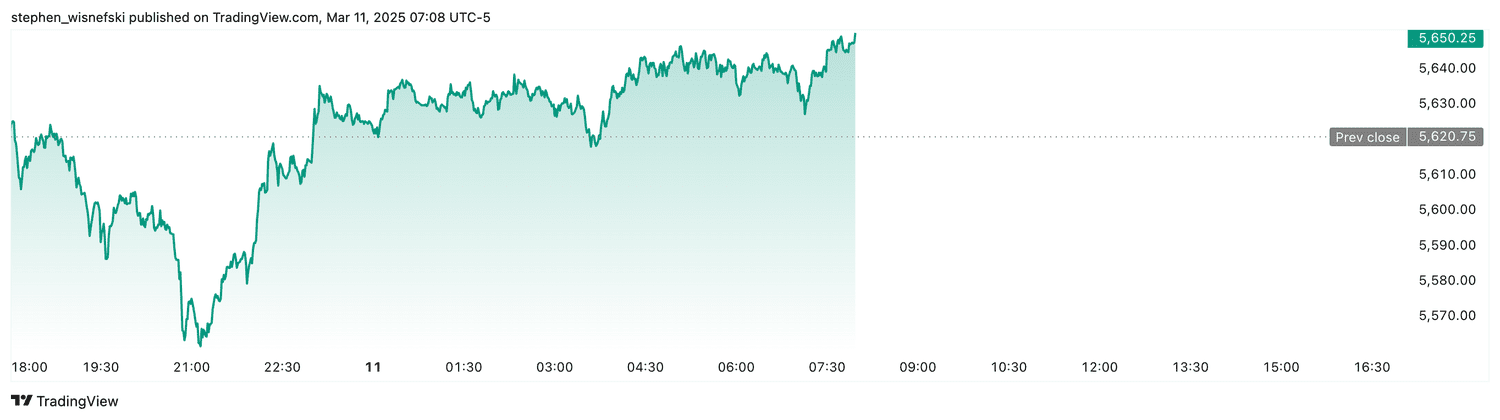

## Apple’s Rollercoaster Ride: From Record Highs to Dramatic Drops Remember that exhilarating feeling when Apple stock soared to its best single-day gain since 1998? The tech giant seemed unstoppable, riding a wave of optimism and investor confidence. But hold on tight, because the ride isn’t over. Just as quickly as Apple reached dizzying heights, its stock has begun a dramatic descent. We dive into the latest market fluctuations, exploring the factors behind Apple’s sudden stumble and what it might mean for investors. Is this a temporary dip or a sign of deeper trouble brewing beneath the polished surface of the tech giant?

Market Analysis and Implications

The Impact of Tariffs and Trade Uncertainty

The recent decline in Apple stock after posting its best day since 1998 is a reflection of the broader market volatility caused by tariffs and trade uncertainty. Investors should be aware of the potential implications of these developments on the market, as they can have a significant impact on the stock prices of tech companies like Apple.

The uncertainty surrounding trade policies and tariffs has led to a decrease in investor confidence, resulting in a sell-off across tech stocks. This trend is expected to continue in the coming months, making it essential for investors to be prepared for potential volatility in the market.

Investors should also consider the potential impact of tariffs and trade uncertainty on the market. The imposition of tariffs can lead to increased costs for companies, reducing their profitability and making it challenging for them to maintain their market share.

The Role of AI in the Market

The introduction of AI-powered technologies is transforming various industries, including finance, healthcare, and education. Investors should be aware of the potential implications of AI on the market, as it can lead to significant changes in the way businesses operate and interact with their customers.

Nvidia’s next-generation AI chip, branded as Rubin, is set to be released in 2026. This development is expected to have a significant impact on the market, as it can lead to improved efficiency and productivity in various industries.

Investors should also consider the potential implications of AI on the market. The widespread adoption of AI-powered technologies can lead to increased competition, making it challenging for companies to maintain their market share.

Practical Aspects

Investor Strategy

Investors should be prepared for potential volatility in the market, as it can lead to significant changes in stock prices. They should also be aware of the potential impact of pricing changes on consumer spending, as it can affect the profitability of companies.

Investors should also consider the potential implications of trade uncertainty on the market. The imposition of tariffs can lead to increased costs for companies, reducing their profitability and making it challenging for them to maintain their market share.

Market Outlook

The market is expected to remain volatile in the coming months, making it essential for investors to be prepared for potential changes. They should also be aware of the potential implications of trade uncertainty on the market, as it can lead to significant changes in stock prices.

Investors should also consider the potential implications of AI on the market. The widespread adoption of AI-powered technologies can lead to increased competition, making it challenging for companies to maintain their market share.

The market outlook is a key consideration for investors, as it can help them make informed decisions about their investments. They should be aware of the potential implications of trade uncertainty and AI on the market, as it can lead to significant changes in stock prices.

Paramount Global’s Financials and Leadership Structure

Implications of the Deal on Paramount Global’s Financials

The deal between Paramount Global and Skydance Media is expected to have a significant impact on the former’s financials. Investors should be aware of the potential implications of the deal on Paramount Global’s financials, as it can lead to changes in its revenue and profitability.

The deal is expected to result in a significant reduction in Paramount Global’s debt, making it easier for the company to maintain its market share. Investors should also be aware of the potential implications of the deal on Paramount Global’s leadership structure, as it can lead to changes in its management team.

