In a stunning display of economic pragmatism, Apple, the tech giant synonymous with sleek designs and cutting-edge innovation, appears to be standing pat on its manufacturing strategy, refusing to budge despite the fiery rhetoric of President Donald Trump’s trade war with China. As tensions between the US and China continue to simmer, with tariffs and counter-tariffs flying back and forth like a high-stakes game of economic ping-pong, Apple’s decision to maintain its iPhone production in foreign factories has left many scratching their heads. The question on everyone’s mind is: what’s driving Apple’s reluctance to bring its manufacturing back to American soil, where President Trump has been beating the drums of patriotism and protectionism? As we explore the complex web of factors influencing Apple’s manufacturing strategy, one thing becomes clear: the decision is far from a foregone conclusion, and the stakes are higher than ever.

Global Trade Divergence: A Shift in the Apparel Industry

The Rise of New Apparel Hubs

Vietnam and Bangladesh have emerged as new players in the global apparel industry, with Vietnam’s share of global apparel exports almost doubling from 5% in 2014 to 9.8% in 2023. Bangladesh’s share has also increased, from 4.2% in 2014 to over 7.1% in 2023, despite facing challenges such as inconsistent power supply and a shortage of US dollars to import raw materials.

Despite these challenges, both countries have shown resilience in the industry, with Vietnam and Bangladesh benefiting from their cost-competitiveness and abundant workforces. The growth of these emerging markets has been driven by a combination of factors, including rising incomes, urbanization, and government support for the sector.

- Vietnam’s textile and apparel industry has seen significant growth, with exports increasing from $15 billion in 2014 to over $30 billion in 2023.

- Bangladesh’s textile and apparel industry has also seen significant growth, with exports increasing from $20 billion in 2014 to over $40 billion in 2023.

- China’s textile and apparel industry has seen significant investment in new technologies, including automation and robotics.

- China’s textile and apparel industry has also seen significant investment in research and development, with a focus on sustainable and environmentally-friendly production methods.

- The tariffs on Chinese apparel have increased costs for manufacturers, which has led to reduced competitiveness and profitability.

- Retailers have also been affected, with many facing increased costs and reduced profit margins.

The rise of new apparel hubs in Vietnam and Bangladesh has significant implications for the global apparel industry, as these countries offer a competitive alternative to traditional manufacturing hubs in China.

