Philadelphia’s tightrope walk between fiscal responsibility and economic growth continues. Mayor Jim Kenney’s successor, David Nutter, is facing a crucial decision: balancing the city’s budget while supporting its residents and businesses. Amidst mounting pressure, the mayor’s proposed budget takes a bold step – slashing both city wages and business taxes. But are these cuts the right solution for a city grappling with affordability challenges and a fragile economic recovery? Unionjournalism digs into the details of Mayor Parker’s proposal, examining the potential benefits and drawbacks for Philadelphia’s working families and the businesses that fuel its economy.

The Business and Parking Tax Debate

Philadelphia Mayor Parker’s proposed budget has ignited a heated debate over tax cuts for businesses and parking lots. The proposal includes a reduction in the Business Income and Receipts Tax (BIRT) and parking lot taxes, measures aimed at stimulating the city’s post-pandemic economic recovery. However, these tax breaks have sparked controversy, with critics arguing that they disproportionately benefit large corporations and developers while doing little to alleviate the financial struggles of ordinary residents.

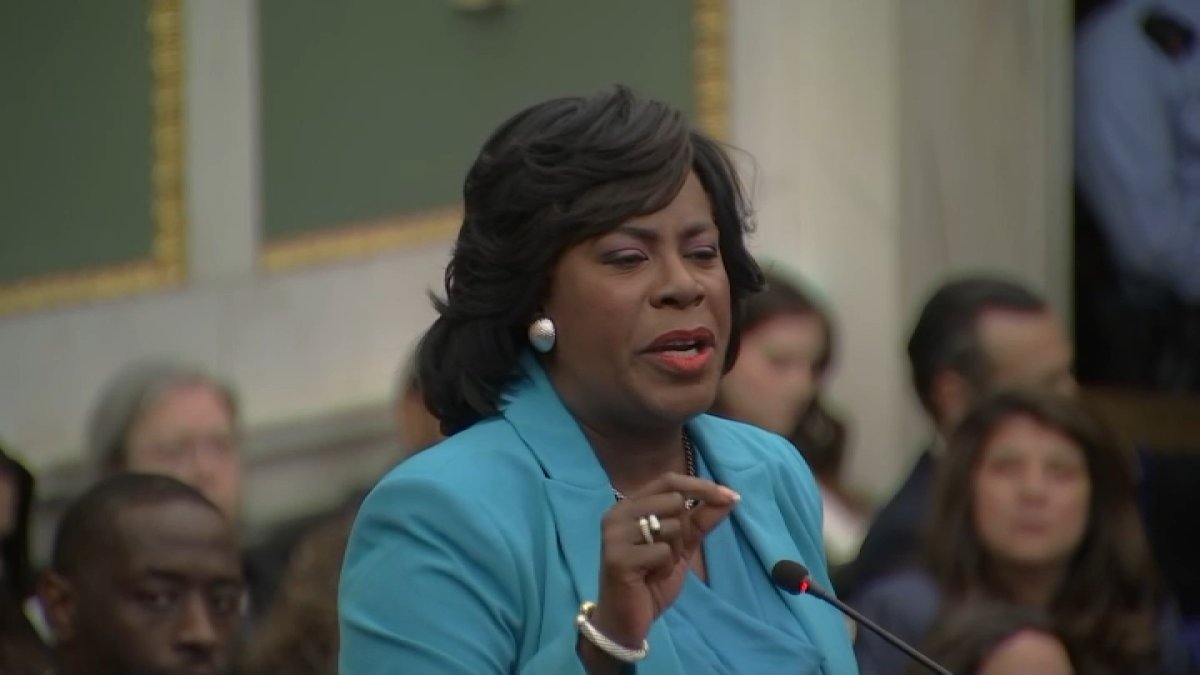

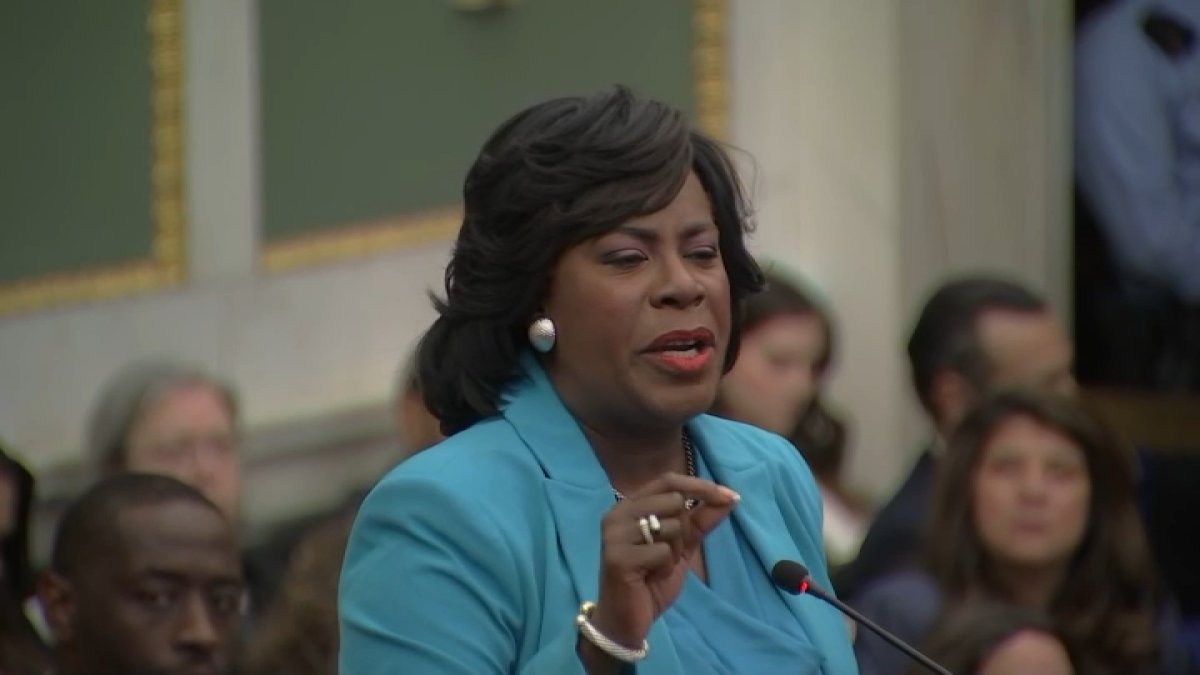

Councilmember Cherelle Parker’s proposal seeks to reduce city parking lot taxes by a third, while Allan Domb’s legislation aims to lower the city’s BIRT. Additionally, Mayor Parker’s budget proposal would resume previously planned BIRT reductions, further reducing the tax burden on businesses. Proponents of these tax cuts argue that they will incentivize business growth, attract investment, and ultimately lead to job creation and economic prosperity.

Who Benefits?

