In a high-stakes game of economic chess, tech giant Apple and luxury car manufacturer Porsche are scrambling to outmaneuver the US tariffs imposed by the Trump administration. A recent report by the New York Post sheds light on the desperate measures these companies are taking to get their goods to American shores, dodging the crippling 25% tax that threatens to derail their lucrative US sales.

Tariff Tensions

The S&P 500 fell almost 5 percent on Thursday, its worst drop since June 2020, as allies and adversaries alike criticized President Trump’s action and weighed their responses. The S&P 500 had already fallen for five of the last six weeks, amid intensifying economic concerns pressured by tariff talk.

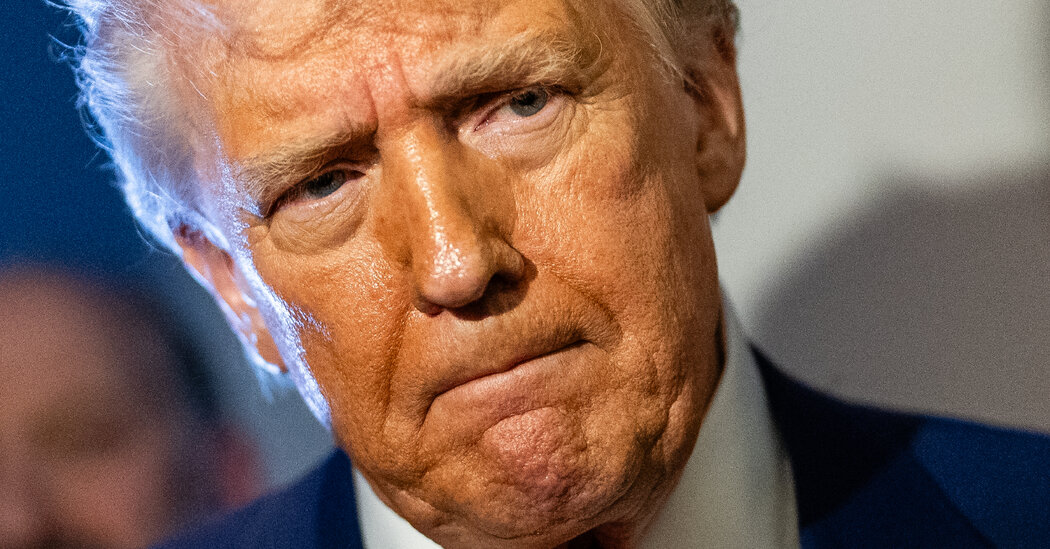

For his part, Mr. Trump and his advisers shrugged off the market turmoil and predicted that stocks would eventually rebound. “The markets are going to boom,” Mr. Trump said on Thursday. “The country is going to boom.”

Economists predicted that tariffs would raise prices for consumers and businesses, which will lead employers to pull back on hiring and, if the tariffs remain in place long enough, lay off workers. The next glimpse of the job situation will arrive on Friday, when the Bureau of Labor Statistics is scheduled to release March figures on hiring and unemployment.

Global Reaction: Allies and Adversaries Weigh In

Officials from the world’s biggest economies reacted swiftly to the new levies, as trade tensions with the United States escalated. China vowed to take countermeasures to “safeguard its own rights and interests.” Its state media described the tariffs as “self-defeating bullying.”

Mr. Trump had said for weeks that he would impose “reciprocal tariffs” on allies and adversaries, but the levies he unveiled on Wednesday were far higher than experts had expected. Economists said that they are likely to drive up prices for American consumers and manufacturers.

- China will subject Chinese goods to a new tariff of 34 percent, on top of earlier tariffs imposed by Mr. Trump.

- The European Union’s tariff was set at 20 percent, Japan’s at 24 percent, and India’s at 26 percent.

- The duties posed a particular threat to attempts to revive the largest economy in Europe, Germany’s, which has been stagnant.

Industry Impact

Consumer brands: Shares in many major consumer brands plunged on Thursday, highlighting their reliance on countries that produce lots of shoes and clothing, such as Vietnam, Indonesia, and Cambodia.

