Title: Breaking: Tesla Drops to #2 as BYD Surpasses 2.25M EV Sales in 2025

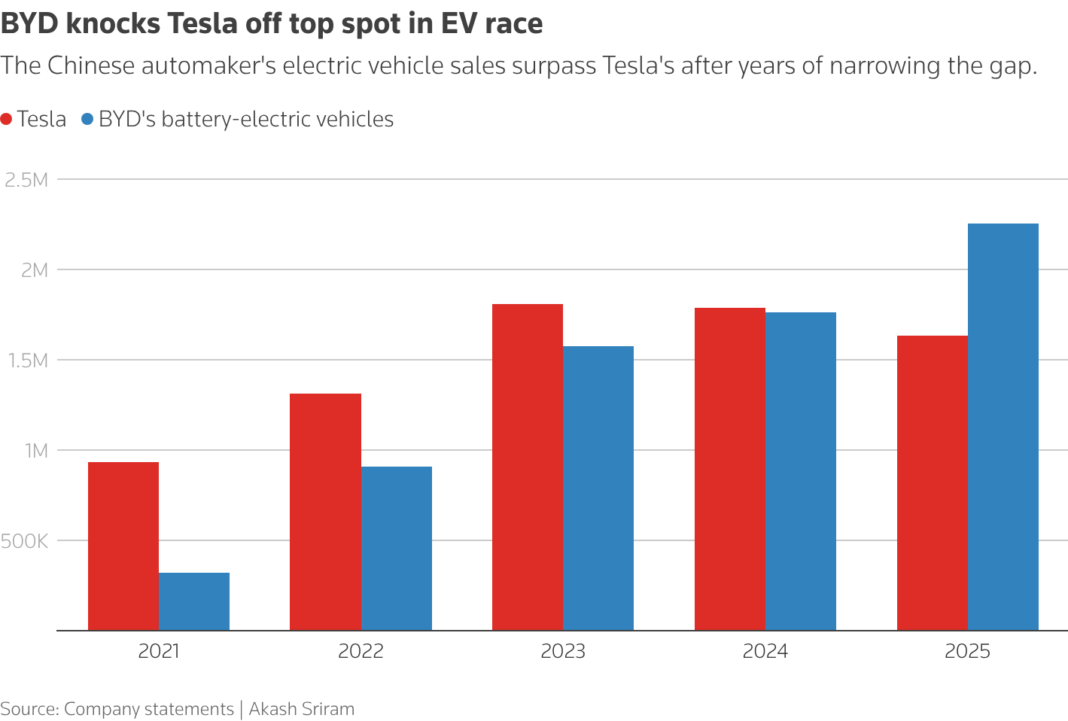

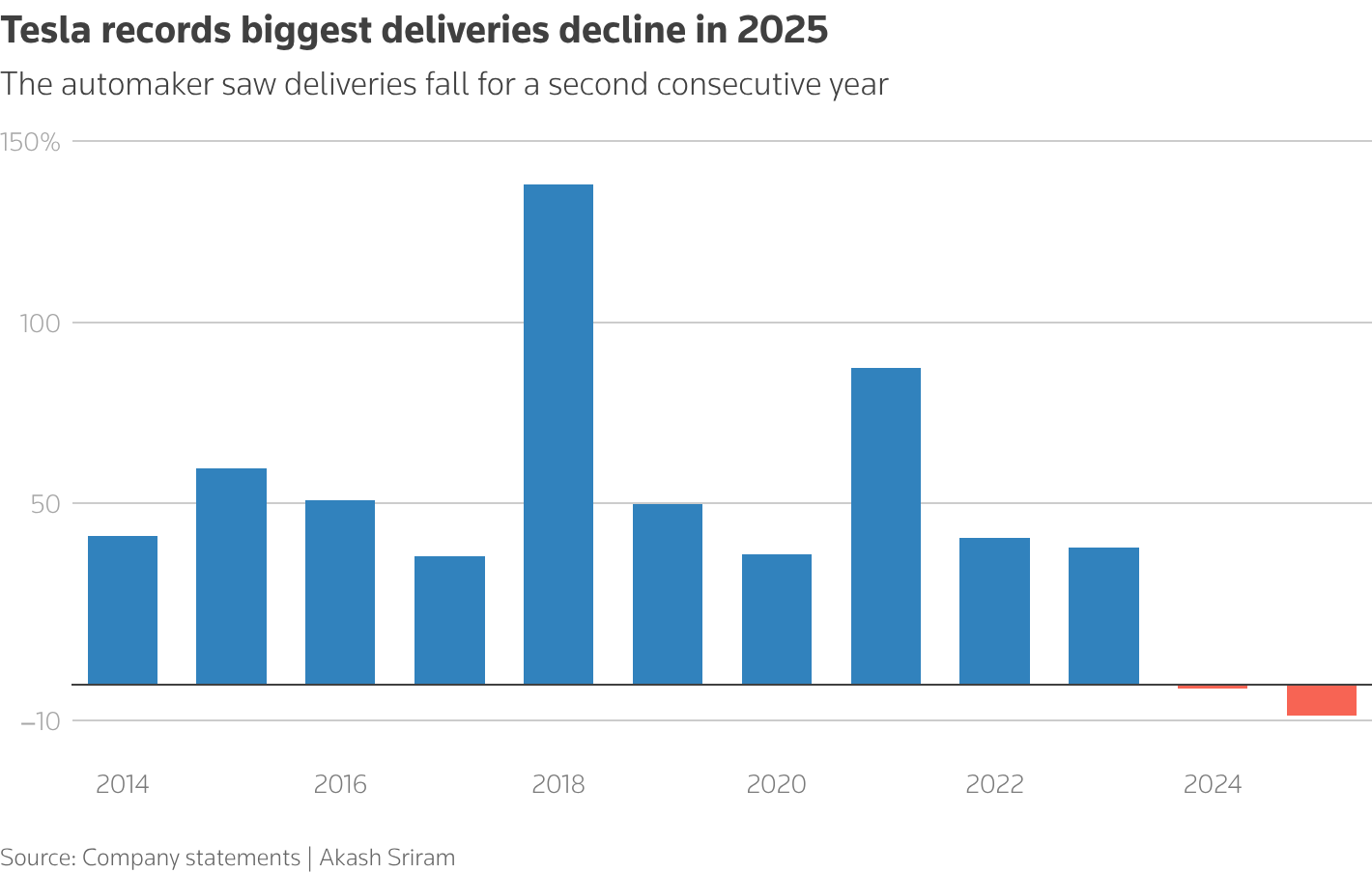

The photograph that flashed across trading-floor screens early Tuesday morning looked almost mundane: a gleaming navy-blue BYD Seal rolling off a cargo ship in the port of Rotterdam, its reflection rippling in North-Sea water. Yet, in that single frame, a decade of electric-vehicle supremacy flipped. BYD—once dismissed outside China as a fringe player with a forgettable acronym—quietly overtook Tesla as the planet’s top seller of battery-only cars in 2025, moving 2.25 million pure-electric vehicles to Elon Musk’s 1.64 million. For the first time since 2015, the Tesla badge no longer crowns the global EV scoreboard, and the Silicon Valley icon is learning what it feels like to chase taillights it once considered decorative.

