As we step into 2026, the world of artificial intelligence (AI) is poised to revolutionize industries and transform the way we live and work. For investors, the question on everyone’s mind is: which AI stocks will lead the charge? Dan Ives, a renowned analyst at Wedbush Securities, has released his top 5 AI stock picks for 2026, and surprisingly, some of the biggest names in tech are making the cut. In this two-part article, we’ll dive into Ives’ expert picks and explore the potential for growth in the AI sector.

The AI Revolution: A $15.7 Trillion Opportunity

The AI market is expected to contribute a staggering $15.7 trillion to the global economy, according to PwC. This growth will be driven by companies that can harness the power of AI to innovate and disrupt traditional industries. Microsoft and Apple, two of the world’s most valuable companies, are poised to be at the forefront of this revolution. Dan Ives believes that these two tech giants will be “front and center” heading into 2026, with Microsoft expected to see an “AI driven shift” in 2026.

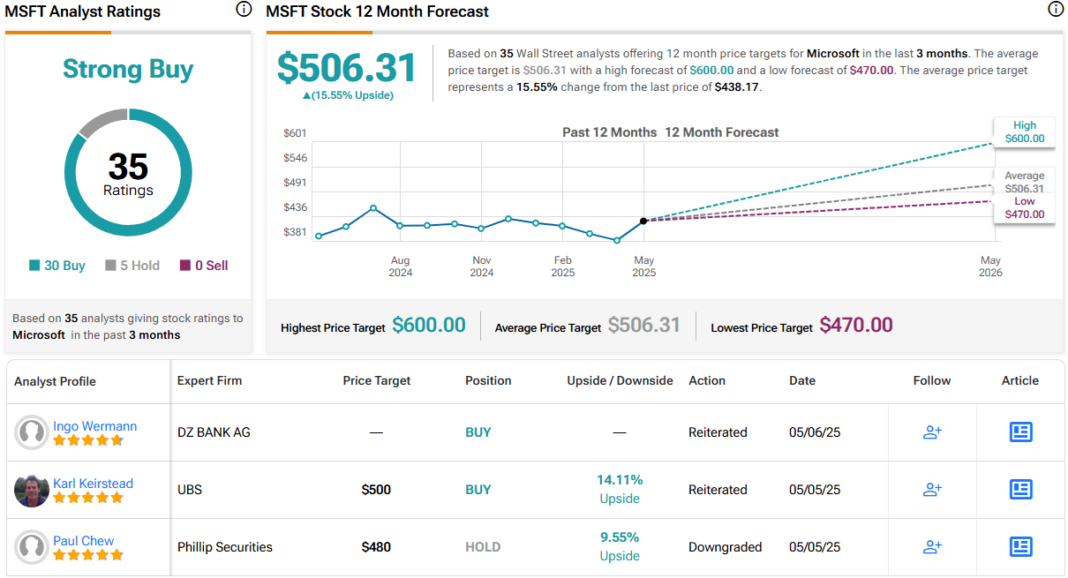

Microsoft’s Azure growth is expected to be a key driver of this shift, with Ives predicting a 28% upside to $625 per share. This growth will be fueled by the company’s emergence as an AI leader in cloud computing. Microsoft’s 2025 performance was +16%, and Ives believes the market is underestimating the company’s growth potential. As the “true inflection year of AI growth” for Microsoft, 2026 is shaping up to be a pivotal year for the company.

The Top AI Stock Picks for 2026

So, which AI stocks made Dan Ives’ top 5 list for 2026? While Nvidia, the leader in AI chips, is not among them, Microsoft and Apple are joined by CrowdStrike Holdings, a cybersecurity company leveraging AI and cloud technology to enable swift threat identification and mitigation. Wedbush analysts have maintained an “Outperform” rating on CrowdStrike’s stock with a $600 price target, implying 24.7% upside from current levels. With a market capitalization of $121.31 billion, CrowdStrike is a significant player in the cybersecurity industry and is well-positioned to benefit from the “AI cybersecurity trend”.

A Deeper Dive into CrowdStrike and the AI Cybersecurity Trend

CrowdStrike’s Falcon platform has gained popularity due to its effectiveness in detecting and preventing cyber threats. The company’s use of AI and machine learning algorithms enables it to stay ahead of emerging threats and provide a high level of protection for its customers. As the AI cybersecurity trend continues to grow, CrowdStrike is poised to be a major beneficiary. With its strong brand and innovative technology, the company is well-positioned to continue its growth trajectory and make a significant impact in the AI sector.

