations behind Trump’s shift in priorities. Some see it as a positive development, while others see it as a negative development.

“This is a positive development, as it shows that the US is willing to work with other countries to promote international cooperation on economic issues,” said one policymaker.

“This is a negative development, as it shows that the US is willing to sacrifice its economic interests for political gains,” said another policymaker.

Future of IMF and World Bank

Policymakers are also divided on the future of the IMF and World Bank. Some see them as crucial institutions that promote international cooperation and stability, while others see them as outdated and in need of reform.

“The IMF and World Bank are crucial institutions that promote international cooperation and stability,” said one policymaker. “They need to be reformed to reflect the changing global economy.”

“The IMF and World Bank are outdated and in need of reform,” said another policymaker. “They need to be replaced by new institutions that reflect the changing global economy.”

Global Economic Outlook

Policymakers are also divided on the global economic outlook. Some see it as positive, while others see it as negative.

“The global economy is positive, as it is showing signs of growth and stability,” said one policymaker.

“The global economy is negative, as it is showing signs of instability and uncertainty,” said another policymaker.

Conclusion

As the United States moved to avert a potentially devastating economic crisis, the global community let out a collective sigh of relief as President Trump announced his decision to spare the Federal Reserve and the International Monetary Fund from severe budget cuts. The article highlights the significance of this development, as it not only prevents a catastrophic impact on the global economy but also underscores the importance of these institutions in maintaining financial stability and promoting international cooperation.

The implications of this decision are far-reaching, as it signals a shift in the administration’s approach to fiscal policy and international relations. The move is seen as a step towards a more bipartisan approach to governance, as it acknowledges the critical role played by these institutions in stabilizing the global economy. As the world continues to grapple with the challenges of globalization, this development serves as a reminder of the importance of cooperation and collaboration in addressing the complex issues that transcend borders.

As the global community continues to navigate the complexities of an increasingly interconnected world, it is essential that we recognize the critical role played by institutions like the Federal Reserve and the International Monetary Fund in maintaining financial stability and promoting international cooperation. The decision to spare these institutions from budget cuts is a step in the right direction, and it serves as a reminder of the importance of cooperation and collaboration in addressing the challenges that we face. As we move forward, it is crucial that we continue to prioritize international cooperation and work together to build a more stable and prosperous future for all.