The numbers that shook the EV world

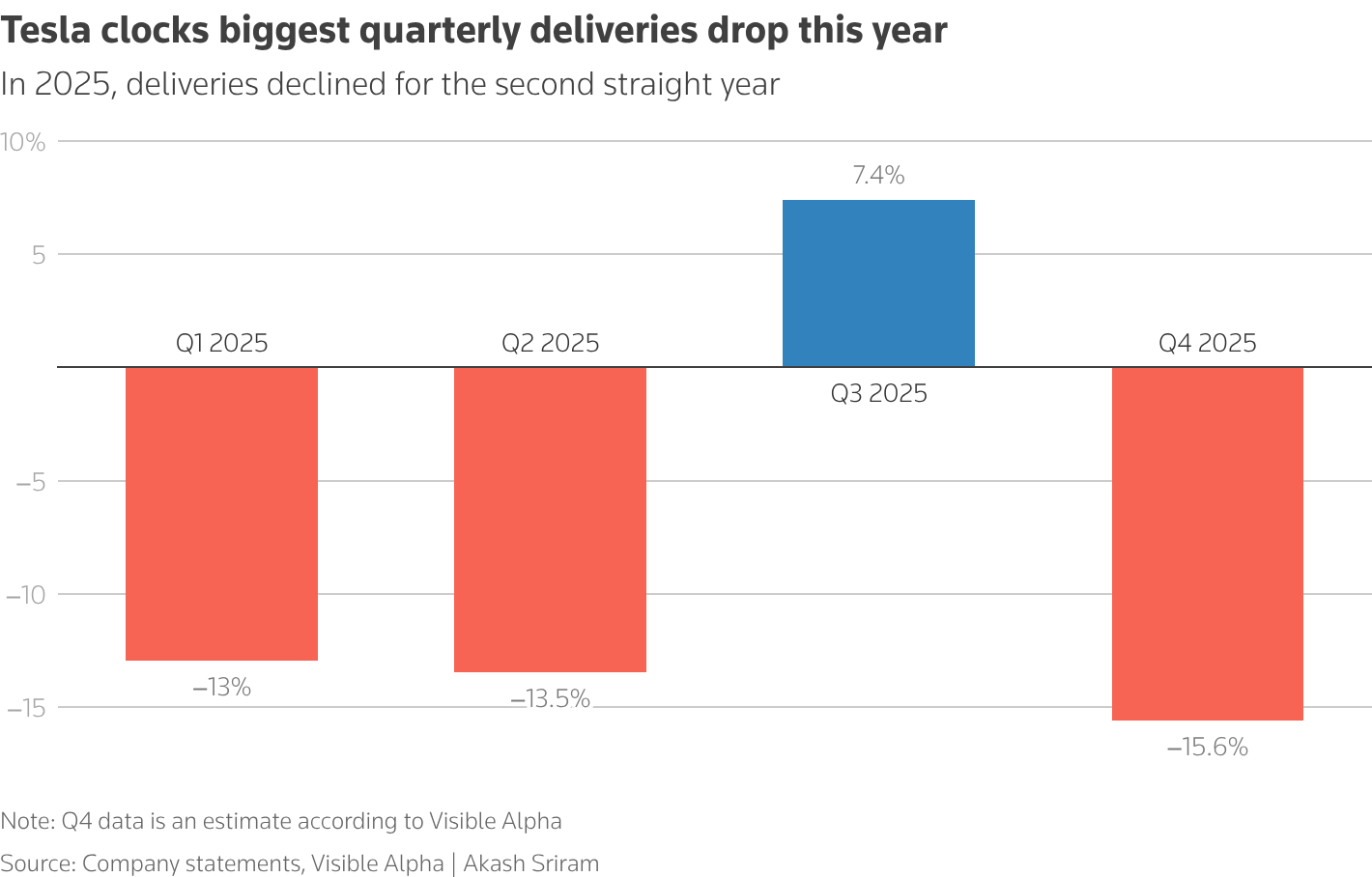

Inside BYD’s Shenzhen headquarters, engineers call it “the surge”—a 28% leap in fully electric deliveries that felt less like a gentle slope than a cliff face. By December, BYD was registering an electric car every 14 seconds somewhere on Earth, while Tesla’s showrooms watched quarterly sales slide 16% and annual volume dip 9%. Add in BYD’s plug-in hybrids and the Chinese giant’s “new-energy” tally swells to a staggering 4.6 million vehicles, enough to blanket every kilometer of Germany’s Autobahn bumper-to-bumper.