While proponents of the tax cuts frame them as a boon for the entire city, critics point to the potential for these benefits to be concentrated among corporations, developers, and non-profit organizations, leaving ordinary residents behind.

Large corporations, particularly those with significant property holdings and parking assets, stand to gain substantial financial advantages from the proposed tax reductions. These savings could be reinvested in expansion, new ventures, or even increased executive compensation, further widening the wealth gap. Similarly, developers, who often rely on favorable tax policies to finance large-scale projects, could see reduced costs and increased profitability.

Non-profits, which already enjoy significant tax exemptions, could also benefit from the proposed tax cuts, potentially receiving a greater share of public resources while facing less scrutiny regarding their financial practices.

In contrast, residents struggling with economic hardship stand to gain little from these tax reductions. The majority of Philadelphians are not in a position to directly benefit from lower business taxes or reduced parking fees. Instead, they are more likely to experience the negative consequences of tax cuts, such as reduced public services, increased costs for essential goods and services, and fewer opportunities for job creation and economic advancement.

Reclaim and the Sunrise Movement: Voices of Dissent

Two prominent activist groups, Reclaim and the Sunrise Movement, have emerged as vocal opponents of Mayor Parker’s proposed tax cuts. They argue that the budget prioritizes the interests of large corporations and wealthy individuals over the needs of ordinary Philadelphians. During a protest at Mayor Kenney’s office, activists from Reclaim denounced the proposed tax cuts as “negligent” and “reckless,” emphasizing the need for increased funding for social programs and a more equitable distribution of resources.