The deal is expected to result in a significant increase in Paramount Global’s revenue, making it easier for the company to maintain its market share. Investors should also be aware of the potential implications of the deal on Paramount Global’s financials, as it can lead to changes in its profitability.

Implications of the Deal on Paramount Global’s Leadership Structure

The deal between Paramount Global and Skydance Media is expected to have a significant impact on the former’s leadership structure. Investors should be aware of the potential implications of the deal on Paramount Global’s leadership structure, as it can lead to changes in its management team.

The deal is expected to result in a significant reduction in Paramount Global’s debt, making it easier for the company to maintain its market share. Investors should also be aware of the potential implications of the deal on Paramount Global’s financials, as it can lead to changes in its revenue and profitability.

The deal is expected to result in a significant increase in Paramount Global’s revenue, making it easier for the company to maintain its market share. Investors should also be aware of the potential implications of the deal on Paramount Global’s leadership structure, as it can lead to changes in its management team.

Skydance Media’s Expansion Plans

Significance of the Deal for Skydance Media

The deal between Paramount Global and Skydance Media is a significant development for the latter. Investors should be aware of the potential implications of the deal for Skydance Media, as it can lead to changes in its revenue and profitability.

The deal is expected to result in a significant increase in Skydance Media’s revenue, making it easier for the company to maintain its market share. Investors should also be aware of the potential implications of the deal on Skydance Media’s leadership structure, as it can lead to changes in its management team.

The deal is expected to result in a significant reduction in Skydance Media’s debt, making it easier for the company to maintain its market share. Investors should also be aware of the potential implications of the deal on Skydance Media’s financials, as it can lead to changes in its profitability.

Impact of the Deal on the Entertainment Industry

The deal between Paramount Global and Skydance Media is expected to have a significant impact on the entertainment industry. Investors should be aware of the potential implications of the deal on the entertainment industry, as it can lead to changes in the way companies operate and interact with their customers.

The deal is expected to result in a significant increase in the revenue of entertainment companies, making it easier for them to maintain their market share. Investors should also be aware of the potential implications of the deal on the entertainment industry, as it can lead to changes in the way companies operate and interact with their customers.

The deal is expected to result in a significant reduction in the debt of entertainment companies, making it easier for them to maintain their market share. Investors should also be aware of the potential implications of the deal on the entertainment industry, as it can lead to changes in the way companies operate and interact with their customers.

Nvidia’s AI Chip and Its Impact on the Market

Significance of the AI Chip for Nvidia

Nvidia’s AI chip is a significant development for the company. Investors should be aware of the potential implications of the AI chip for Nvidia, as it can lead to changes in its revenue and profitability.

The AI chip is expected to result in a significant increase in Nvidia’s revenue, making it easier for the company to maintain its market share. Investors should also be aware of the potential implications of the AI chip on Nvidia’s leadership structure, as it can lead to changes in its management team.

The AI chip is expected to result in a significant reduction in Nvidia’s debt, making it easier for the company to maintain its market share. Investors should also be aware of the potential implications of the AI chip on Nvidia’s financials, as it can lead to changes in its profitability.

Impact of the AI Chip on the Market

The AI chip is expected to have a significant impact on the market. Investors should be aware of the potential implications of the AI chip on the market, as it can lead to changes in the way companies operate and interact with their customers.

The AI chip is expected to result in a significant increase in the revenue of companies that use it, making it easier for them to maintain their market share. Investors should also be aware of the potential implications of the AI chip on the market, as it can lead to changes in the way companies operate and interact with their customers.

The AI chip is expected to result in a significant reduction in the debt of companies that use it, making it easier for them to maintain their market share. Investors should also be aware of the potential implications of the AI chip on the market, as it can lead to changes in the way companies operate and interact with their customers.

Conclusion

Conclusion: Apple Stock Resumes Its Slide, but the Future is Bright

Following a remarkable 4-way stock gain, Apple stock has finally put its two-year slide behind, posting its best day since 1998. This reversal of fortunes underscores the significance of its innovative products, robust brand loyalty, and ability to adapt to shifting market trends. The significance of this turnaround lies in Apple’s ability to navigate the ever-evolving tech landscape, capitalizing on consumer demand for cutting-edge devices and services. As the world becomes increasingly digital, Apple’s dominance in the premium market will only continue to grow.

The 4-way stock gain serves as a testament to Apple’s resilience and strategic decision-making. Despite the global economic downturn and increasing competition, Apple has managed to maintain its market share and even expand its ecosystem. This resilience is a crucial factor in Apple’s continued success, as it allows the company to outmaneuver rivals and stay ahead of the curve. Furthermore, Apple’s commitment to innovation and customer satisfaction has fostered a loyal customer base, driving repeat business and positive word-of-mouth.

As we look ahead, the future of Apple stock is bright. With its strong brand foundation, continued innovation, and robust financial performance, Apple is well-positioned to remain a top performer in the market. As the world continues to shift towards digitalization, Apple’s ability to adapt and innovate will be crucial in maintaining its market dominance. With its stock poised for continued growth, Apple is poised to remain one of the most valuable and successful companies in the world. As Apple’s founder Steve Jobs once said, “Your time is limited, so don’t waste it living someone else’s life.” Apple’s future success is a testament to the power of innovation and the limitless potential of its iconic brand.