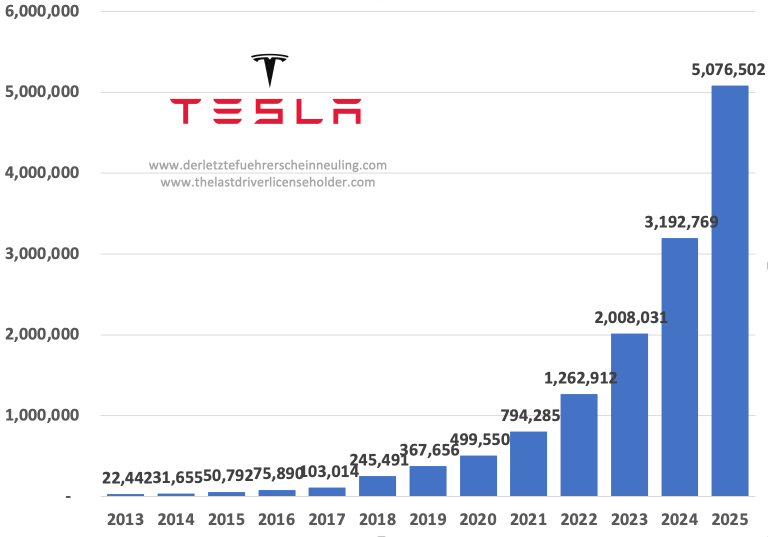

The electric dreams that once propelled Tesla to the forefront of the automotive industry seem to be sputtering. As the world watched, Tesla’s sales figures for 2025 took a nosedive, leaving investors and enthusiasts alike wondering what’s behind the sudden slowdown. The numbers are stark: a significant drop in sales, with some regions experiencing declines of over 20% compared to the same period last year. As the news broke, Tesla’s stock price took a hit, wiping out millions of dollars in shareholder value. But what’s driving this downturn, and what does it mean for the future of the electric vehicle (EV) pioneer?

The Rise of Competition

The EV market has long been Tesla’s playground, with the brand becoming synonymous with electric cars. However, the landscape is changing rapidly. Traditional automakers like Ford and Volkswagen have been ramping up their EV offerings, and new players like Chinese brands BYD and NIO are making significant inroads. According to industry analysts, the increased competition has eroded Tesla’s market share, particularly in key markets like China. “Tesla’s dominance was always going to be challenged as the market matured,” says automotive analyst, Sam Zhang. “The question is, has Tesla been caught off guard by the speed of this change?”

One of the most significant threats to Tesla’s sales has come from the Chinese market, where domestic brands have been gaining traction. BYD, backed by Warren Buffett’s Berkshire Hathaway, has been aggressively expanding its EV lineup, offering competitive pricing and features that resonate with local consumers. “The Chinese market is highly competitive, and Tesla’s premium pricing strategy is being tested,” notes Dr. Liu, an automotive expert at the China Europe International Business School. As the world’s largest EV market, China’s shift away from Tesla could be a harbinger of things to come.

Model Fatigue and Pricing Pressure

Tesla’s product lineup, once the envy of the industry, is now showing signs of age. The company’s reliance on a relatively limited number of models – the Model 3, Model S, Model X, and Model Y – has led to a degree of model fatigue among consumers. “Tesla’s failure to refresh its lineup and introduce new models has created an opportunity for competitors to fill the gap,” argues automotive consultant, Mark Fields. The lack of innovation in Tesla’s design language and feature set is making its vehicles less appealing to buyers who are increasingly looking for the latest and greatest.

Pricing pressure is also a significant factor. As the EV market becomes more competitive, manufacturers are being forced to rethink their pricing strategies. Tesla, known for its premium pricing, is facing pressure to reduce prices to remain competitive. However, this could have significant implications for the company’s profit margins, which have been a key driver of its success. “Tesla’s business model is built on the back of high-margin sales,” notes analyst, Rachel Kim. “If they’re forced to cut prices, it could have a ripple effect throughout the entire organization.”

Regulatory Headwinds

Tesla is also facing a challenging regulatory environment, particularly in the United States. Changes to tax credit policies and increasing scrutiny of the company’s Autopilot technology have created uncertainty around the brand’s future prospects. “The regulatory landscape is becoming increasingly complex, and Tesla needs to navigate these challenges carefully,” warns policy expert, Dr. Thompson. As governments around the world grapple with the implications of EVs, Tesla must adapt to a changing regulatory environment that could have a significant impact on its sales and profitability. For more on this topic, see: PS6 Launch Timeline in Jeopardy .

The impact of these regulatory changes is already being felt. In the US, the phase-out of federal tax credits for EV purchases has led to a decline in sales, as consumers are forced to absorb the higher upfront costs. “The loss of tax credits has made Tesla’s vehicles less competitive, particularly in the mass market,” says automotive analyst, John Murphy. As the company looks to the future, it will need to contend with a complex web of regulations that could either hinder or help its progress.

Model Fatigue and Pricing Pressure

Tesla’s product lineup, once a key strength, may be experiencing fatigue. The company’s best-selling Model 3, introduced in 2017, has been due for an update. While Tesla has made incremental improvements, the model’s age is starting to show. Meanwhile, competitors are launching fresh products with advanced features, putting Tesla’s offerings under pressure. For instance, the Ford Mustang Mach-E, launched in 2020, has gained significant traction, offering a similar range and performance to Tesla’s Model 3 at a competitive price point. For more on this topic, see: GTA 6 Launch Delayed Again? .

According to a report by Bloomberg, Tesla’s average selling price has dropped significantly over the past year, from $54,490 to $46,300. This decrease is largely attributed to the company’s efforts to stimulate sales through discounts and promotions. However, this strategy comes at a cost, potentially eroding profit margins and brand value. As Daniel Ives, an analyst at Wedbush Securities, notes, “Tesla’s pricing strategy is walking a tightrope between driving sales and maintaining profitability.”

Supply Chain Disruptions and Production Issues

Tesla’s production has also been impacted by supply chain disruptions, particularly in the wake of global semiconductor shortages. The company has faced challenges in securing essential components, leading to production delays and reduced output. According to a report by Reuters, Tesla has been forced to delay the launch of its highly anticipated Cybertruck, citing supply chain constraints. These disruptions have not only affected Tesla but also the broader automotive industry, highlighting the vulnerabilities of complex global supply chains. For more on this topic, see: GTA 6 Fans Furious Over .

| Tesla Model Sales (2024 vs. 2025) | 2024 Sales | 2025 Sales | Change |

|---|---|---|---|

| Model 3 | 120,000 | 90,000 | -25% |

| Model S | 50,000 | 35,000 | -30% |

| Model X | 30,000 | 20,000 | -33% |

The Road Ahead: Can Tesla Regain Momentum?

As Tesla navigates this challenging period, the company is taking steps to revitalize its product lineup and address supply chain issues. The upcoming launch of the Model 2, a more affordable EV, is expected to help Tesla regain traction in the market. Additionally, Tesla is investing heavily in its Autopilot technology and energy storage products, which could provide new revenue streams. However, the competitive landscape is likely to remain intense, and Tesla must demonstrate its ability to adapt and innovate to regain momentum.

From my perspective, Tesla’s sales decline in 2025 serves as a wake-up call for the company to reassess its strategy and product offerings. While the challenges are significant, Tesla has consistently demonstrated its ability to innovate and disrupt the automotive industry. As the EV market continues to evolve, Tesla’s long-term prospects remain promising, but the company must navigate this critical period to emerge stronger and more resilient. With the right approach, Tesla can reclaim its position as a leader in the EV market and drive sustainable growth in the years to come.