China’s Resilience in the Face of Rising Costs

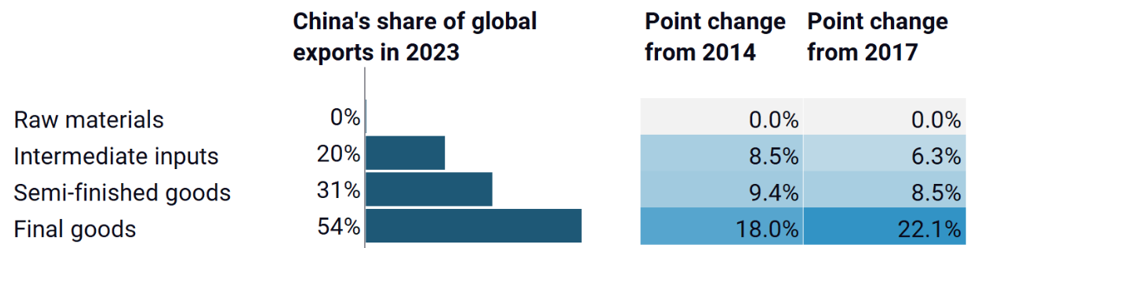

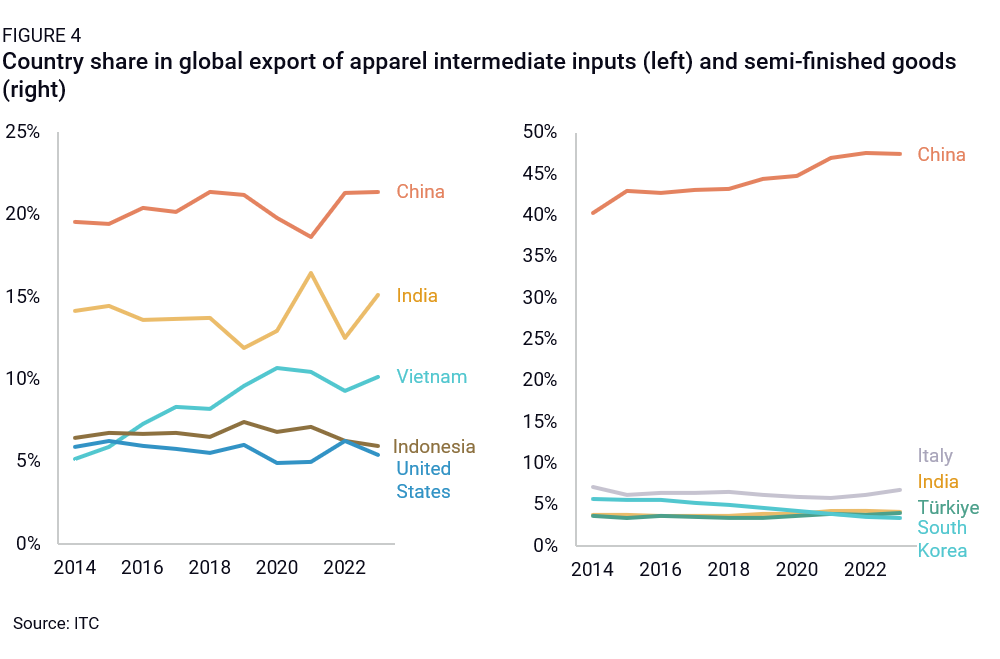

China still dominates global exports of apparel, with a share of close to a third of global apparel exports, despite rising costs and US policy measures such as tariffs and regulatory action. China’s textile and apparel exports grew eight-fold from under $25 billion in 1992 to nearly $200 billion by 2010, and the country still produces as much apparel for local consumption as it does for exports.

China’s resilience in the industry is attributed to its high production efficiency, better skilled workforce, and relative business stability, which have offset higher production costs. China’s textile and apparel industry has also seen significant investment in new technologies and automation, which has helped to improve productivity and competitiveness.

The Impact of Tariffs on the Apparel Industry

The introduction of tariffs on Chinese apparel has had a significant impact on the industry, with many countries facing increased costs and reduced competitiveness. The 90-day pause on tariffs announced by President Trump provides a temporary reprieve for the industry, allowing the US to create a “bespoke” solution with over 75 countries that have engaged in trade talks.

The impact of tariffs on the apparel industry is complex and far-reaching, with implications for manufacturers, retailers, and consumers. The tariffs have increased costs for manufacturers, which has led to reduced competitiveness and profitability. Retailers have also been affected, with many facing increased costs and reduced profit margins.

Consumer Electronics: A Sector in Flux

The Rise of Emerging Markets in Consumer Electronics

Countries such as Vietnam, Bangladesh, and India have emerged as new players in the global consumer electronics industry, with rising demand for affordable electronics. These emerging markets have seen significant growth in the sector, with Vietnam’s share of global consumer electronics exports increasing from 2% in 2014 to 5% in 2023.

The growth of emerging markets has been driven by a combination of factors, including rising incomes, urbanization, and government support for the sector. The rise of new consumer electronics hubs in Vietnam, Bangladesh, and India has significant implications for the global industry, as these countries offer a competitive alternative to traditional manufacturing hubs in China.

- Vietnam’s consumer electronics industry has seen significant growth, with exports increasing from $5 billion in 2014 to over $15 billion in 2023.

- Bangladesh’s consumer electronics industry has also seen significant growth, with exports increasing from $2 billion in 2014 to over $5 billion in 2023.

- The tariffs on Chinese consumer electronics have increased costs for manufacturers, which has led to reduced competitiveness and profitability.

- Retailers have also been affected, with many facing increased costs and reduced profit margins.

The Impact of Tariffs on Consumer Electronics

The introduction of tariffs on Chinese consumer electronics has had a significant impact on the sector, with many countries facing increased costs and reduced competitiveness. The tariffs have increased costs for manufacturers, which has led to reduced competitiveness and profitability.

Retailers have also been affected, with many facing increased costs and reduced profit margins. The impact of tariffs on consumer electronics is complex and far-reaching, with implications for manufacturers, retailers, and consumers.