Wall Street analysts, who had braced for a Tesla Q4 rebound of roughly 440,000 units, instead absorbed a 418,227-unit reality check—Tesla’s second straight annual contraction. In hushed Zoom calls, portfolio managers compared notes on inventory build-ups in Fremont and Shanghai, while BYD’s export charts spiked 145% year-over-year, crossing the million-car threshold despite being locked out of the lucrative U.S. market. The headline writes itself: Tesla has slipped to No. 2, and the new No. 1 doesn’t even sell cars in American showrooms—yet.

How BYD built a bridge while Tesla built walls

Inside BYD’s battery gigafactory in Chongqing, the assembly lines reveal a strategy Tesla hasn’t embraced: sharing technology to drive down costs. BYD’s blade-cell lithium-iron-phosphate packs power not just its own models but also rival brands from Dongfeng to SAIC, creating economies of scale that push unit costs below the psychologically critical $60-per-kilowatt-hour mark. Translation: BYD can sell a made-in-China Seal for the price of a mid-trim Toyota Camry in Europe and still eke out margin.

Meanwhile, Tesla spent 2024–25 juggling price cuts to defend share, trimming the Model Y’s sticker by up to 21% in key Chinese cities and igniting a margin-shedding price war it can no longer easily win. The gambit kept showrooms busy but eroded the aura of tech exclusivity that once let Tesla charge premium prices for minimalist cabins and over-the-air updates. Where Musk bet on robotaxis and Cybertruck hype to rekindle lust, BYD flooded the field with pragmatic choices: a $11,000 Seagull hatch for first-time buyers, a 600-mile-range Han sedan for luxury refugees, and a plug-in pickup for markets still spooked by charging deserts.

Geography also tilted the board. Barred from American dealerships by tariffs and political headwinds, BYD doubled down on Europe, Latin America, and Southeast Asia—regions whose regulators greeted Chinese EVs with incentives rather than suspicion. In Thailand, BYD’s Atto 3 became the bestselling EV of any stripe, while Tesla’s imports languished in third place behind even sibling Chinese marques. The result: BYD’s export explosion compensated for a cooling domestic market, whereas Tesla’s heavy China exposure dragged global totals down when local demand softened.

What Tesla’s stumble means for the road ahead

Inside Tesla’s Austin command center, the mood has shifted from swagger to surgical urgency. Executives have green-lit a rumored $25,000 “Model 2” platform, accelerated 4680-cell production, and quietly scouted joint-venture battery plants in South Korea and Morocco—anything to claw back cost parity. Yet suppliers whisper that the timeline for the budget Tesla keeps sliding; BYD already sells a profitable EV at half that price.

For drivers, Tesla’s slip signals more than corporate score-settling. Competition is flooding forecourts with affordable electrics, pressuring legacy automakers—and oil markets—to adapt or perish. Charging giants like Electrify America and BP Pulse are scrambling to add BYD-compatible infrastructure, while used-Tesla prices soften, handing budget-conscious commuters their first realistic shot at going electric.

Still, Tesla’s brand retains a gravitational pull: its Supercharger network remains the industry’s golden on-ramp, and Full-Self-Driving beta miles now top eight billion. The question is whether technological bragging rights can outweigh the raw arithmetic of sticker prices and delivery tallies. For the moment, the scoreboard is merciless: BYD on top, Tesla in second, and the rest of the EV pack suddenly realizing the race is no longer a one-horse phenomenon.

The battery that changed everything

Three floors beneath the Chongqing cafeteria, a conveyor spits out what BYD engineers call “the blade.” It’s not marketing fluff: the lithium-iron-phosphate cell is literally long, thin and—when stacked—strong enough to support the weight of a 50-ton bus. That structural trick let BYD yank out the traditional battery cage, trim 110 kg of steel from every chassis and squeeze 25% more cells into the same footprint. Translation: a Seal sedan that travels 650 km on the Chinese cycle for the price of a Corolla in Kansas.