These groups argue that the proposed tax cuts will exacerbate existing inequalities and undermine efforts to address the city’s most pressing social challenges. They call for a more progressive tax system that requires corporations and wealthy individuals to contribute their fair share, allowing for greater investment in affordable housing, healthcare, education, and other essential services. The Sunrise Movement, known for its focus on climate justice, also criticizes the tax cuts for potentially hindering efforts to transition to a more sustainable economy.

Tax Reform: A Longstanding Issue in Philadelphia

The debate over tax reform in Philadelphia is not new. For decades, the city has relied heavily on its wage tax and business taxes to fund essential services. However, these taxes have come under increasing scrutiny, with critics arguing that they are outdated, burdensome, and disproportionately affect lower-income residents and small businesses.

The Philadelphia Tax Reform Commission: A Call for Change

In February 2023, the Philadelphia Tax Reform Commission, convened by City Council, released its recommendations after a year of research, hearings, and deliberation. The commission, comprised of experts in economics, tax policy, and urban planning, proposed a series of sweeping changes to the city’s tax structure, including:

- Phasing out the Business Income and Receipts Tax (BIRT) over a 12-year period.

- Reducing the city wage tax below 3%.

- Raising the minimum wage to $15 an hour.

These recommendations reflect a shift towards a more equitable and sustainable tax system that relies less on income and business taxes and more on property taxes and other revenue streams. The commission argues that this approach will create a fairer playing field for businesses of all sizes, attract investment, and generate more revenue for the city, allowing for greater investment in public services and economic development.

The “Uniformity Clause”: A Roadblock to Property Tax Reform

While the commission’s recommendations offer a promising path towards tax reform, a significant obstacle stands in the way: the “uniformity clause” of the Pennsylvania Constitution. This clause prohibits municipalities from adopting different property tax rates for commercial and residential properties, effectively limiting Philadelphia’s ability to generate more revenue from its commercial real estate sector.

This restriction poses a major challenge to the commission’s proposal to rely more heavily on property taxes. Without the ability to levy higher rates on commercial properties, the city’s property tax revenue stream is likely to remain insufficient to fully fund the recommended changes to the tax structure and support the necessary investments in public services and infrastructure.

Looking Ahead: The Future of Philadelphia’s Tax Policy

The debate over Mayor Parker’s proposed tax cuts and the Philadelphia Tax Reform Commission’s recommendations highlights the complex and contentious nature of tax policy in Philadelphia. Finding a balance between stimulating economic growth, ensuring fiscal sustainability, and promoting social equity remains a significant challenge for the city’s leaders.

The outcome of this debate will have profound implications for Philadelphia’s future. If the city continues to rely primarily on income and business taxes, it risks exacerbating existing inequalities and hindering its ability to address its most pressing social challenges. However, if the city embraces a more progressive tax system that requires corporations and wealthy individuals to pay their fair share, it has the potential to create a more equitable and prosperous society for all Philadelphians.

Conclusion

Mayor Parker’s proposed budget for Philadelphia, with its focus on wage and business tax cuts, signals a bold shift in economic strategy. While the administration emphasizes its potential to stimulate job creation and attract investment, critics raise concerns about the potential impact on city services and revenue streams. The article highlights the delicate balancing act the mayor faces: invigorating the city’s economy while ensuring the continued provision of essential services for its residents. This debate ultimately raises fundamental questions about the role of government in fostering economic growth and its responsibility to its citizens. The implications of this budget proposal are far-reaching. If successful, it could lay the groundwork for a more vibrant and prosperous Philadelphia. However, if it fails to deliver on its promises, it could exacerbate existing inequalities and strain city resources. The coming months will be crucial as the proposal undergoes scrutiny and public debate. Union members, city residents, and businesses alike will need to engage in this conversation to ensure that Philadelphia’s future is built on a foundation of shared prosperity and sustainable growth. The choices made today will shape the city’s economic landscape for generations to come. Will Philadelphia choose growth at all costs, or will it prioritize a more equitable and inclusive path forward? The answer lies in the hands of its citizens.