Auto tariffs: New tariffs on all automobiles made outside the United States took effect at 12:01 a.m. Apple tumbles: Apple led a sell-off of tech stocks, falling more than 9 percent. Its drop was one of its steepest intraday declines since early 2019, when the company plunged 10 percent after it warned that iPhone sales in China would fall short of expectations.

A 10 percent tariff will apply to all countries, but trading partners like China, Japan, and Europe will face rates two and three times as high.

Tech Stocks Tumble: Apple Leads the Decline

Apple led a sell-off of tech stocks, falling more than 9 percent. Its drop was one of its steepest intraday declines since early 2019, when the company plunged 10 percent after it warned that iPhone sales in China would fall short of expectations.

The tech sector was hit hard, with the Nasdaq composite falling 4.3 percent. Other big tech names, such as Microsoft and Intel, also declined significantly.

Experts said that the tariffs could lead to higher prices for consumers and a decrease in demand for American-made goods.Global Trade War

China’s Response: Countermeasures and Retaliation

China’s commerce ministry vowed countermeasures against President Trump’s sweeping new tariffs, warning that there would be no winners in a trade war. The tariffs imposed on Chinese imports by Mr. Trump during his second term have created a severe burden on companies importing from China. These are on top of the tariffs he placed on Chinese imports during his first term. “There are no winners in a trade war,” the commerce ministry said, urging the United States to use dialogue for resolving trade issues.

European Union’s United Front: No Country Left Behind

In Brussels, Ursula von der Leyen, the European Commission president, said that the bloc would be united in its response to the tariffs. “If you take on one of us, you take on all of us,” she said. President Emmanuel Macron of France called on European companies to suspend all investments in the United States “until things have been clarified” over the tariffs.

Japan’s Measured Response: Regret and Caution

The response from Japan, the largest overseas investor in the United States, was more restrained. Prime Minister Shigeru Ishiba called the tariffs “extremely regrettable.” But he refrained from talk of retaliation.

Practical Implications

New Tariffs and Rising Prices: The Consumer Burden

Economists predicted that tariffs would raise prices for consumers and businesses, which will lead employers to pull back on hiring and, if the tariffs remain in place long enough, lay off workers. The next glimpse of the job situation will arrive on Friday, when the Bureau of Labor Statistics is scheduled to release March figures on hiring and unemployment.

Businesses Scramble to Adapt: Supply Chain Disruptions

Shares in many major consumer brands plunged on Thursday, highlighting their reliance on countries that produce lots of shoes and clothing, such as Vietnam, Indonesia and Cambodia. Apple tumbles: Apple led a sell-off of tech stocks, falling more than 9 percent. Its drop was one of its steepest intraday declines since early 2019, when the company plunged 10 percent after it warned that iPhone sales in China would fall short of expectations.

The Future of Global Trade: Uncertainty and Risk

Mr. Trump could have tried to fix the rules governing global trade, which he says allies have abused at the cost of the U.S. economy and consumer, said Eswar Prasad, a professor of trade policy at Cornell University. Instead, he said, “Trump has chosen to blow up the system governing international trade.”

Conclusion

As reported by the New York Post, Apple and Porsche are racing against the clock to circumvent Trump-era tariffs and get their goods to the US market. The article reveals that these two prominent brands are taking drastic measures to mitigate the impact of the tariffs, which have been in effect since 2018. Key points highlighted in the article include Apple’s attempts to shift production to non-US countries, Porsche’s decision to raise prices due to tariff costs, and the companies’ efforts to lobby the US government for relief.

The implications of these developments are far-reaching, with the article underscoring the significant economic stakes at play. The tariffs have already taken a substantial toll on Apple’s bottom line, and the company’s efforts to adapt its supply chain will have ripple effects across the industry. The article also highlights the broader implications for the US economy, as the ongoing trade tensions threaten to disrupt global supply chains and impact consumer spending.

As the US government continues to navigate its trade policies, companies like Apple and Porsche will be forced to adapt and innovate in response. The article serves as a reminder that the world of international trade is complex, ever-changing, and fraught with uncertainty. As the US continues to grapple with its trade relationships, one thing is clear: companies that fail to adapt to the shifting landscape will be left behind, while those that innovate and adapt will thrive. The question remains: what will be the true cost of the Trump tariffs, and will the US economy be able to recover from the damage already done?