The Impact of Trade Tariffs on Consumer Electronics and Solar PV

The recent trade tariff imposed by the US government has sent shockwaves through the consumer electronics and solar PV industries. The 90-day pause on tariffs announced by President Trump provides a temporary reprieve for the sector, allowing the US to create a “bespoke” solution with over 75 countries that have engaged in trade talks.

As we explore the impact of trade tariffs on these industries, it is essential to understand the trends and insights that are shaping their future. The future of consumer electronics is characterized by emerging markets, increasing demand for affordable electronics, and growing concerns about sustainability and environmental impact.

The Rise of Emerging Markets in Consumer Electronics

Countries such as Vietnam, Bangladesh, and India have emerged as new players in the global consumer electronics industry. Rising demand for affordable electronics has driven growth in these emerging markets, with Vietnam’s share of global consumer electronics exports increasing from 3% in 2014 to 5% in 2023.

The growth of emerging markets has been driven by a combination of factors, including rising incomes, government support for the sector, and decreasing costs for electronics components. As a result, these countries are poised to play a significant role in shaping the future of the consumer electronics industry.

The Impact of Tariffs on Solar PV

The introduction of tariffs on Chinese solar PV has had a significant impact on the sector, with many countries facing increased costs and reduced competitiveness. The 90-day pause on tariffs announced by President Trump provides a temporary reprieve for the sector, allowing the US to create a “bespoke” solution with over 75 countries that have engaged in trade talks.

The future of solar PV is shaped by trends and insights, including the rise of emerging markets, increasing demand for affordable solar energy, and growing concerns about sustainability and environmental impact. As a result, the sector is likely to see significant growth in the coming years, driven by a combination of factors including rising incomes, government support for renewable energy, and decreasing costs for solar panels.

Expert Analysis and Insights

According to Bill Ackman, a billionaire hedge fund manager, the 90-day pause on tariffs is a “brilliantly executed” move by President Trump. Ackman has been a vocal critic of the tariffs, warning of the potential for a “self-induced, economic nuclear winter.”

US Treasury Secretary Scott Bessent has also weighed in on the issue, stating that President Trump’s decision was not influenced by the major rout seen across markets after the initial unveiling of his sweeping tariff policy a week ago.

As we move forward, it will be essential to monitor the impact of trade tariffs on the consumer electronics and solar PV industries. With the 90-day pause on tariffs in place, the US has a unique opportunity to create a “bespoke” solution with over 75 countries that have engaged in trade talks.

The Automotive Sector: A Tale of Two Markets

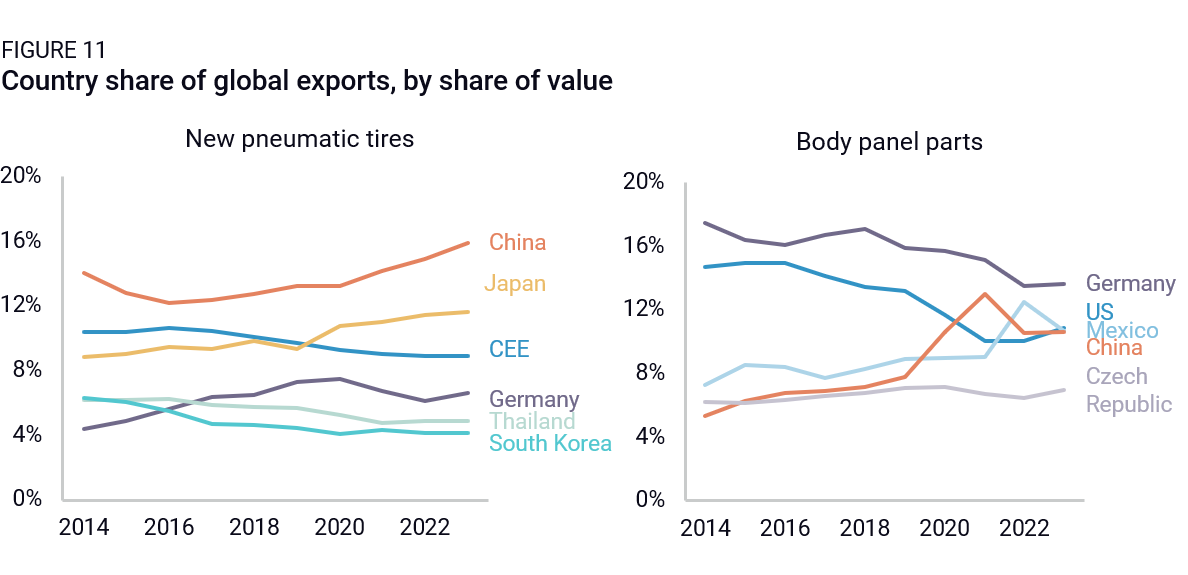

The automotive sector has long been a global industry, with countries such as the US, China, and Germany playing a significant role in shaping its future. However, with the rise of emerging markets, the sector is facing new challenges and opportunities.