The AI chip market is dominated by Nvidia, which currently occupies more than 90% of the market. However, Broadcom and Marvell Technology are designing application-specific integrated circuits (ASICs) that could potentially threaten Nvidia’s dominance in 2026. Hyperscalers like Alphabet and Meta Platforms are also placing orders for custom AI processors, which are more powerful and power-efficient than GPUs for specific tasks. As the AI landscape continues to evolve, it will be interesting to see how these companies navigate the changing landscape and which ones emerge as leaders.

The growth potential of AI stocks is significant, with Morningstar analysts ranking Nvidia and Microsoft as the top two AI stocks to buy. Nvidia has a median target price of $250 per share among 69 analysts, implying 31% upside from its current price. Microsoft has a median target price of $631 per share among 63 analysts, implying 29% upside from its current price. As we continue to explore the top AI stock picks for 2026, it’s clear that the opportunities for growth are vast and varied. But which companies will ultimately lead the charge? Only time will tell.

With the AI sector poised for significant growth, investors are eager to get in on the action. But with so many options available, it can be difficult to know where to start. In the next part of this article, we’ll take a closer look at Dan Ives’ top 5 AI stock picks for 2026 and explore the potential for growth in each of these companies. From the leaders in AI chips to the innovators in AI cybersecurity, we’ll dive deeper into the companies that are shaping the future of AI.

Unpacking the AI Investment Thesis: Growth Potential and Risks

As we dive deeper into Dan Ives’ top 5 AI stock picks for 2026, it’s essential to understand the underlying investment thesis. The AI revolution is expected to transform industries, and companies that can harness its power will be well-positioned for growth. However, with great potential comes great risk. Investors must carefully consider the growth prospects and challenges facing each company.

Microsoft and Apple, two of Ives’ top picks, are expected to drive growth through their cloud computing and AI capabilities. Microsoft’s Azure growth is a key driver of this shift, with Ives predicting a 28% upside to $625 per share. Apple’s AI products, on the other hand, are expected to begin monetizing over the next few years, potentially adding $75 to $100 of value per share.

| Company | Wedbush Price Target | Upside Potential |

|---|---|---|

| Microsoft | $625 | 28% |

| Apple | $350 | 28% |

| CrowdStrike Holdings | $600 | 24.7% |

The Cybersecurity Angle: CrowdStrike Holdings and the AI-Driven Threat Landscape

CrowdStrike Holdings, a cybersecurity company leveraging AI and cloud technology, is another one of Ives’ top picks. The company’s Falcon platform has gained popularity due to its ability to swiftly identify and mitigate threats. As the threat landscape continues to evolve, CrowdStrike is well-positioned to benefit from the “AI cybersecurity trend.”

According to Wedbush analysts, CrowdStrike’s stock has an “Outperform” rating with a $600 price target, implying 24.7% upside from current levels. The company’s market capitalization of $121.31 billion indicates its significant presence in the cybersecurity industry.

Beyond the Top Picks: Other AI Stocks to Watch

While Microsoft, Apple, and CrowdStrike Holdings are Dan Ives’ top picks, other AI stocks are worth considering. Morningstar analysts ranked Nvidia and Microsoft as the top two AI stocks to buy, citing Nvidia’s leadership in GPUs, networking, and software tools, and Microsoft’s cloud computing unit’s emergence as an AI leader.

Nvidia has a median target price of $250 per share among 69 analysts, implying 31% upside from its current price. Microsoft has a median target price of $631 per share among 63 analysts, implying 29% upside from its current price.

For more information on these companies, visit:

Microsoft Investor Relations

Apple Investor Relations

Wikipedia: Artificial Intelligence

Conclusion

The AI revolution is expected to contribute a staggering $15.7 trillion to the global economy, and companies that can harness its power will be well-positioned for growth. Dan Ives’ top 5 AI stock picks for 2026 offer a compelling investment opportunity, with Microsoft, Apple, and CrowdStrike Holdings leading the charge.

However, investors must carefully consider the growth prospects and risks facing each company. As the AI landscape continues to evolve, it’s essential to stay informed and adapt to changing market conditions. With a thorough understanding of the investment thesis and the companies involved, investors can make informed decisions and potentially reap the rewards of the AI revolution.

Ultimately, the key to success in the AI space is to focus on companies that can drive innovation and disruption through AI. By doing so, investors can position themselves for long-term growth and success in this exciting and rapidly evolving field.

To learn more about the AI market and its potential, visit:

PwC: Global Economic Impact of Artificial Intelligence