Tesla’s 4680 cylindrical cells still carry higher energy density, but BYD’s chemistry costs 34% less per kWh and laughs at heat. While a Model Y in Death Valley keeps its battery at a balmy 45°C to avoid degradation, a BYD Atto 3 taxis in Riyadh without active cooling, its roof-mounted solar panel trickling in enough juice to offset air-conditioning losses. The result? BYD warranties its packs for eight years anywhere on Earth; Tesla’s fine print shortens to six in desert markets.

| Battery Metric (2025) | BYD Blade LFP | Tesla 4680 NCM |

|---|---|---|

| Cost per kWh | $63 | $96 |

| Cycle life (80% capacity) | 4,000 cycles | 1,500 cycles |

| Fast-charge time (10-80%) | 18 min | 15 min |

| Pack warranty | 8 yrs / 1.6 million km | 8 yrs / 192,000 km |

Silicon Valley speed meets Pearl Delta scale

Elon Musk still pushes weekly over-the-air updates that can turn a parked Model 3 into a karaoke lounge overnight; BYD pushes hardware. The company’s vertical integration borders on the surreal: it mines lithium in Yichun, refines it in Qinghai, stamps fenders in Hefei and writes the microcontroller code in Shenzhen—often within 200 km of each other. When a shipment of semiconductors stalled at Shanghai port last spring, BYD simply rerouted the chips through its own customs-bonded warehouse and had production rolling again in 36 hours. Tesla, reliant on a lattice of external suppliers, needed nine days.

Yet Tesla’s software edge remains. Autopilot may not yet deliver on robotaxi promises, but its neural network ingests 500 million real-world miles daily, a data firehose BYD can’t match because Chinese privacy law restricts cross-border uploads. So BYD plays a different game: it sells fleets—taxis, buses, municipal trucks—then mines those vehicles’ telematics for battery-health algorithms it can sell back to city governments as subscription services. While Musk dreams of million-dollar robotaxis, BYD quietly books recurring revenue every time a Guangzhou sanitation truck backs up to a charger.

The road from Rotterdam to Detroit

Back in Rotterdam, the navy-blue Seal is already homologated for European crash tests; its next stop is a pop-up showroom in Utrecht where 1,200 hand-raisers placed €100 deposits before ever touching the steering wheel. BYD’s European chief, the perpetually smiling Shu Youxing, told Dutch journalists the company will add a compact hatchback—priced to undercut the VW ID.3 by €6,000—before the tulips bloom again. No one asked if BYD plans to enter the United States; the question feels as quaint as asking Samsung when it will build flip phones.

Still, the American market is too large to ignore. BYD already supplies batteries for every Mack electric garbage truck sold in North Carolina and powers Amazon delivery vans through a quiet partnership with Rivian. Industry veterans whisper that a U.S. assembly plant—perhaps on the shuttered Mitsubishi site in Illinois—could be announced as early as 2027, once the Inflation Reduction Act battery-mineral rules shift in favor of North American supply chains. If that happens, Tesla’s home-court advantage shrinks to a zip code.

Epilogue: the moment the torch passed

I keep returning to that Rotterdam photograph. The Seal’s wheels are still dripping brine, but the license-plate bracket is already drilled for a Dutch tag—someone in Shenzhen thought that far ahead. Tesla, meanwhile, is scrambling to retool its Fremont line for a cheaper Model 2 that won’t arrive until 2026 at the earliest. By then, BYD’s million-export milestone will feel like a floor, not a ceiling.

History rarely announces its pivots with brass bands. Sometimes it’s just a blue sedan gliding down a gangplank, carrying inside it the new world order. The scoreboard now reads BYD 2.25 million, Tesla 1.64 million—and the next chapter hasn’t even hit the presses.