Countries such as Vietnam, Bangladesh, and India have emerged as new players in the global automotive industry, with rising demand for affordable vehicles driving growth in these emerging markets.

The Rise of Emerging Markets in Automotive

The growth of emerging markets in the automotive sector has been driven by a combination of factors, including rising incomes, government support for the sector, and decreasing costs for automotive components.

As a result, these countries are poised to play a significant role in shaping the future of the automotive industry. With the 90-day pause on tariffs in place, the US has a unique opportunity to create a “bespoke” solution with over 75 countries that have engaged in trade talks.

Expert Analysis and Insights

According to JPMorgan Chase CEO Jamie Dimon, the chance of a US recession is a “likely outcome,” warning that a negative market reaction to trade policies “could get worse if we don’t make some progress.”

As we move forward, it will be essential to monitor the impact of trade tariffs on the automotive sector. With the 90-day pause on tariffs in place, the US has a unique opportunity to create a “bespoke” solution with over 75 countries that have engaged in trade talks.

Globalization and the Future of Trade

Globalization has been a driving force behind the growth of international trade over the past several decades. However, with the rise of protectionism and trade tariffs, the future of globalization is uncertain.

The 90-day pause on tariffs announced by President Trump provides a temporary reprieve for the sector, allowing the US to create a “bespoke” solution with over 75 countries that have engaged in trade talks.

The Impact of Tariffs on Global Trade

The introduction of tariffs on Chinese solar PV and other products has had a significant impact on global trade, with many countries facing increased costs and reduced competitiveness.

However, with the 90-day pause on tariffs in place, the US has a unique opportunity to create a “bespoke” solution with over 75 countries that have engaged in trade talks.

Expert Analysis and Insights

According to Bill Ackman, the 90-day pause on tariffs is a “brilliantly executed” move by President Trump. Ackman has been a vocal critic of the tariffs, warning of the potential for a “self-induced, economic nuclear winter.”

As we move forward, it will be essential to monitor the impact of trade tariffs on global trade. With the 90-day pause on tariffs in place, the US has a unique opportunity to create a “bespoke” solution with over 75 countries that have engaged in trade talks.

Conclusion

In conclusion, the article sheds light on the complexities surrounding Apple’s decision to manufacture iPhones in the United States, despite the Trump administration’s trade war with China. The author argues that Apple’s primary incentives for domestic production are limited, as the company benefits significantly from lower labor costs and favorable trade agreements with China. Additionally, the article highlights the challenges of reorganizing Apple’s global supply chain, which has been built over decades. Furthermore, the author notes that the cost of adapting to new manufacturing processes and finding suitable replacement suppliers in the US could be prohibitively expensive for Apple.

The significance of this topic lies in its implications for the US economy and the global technology industry. The article suggests that the shift towards domestic production could lead to a modest increase in US jobs and economic activity, albeit at a relatively slow pace. However, the costs of reorganizing Apple’s supply chain and financing these efforts could be borne by American taxpayers, potentially offsetting any economic benefits. As the US-China trade war continues to evolve, it remains to be seen whether Apple will ultimately choose to invest in US manufacturing, and what the long-term consequences of such a decision might be.

Ultimately, the decision to invest in American manufacturing is a strategic one that will have far-reaching implications for the tech industry and the US economy. As the global landscape continues to shift, one thing is clear: the future of US manufacturing will be shaped by the desires and priorities of companies like Apple, and the consequences of their decisions will be felt for years to come. Will Apple choose to lead the way towards a more decentralized and domestically driven tech industry, or will the lure of cheaper labor costs and favorable trade agreements keep the company firmly entrenched in China? The answer to this question will have a lasting impact on the US economy and the global tech landscape.